Undiscovered Gems in the Middle East for December 2025

As most Gulf markets ease despite firmer oil prices, the Middle East's financial landscape presents a complex picture influenced by fluctuating crude supply concerns and anticipated shifts in U.S. monetary policy. In this environment, identifying stocks that demonstrate resilience and potential for growth becomes crucial, particularly those that can navigate the challenges posed by global economic dynamics and regional market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Amlak Finance PJSC (DFM:AMLAK)

Simply Wall St Value Rating: ★★★★★★

Overview: Amlak Finance PJSC, along with its subsidiaries, operates in the Middle East focusing on real estate financing and investment activities, with a market capitalization of AED 2.48 billion.

Operations: The company's primary revenue streams include real estate finance generating AED 83.97 million, and real estate investment contributing AED 3.16 billion. Corporate finance investment adds another AED 68.42 million to the overall revenue mix.

Amlak Finance PJSC, a financial entity in the Middle East, has shown remarkable performance recently. The company turned profitable this year with high-quality earnings and no debt burden, marking a significant shift from five years ago when its debt-to-equity ratio was 30.4%. Its price-to-earnings ratio stands at an attractive 1.2x compared to the AE market's 11.7x. In the third quarter of 2025 alone, Amlak reported net income of AED 1.93 billion against AED 8.93 million last year, showcasing robust growth and value potential in its sector despite a slight dip in sales to AED 5.05 million from AED 5.41 million previously.

- Dive into the specifics of Amlak Finance PJSC here with our thorough health report.

Evaluate Amlak Finance PJSC's historical performance by accessing our past performance report.

Odine Solutions Teknoloji Ticaret ve Sanayi (IBSE:ODINE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Odine Solutions Teknoloji Ticaret ve Sanayi operates in the technology sector, focusing on internet software and services, with a market capitalization of TRY32.76 billion.

Operations: Odine generates revenue primarily from its internet software and services segment, amounting to TRY1.59 billion. The company's financial performance can be analyzed through its net profit margin, which reflects the profitability after accounting for all expenses.

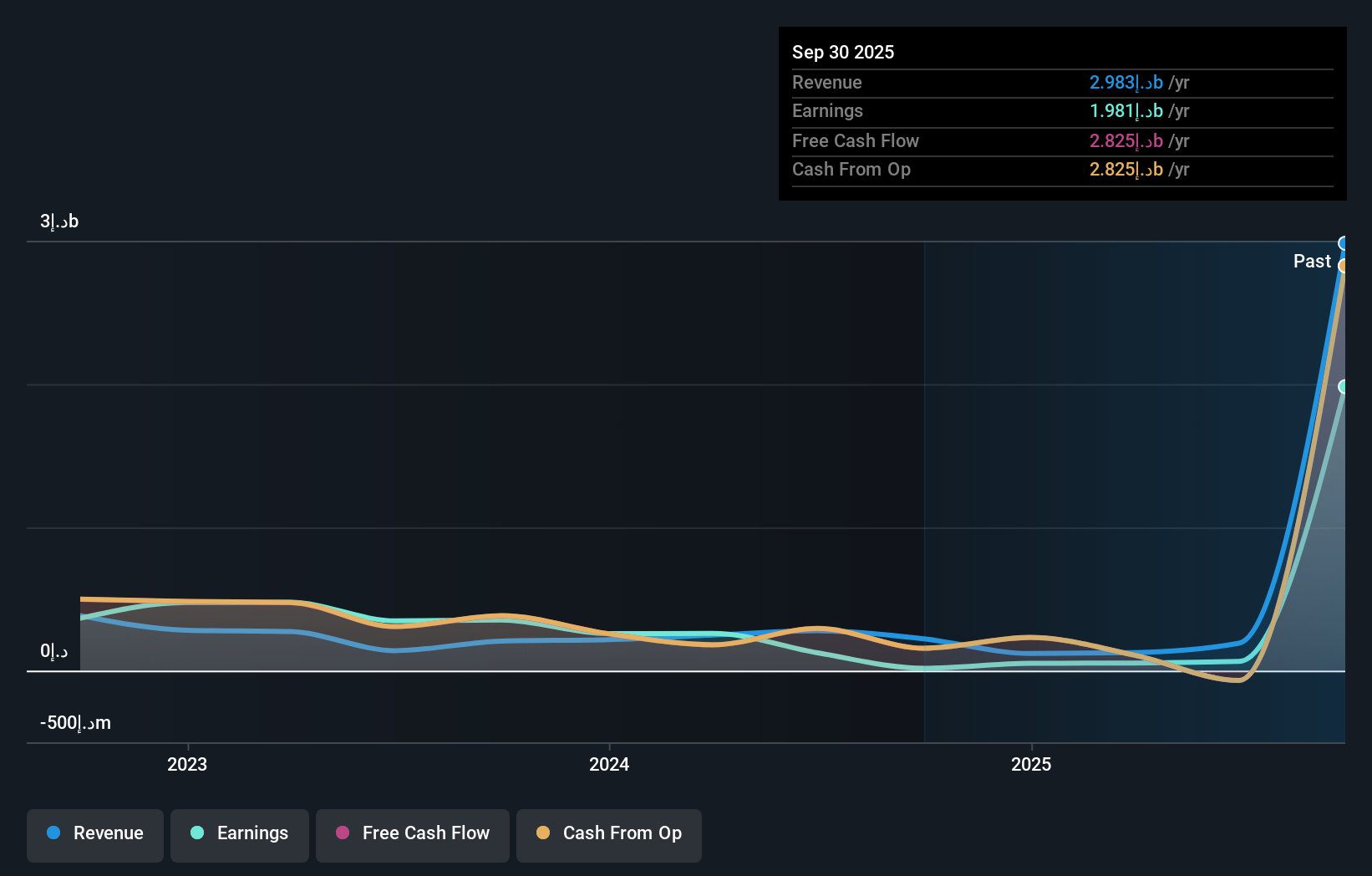

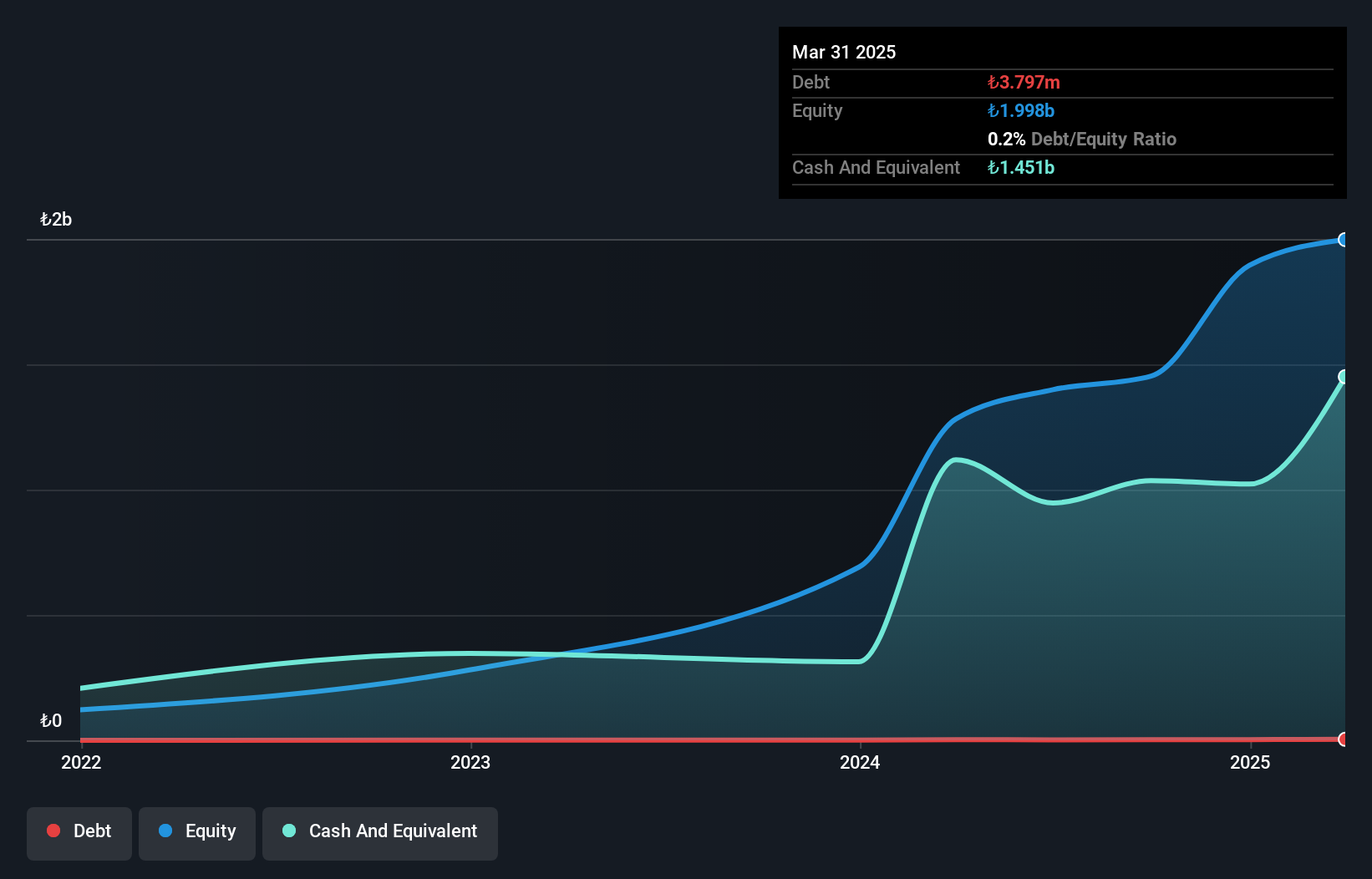

Odine Solutions, a nimble player in the tech sector, has showcased impressive growth with earnings surging 44.5% over the past year, outpacing the IT industry's 12.5%. Despite a volatile share price recently, Odine's financial health seems robust as it holds more cash than total debt and generates positive free cash flow. In Q3 2025, sales skyrocketed to TRY 448.55 million from TRY 157.89 million last year; however, net income dipped to TRY 5.88 million from TRY 17.15 million previously due to increased operational costs or other factors impacting profitability despite higher revenues.

Neto Malinda Trading (TASE:NTML)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Neto Malinda Trading Ltd. is involved in the manufacturing, importing, marketing, and distribution of kosher food products with a market capitalization of ₪2.97 billion.

Operations: Neto Malinda Trading generates its revenue primarily from three segments: imports (₪1.95 billion), local market sales (₪2.37 billion), and Neto Group factories (₪757.02 million). The company's net profit margin is a key financial metric to consider when analyzing its profitability.

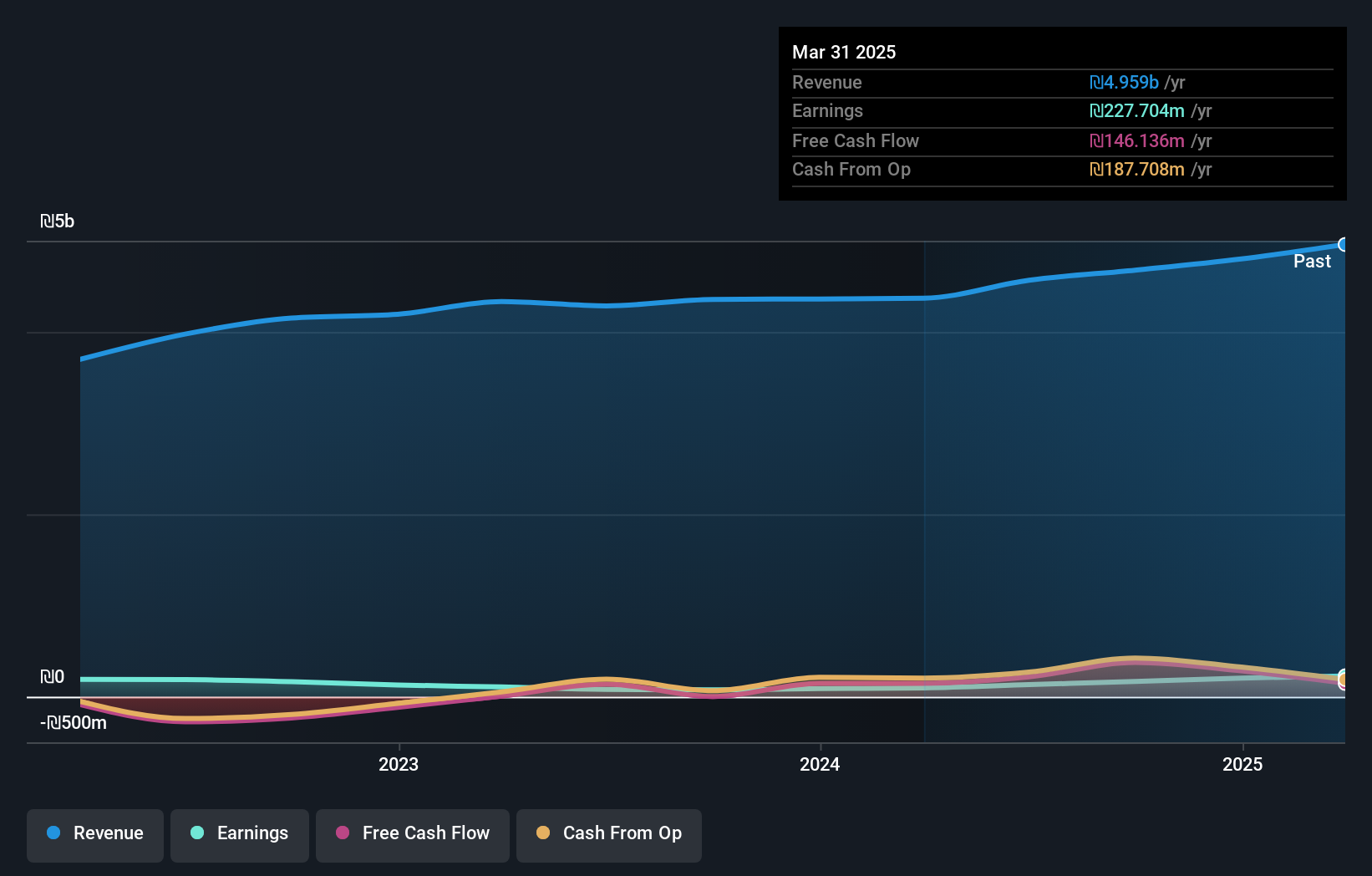

Neto Malinda Trading, a smaller player in the Middle East food sector, showcases robust financial health with a net debt to equity ratio of 16.7%, indicating satisfactory leverage management. The company’s earnings surged by 39% over the past year, outpacing the industry average of 19.8%. Despite not being free cash flow positive recently, its high-quality earnings and strong EBIT coverage of interest payments at 33.7x highlight operational efficiency. Recent results show increased sales to ILS 1,421 million for Q3 2025 and net income rising to ILS 70.85 million from ILS 62.89 million year-on-year, reflecting solid growth momentum in its operations.

Where To Now?

- Explore the 180 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報