Middle Eastern Dividend Stocks With Up To 5.6% Yield

Despite firmer oil prices, most Gulf markets have recently eased, reflecting a cautious sentiment amid concerns about crude oversupply and the impact of U.S. monetary policy shifts. In this environment, dividend stocks can offer investors a degree of stability and income potential, making them an attractive option for those looking to navigate the current market landscape in the Middle East.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.67% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.17% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.58% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.45% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.54% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.94% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.30% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.05% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.51% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Panora Gayrimenkul Yatirim Ortakligi (IBSE:PAGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Panora Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector and has a market capitalization of TRY6.79 billion.

Operations: Panora Gayrimenkul Yatirim Ortakligi A.S. generates revenue primarily from its REIT - Commercial segment, amounting to TRY842.94 million.

Dividend Yield: 3.7%

Panora Gayrimenkul Yatirim Ortakligi offers a compelling Price-To-Earnings ratio of 10x, below the TR market average. However, its dividend payments have been unreliable and volatile over the past decade. Despite being in the top 25% for dividend yield at 3.67%, these dividends are not well-covered by earnings, with a high payout ratio of 122.5%. Recent earnings show decreased net income and EPS compared to last year, highlighting potential sustainability concerns.

- Take a closer look at Panora Gayrimenkul Yatirim Ortakligi's potential here in our dividend report.

- According our valuation report, there's an indication that Panora Gayrimenkul Yatirim Ortakligi's share price might be on the expensive side.

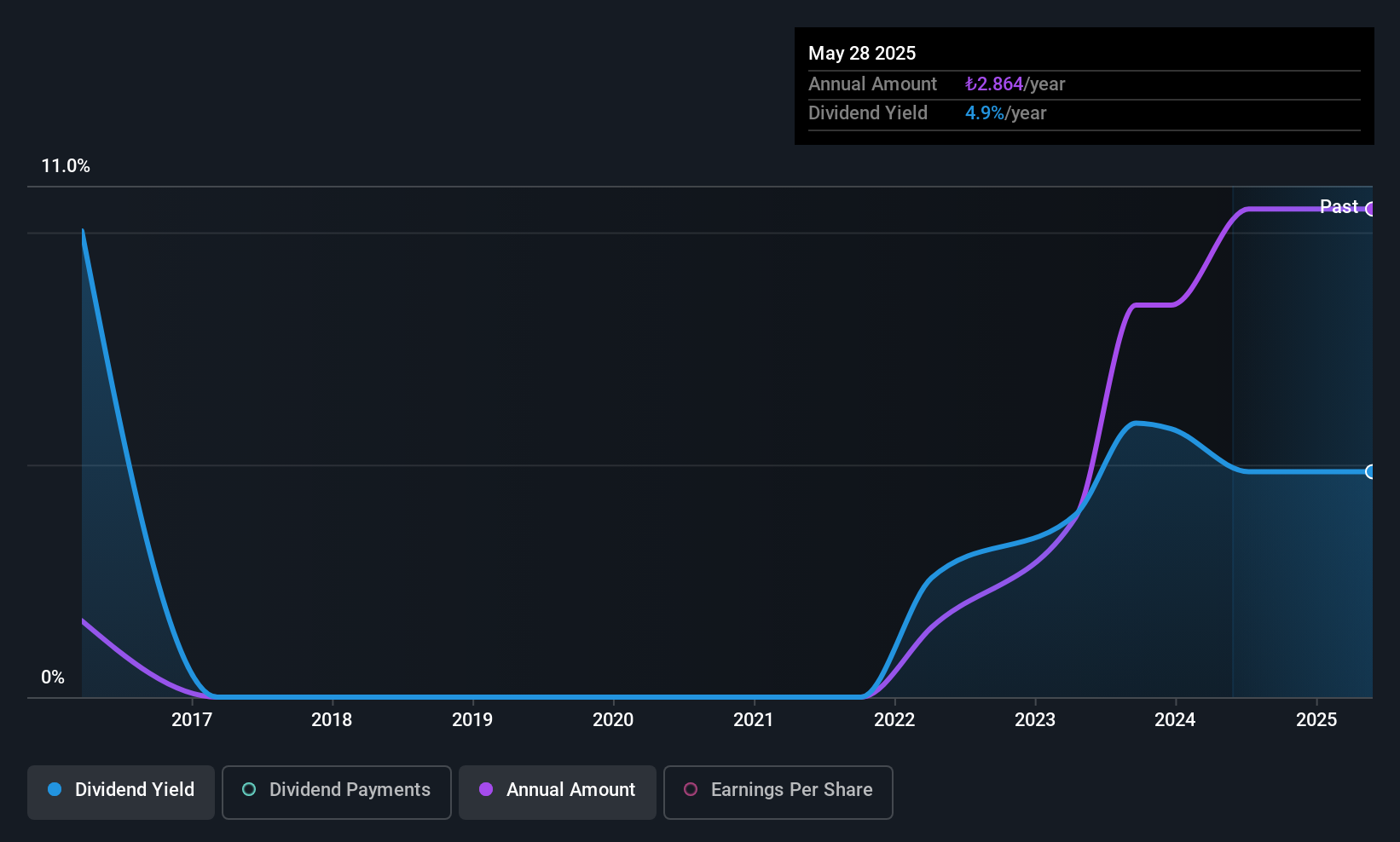

Torunlar Gayrimenkul Yatirim Ortakligi (IBSE:TRGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Torunlar Gayrimenkul Yatirim Ortakligi operates as a real estate investment company and has a market capitalization of TRY72.42 billion.

Operations: Torunlar Gayrimenkul Yatirim Ortakligi's revenue segments include Residential and Office Projects, with the 5. Levent Project generating TRY5.88 billion and Torun Center contributing TRY306.29 million, alongside various Office for Rent and Shopping Malls such as Korupark AVM at TRY1.24 billion, Mall of Istanbul AVM at TRY2.82 billion, Torium AVM at TRY594.59 million, and several others including income from tourism through Hilton Hotel at TRY319.91 million.

Dividend Yield: 3.2%

Torunlar Gayrimenkul Yatirim Ortakligi's Price-To-Earnings ratio of 4.3x is significantly below the TR market average, suggesting potential value. The company's dividend yield of 3.23% places it in the top quartile among Turkish dividend payers and is covered by earnings and cash flows with payout ratios of 94.5% and 65.1%, respectively. However, dividends have been paid for less than a decade, indicating limited historical reliability despite recent growth in payments.

- Unlock comprehensive insights into our analysis of Torunlar Gayrimenkul Yatirim Ortakligi stock in this dividend report.

- Our valuation report unveils the possibility Torunlar Gayrimenkul Yatirim Ortakligi's shares may be trading at a premium.

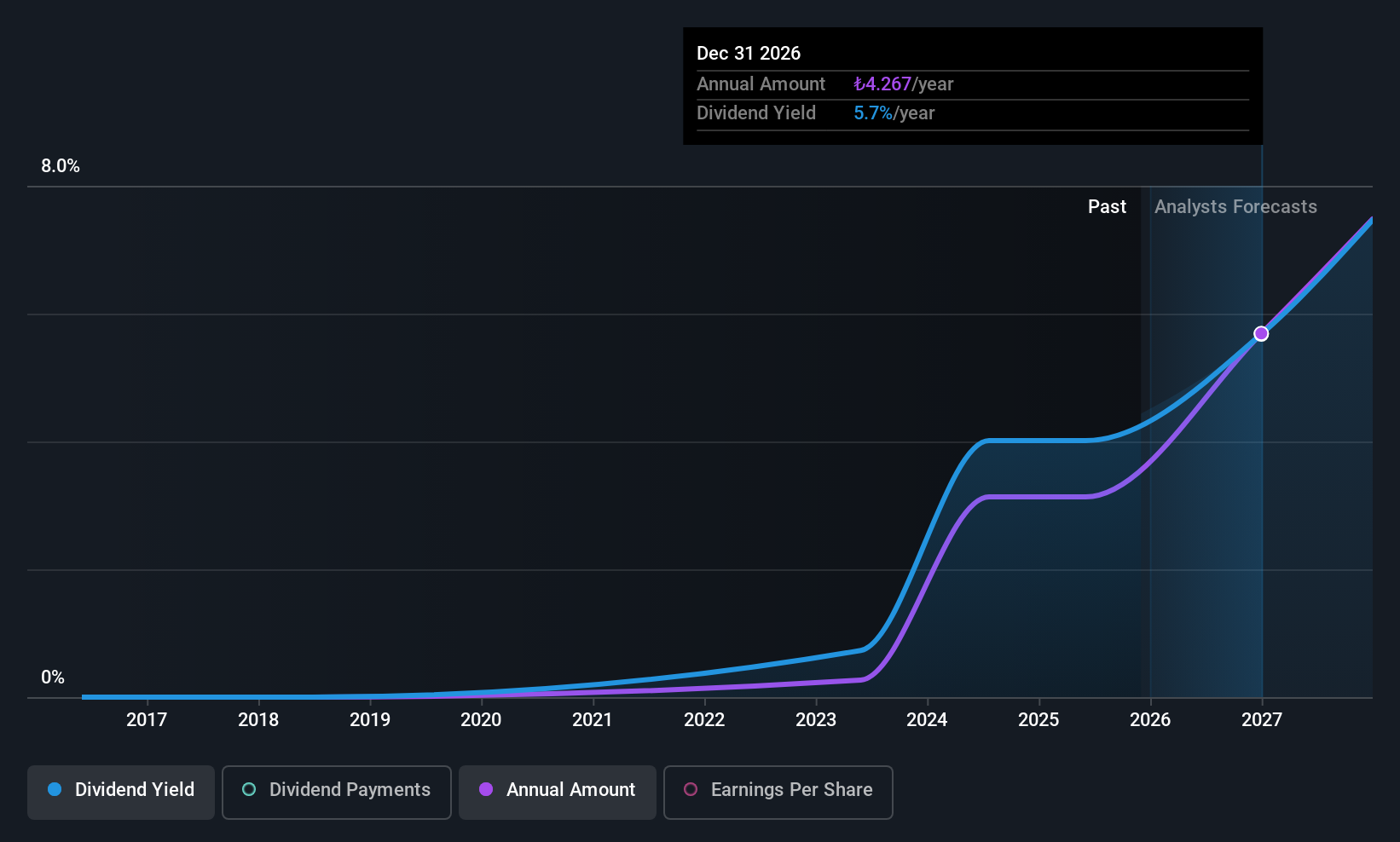

Cohen Development Gas & Oil (TASE:CDEV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cohen Development Gas & Oil Ltd. is involved in the exploration, development, production, and marketing of natural gas, condensate, and oil across Israel, Cyprus, and Morocco with a market cap of ₪1.21 billion.

Operations: Cohen Development Gas & Oil Ltd. generates revenue primarily from the production and management of oil and gas exploration, amounting to $27.42 million.

Dividend Yield: 5.7%

Cohen Development Gas & Oil's dividend yield of 5.66% ranks in the top 25% of Israeli dividend payers, but its sustainability is questionable due to a high cash payout ratio (114.2%) and volatile past payments. Despite recent earnings growth, dividends are not well covered by free cash flows or earnings. The recent private placement raised NIS 100 million, potentially impacting future financial flexibility amidst these challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Cohen Development Gas & Oil.

- Upon reviewing our latest valuation report, Cohen Development Gas & Oil's share price might be too optimistic.

Key Takeaways

- Take a closer look at our Top Middle Eastern Dividend Stocks list of 58 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報