Virgin Galactic (SPCE): Reassessing Valuation After NASA Leadership Shift and New Lunar, Imaging, and Financing Moves

Recent policy moves around a permanent U.S. lunar base, plus Jared Isaacman taking the helm at NASA, have suddenly made Virgin Galactic Holdings (SPCE) look more central to the commercial space conversation.

See our latest analysis for Virgin Galactic Holdings.

Even with the excitement around new NASA leadership, lunar ambitions, and Virgin Galactic’s Lawrence Livermore collaboration, the stock tells a tougher story. The share price is sitting at $3.34 and there is a steep year to date share price loss alongside a similarly heavy long term total shareholder return decline. This suggests sentiment is still fragile rather than in full risk on mode.

If you are watching how space and defense names react to this policy shift, it can be useful to compare SPCE’s profile with other aerospace and defense stocks that might be better positioned or more diversified.

With the stock still down sharply over one and three years, but trading at a modest discount to analyst targets and boasting rapid revenue growth, is Virgin Galactic a contrarian buy or is the market already pricing in its second act?

Price to Book of 0.9x: Is it justified?

At a last close of $3.34, Virgin Galactic trades on a price to book ratio of 0.9x, pointing to a meaningful discount versus peers and the wider market.

The price to book multiple compares the company’s market value with the net assets on its balance sheet. This is a common yardstick for capital intensive aerospace and defense names. For a business that is still loss making and in heavy investment mode, the fact that investors are paying less than book value suggests skepticism about how productive those assets will be over time.

Relative to similar companies, that 0.9x multiple stands out. It is well below the average of 3.1x for peers and even further under the 3.8x typical for the broader US Aerospace and Defense industry. This implies the market is pricing Virgin Galactic at a substantial discount to the sector’s asset base.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 0.9x (UNDERVALUED)

However, persistent losses and a brutal long term share price decline still loom, and any setback in commercialization timelines could quickly erode renewed enthusiasm.

Find out about the key risks to this Virgin Galactic Holdings narrative.

Another View on Value

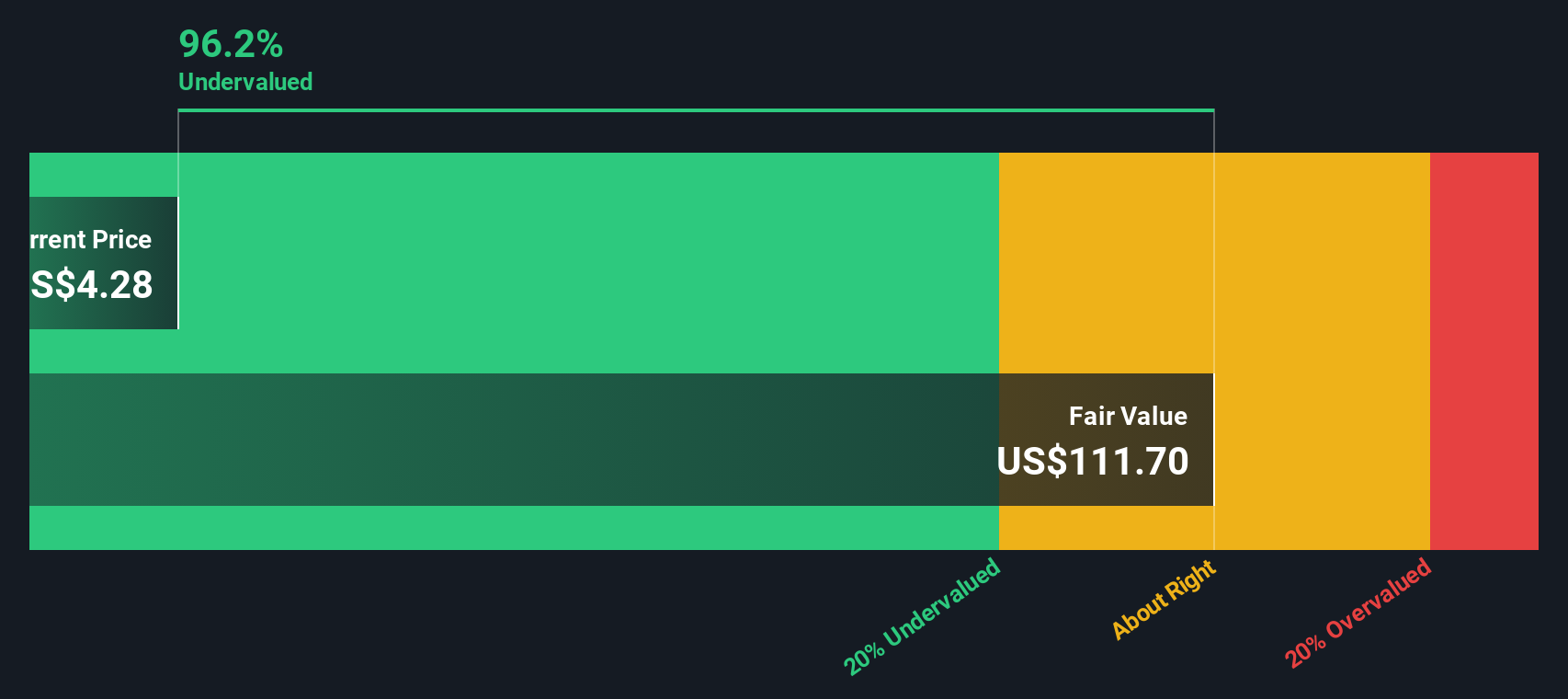

Our DCF model paints a far more optimistic picture than the balance sheet. It suggests that SPCE trades at roughly 96% below its estimated fair value. If that long term cash flow story is even half right, is the market overreacting to past losses or including too much execution risk in the price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Virgin Galactic Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Virgin Galactic Holdings Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized thesis in minutes: Do it your way.

A great starting point for your Virgin Galactic Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities that fit your style, instead of waiting for the next headline to move first.

- Capture early stage potential by reviewing these 3630 penny stocks with strong financials that pair low share prices with resilient financials and room for growth.

- Target cutting edge innovation through these 24 AI penny stocks that are turning artificial intelligence into real revenue momentum and long term competitive advantages.

- Strengthen your portfolio’s foundation with these 10 dividend stocks with yields > 3% that aim to deliver steady income while still leaving room for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報