Is It Too Late To Consider Sezzle After Its 72.8% Surge And Valuation Debate?

- Wondering if Sezzle at $73.64 is still a smart buy or if the easy gains are gone? You are not alone, and that is exactly what we are going to unpack here.

- The stock has climbed 5.0% over the last week, 37.8% in the last 30 days, and is up 62.0% year to date, with a 72.8% gain over the past year shifting how the market is thinking about its risk and reward profile.

- These moves have come alongside growing attention on buy now, pay later players as regulators and investors reassess the space, and Sezzle has been frequently mentioned in market commentary as one of the more nimble operators in the niche. Broader fintech optimism and shifting consumer spending trends have also kept it on the radar of growth focused investors.

- Right now Sezzle scores a 3/6 valuation check score, suggesting it looks undervalued on some measures but not others. In the sections that follow we will break down those methods in detail before circling back to a more complete way of thinking about what the stock is really worth.

Approach 1: Sezzle Excess Returns Analysis

The Excess Returns model looks at how much profit Sezzle can generate above the minimum return that shareholders demand, and then treats those extra profits as the real source of value. Instead of focusing on near term earnings, it asks whether management can keep reinvesting capital at attractive rates over time.

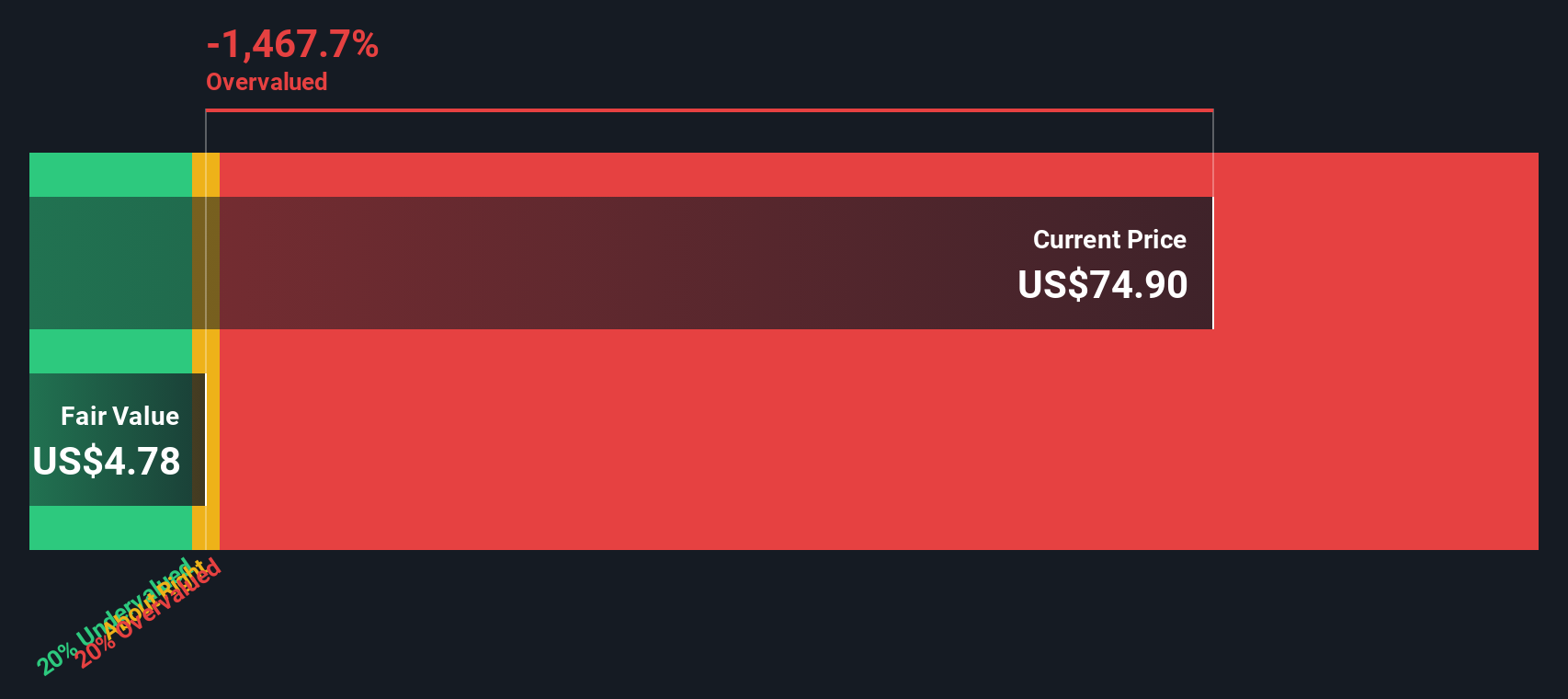

For Sezzle, the inputs suggest a very profitable engine. Book value sits at $4.55 per share, with a stable earnings per share estimate of $0.40, based on the median return on equity from the past 5 years. That translates into an average return on equity of 45.18%, which is far above the implied cost of equity of about $0.07 per share. The gap between the two, an excess return of roughly $0.33 per share, is what this model capitalizes. A stable book value of $0.88 per share, also taken from historical medians, underpins these forecasts.

When all future excess returns are added up, the Excess Returns model indicates Sezzle is about 735.4% overvalued at the current share price, implying a far lower intrinsic value than the market is paying today.

Result: OVERVALUED

Our Excess Returns analysis suggests Sezzle may be overvalued by 735.4%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sezzle Price vs Earnings

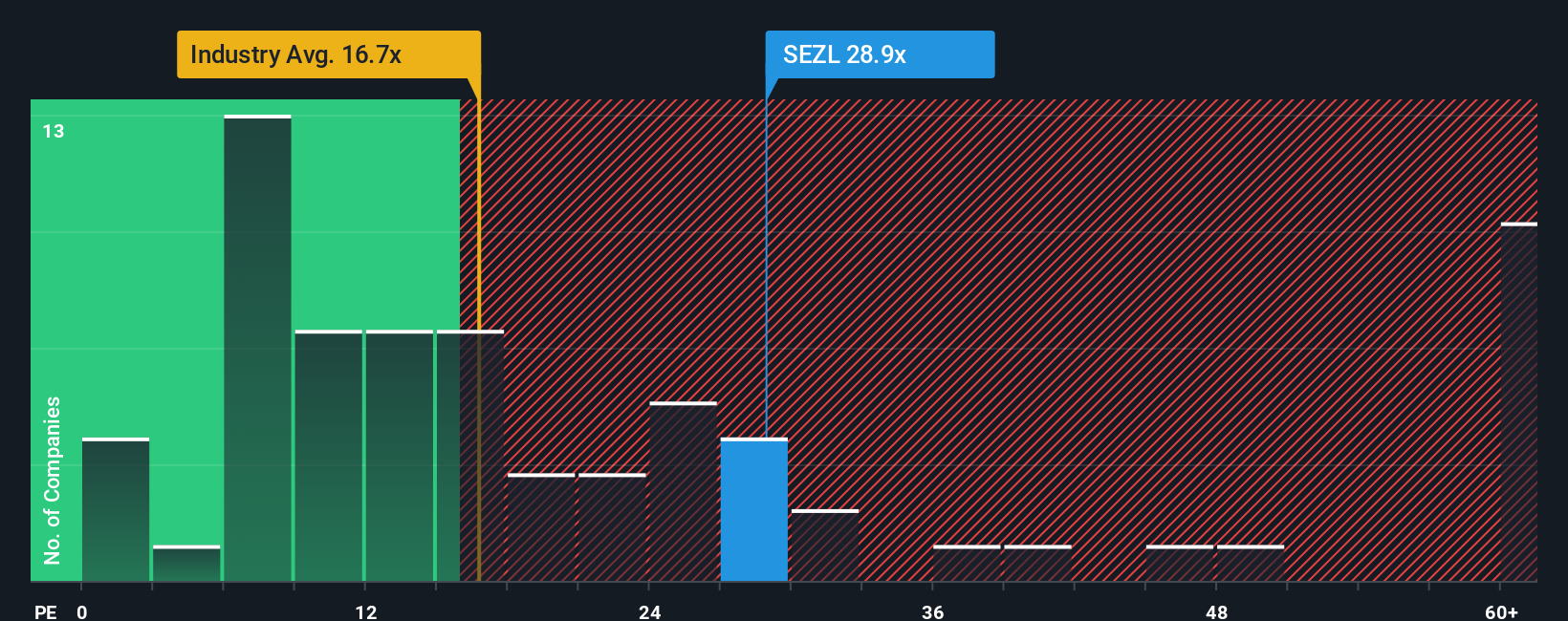

For profitable companies like Sezzle, the price to earnings, or PE, ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current earnings. It links today’s share price directly to the business’s profit engine, which makes it a useful cross check against more complex valuation models.

What counts as a “normal” PE depends heavily on how fast earnings are expected to grow and how risky those earnings are. Higher growth and more predictable profits can justify a higher multiple, while cyclical or uncertain earnings typically command a discount. Right now Sezzle trades on a PE of about 21.7x, notably above the Diversified Financial industry average of around 13.7x, but below the peer group’s punchy 61.0x. This suggests the market sees it as a higher quality, higher growth name than the sector overall, but not the most aggressively valued in its niche.

Simply Wall St’s Fair Ratio, at roughly 29.9x, estimates the PE Sezzle should trade on after adjusting for its specific growth outlook, margins, risk profile, industry and market cap. This tailored view is more informative than simple peer or industry comparisons, which can overlook big differences in quality and risk. With the current PE sitting below that Fair Ratio, Sezzle screens as modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sezzle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Sezzle’s future to a concrete financial forecast and fair value estimate. A Narrative is your story behind the numbers, where you plug in your assumptions about future revenue, earnings and margins, and the platform turns that story into a forecast and a Fair Value that you can easily compare to today’s share price to decide whether Sezzle looks like a buy, hold or sell. Narratives live inside Simply Wall St’s Community page, used by millions of investors, and they update dynamically when new information like earnings, guidance changes or major news hits the market, so your Fair Value stays aligned with reality. For Sezzle, for example, one investor might build a bullish Narrative around strong BNPL adoption, index inclusion and share buybacks supporting a Fair Value closer to $150. A more cautious investor could focus on credit losses, litigation and customer mix to arrive nearer $111. Seeing where your own view fits on that spectrum helps you act with more confidence.

Do you think there's more to the story for Sezzle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報