Snap (SNAP) Valuation Check After New ‘Animate It’ AI Feature and Lawsuit Dismissal

Snap (SNAP) grabbed fresh investor attention after launching its Animate It AI video generator for Lens+ subscribers, while a separate lawsuit over an ad tech issue was quietly dropped, easing overhang risk.

See our latest analysis for Snap.

Those AI moves have given Snap a short term lift, with a 7 day share price return of 4.67 percent. However, the year to date share price return of negative 30.16 percent and one year total shareholder return of negative 29.79 percent show that momentum is still trying to turn the corner rather than being fully established.

If this kind of product driven story interests you, it could be a good moment to explore other high growth tech and AI stocks that might be earlier in their growth runway.

With shares still down sharply over one and five years, but trading at a sizeable discount to analyst targets and some intrinsic value estimates, is Snap a beaten down growth story to consider or already priced for recovery?

Most Popular Narrative: 20.5% Undervalued

With Snap closing at $7.85 versus a narrative fair value near the high single digits, followers see meaningful upside if long term assumptions play out.

Monetization progress in subscription products such as Snapchat+ and Lens+, alongside growing engagement with Spotlight and creator driven content, is diversifying Snap's revenue base and improving net margin potential by capturing higher margin direct to consumer and content revenue streams.

Want to see how modest revenue growth, rising margins, and a richer earnings multiple combine into that upside case? The narrative spells out the full math.

Result: Fair Value of $9.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent unprofitability and intensifying competition from Meta, Alphabet, and TikTok could still derail hopes for a sustained, high margin recovery.

Find out about the key risks to this Snap narrative.

Another View On Value

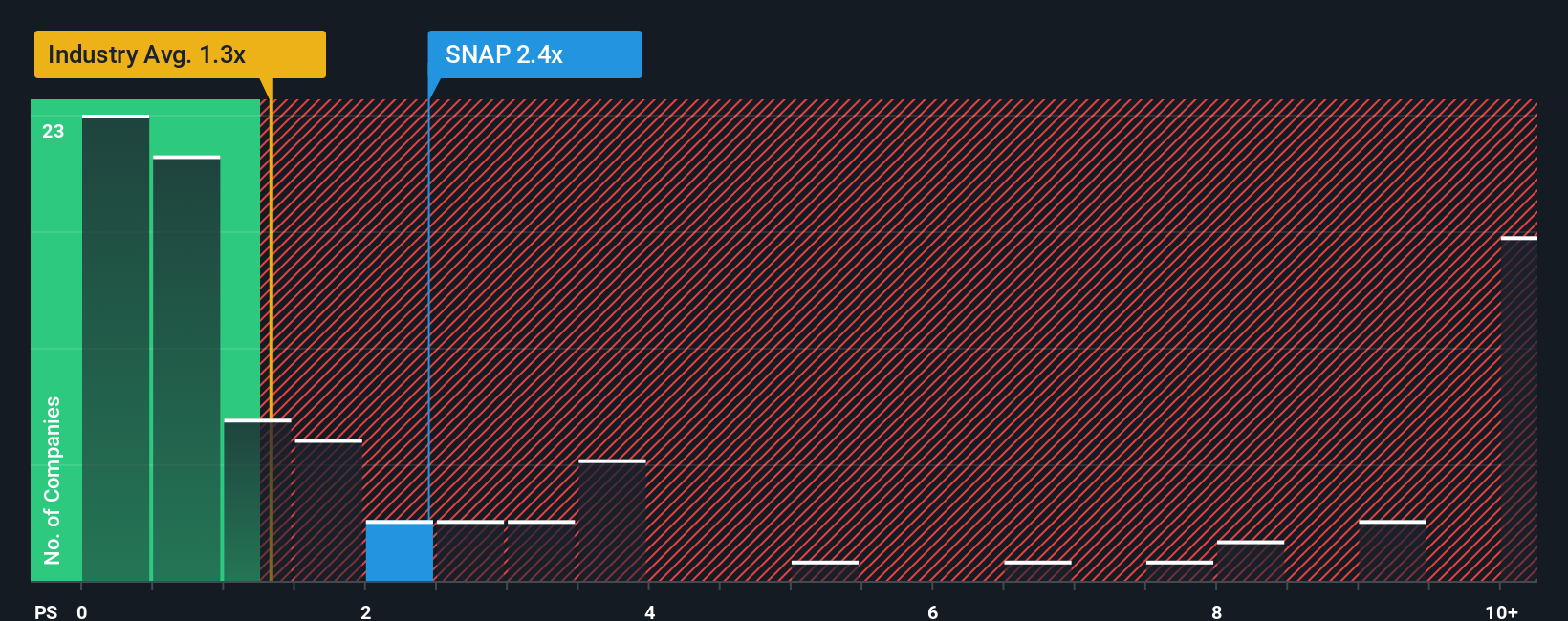

While the narrative and analyst targets point to around 20 percent upside, the market is sending mixed signals. Snap trades at about 2.3 times sales, richer than the US Interactive Media and Services average of 1 times but slightly below peers at 2.8 times and near its 2.5 times fair ratio. Is this a cautious opportunity or a value trap waiting for better proof of profits?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Snap Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom Snap narrative in minutes: Do it your way.

A great starting point for your Snap research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For Your Next Investing Move?

Snap may be on your radar, but you will miss some of the market’s most compelling opportunities if you stop your research here. Use the Simply Wall Street Screener to uncover ideas that truly fit your strategy.

- Capture potential small cap breakouts by scanning through these 3630 penny stocks with strong financials that pair higher risk with surprisingly solid foundations.

- Position yourself for the next wave of innovation by checking out these 24 AI penny stocks shaping how businesses use artificial intelligence.

- Identify possible value opportunities by reviewing these 904 undervalued stocks based on cash flows that current cash flow models suggest may be mispriced by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報