Should Deeper Agentforce 360 Adoption in Regulated Sectors Require Action From Salesforce (CRM) Investors?

- In mid-December 2025, Salesforce and partners including Novartis, Vonage, ZS, and the U.S. Department of Transportation expanded their adoption of Salesforce’s Agentforce 360 and Data 360 platforms to power AI-driven customer and citizen engagement, compliance, and workflow orchestration across global life sciences, contact centers, and public-sector operations.

- These announcements underscore how Salesforce’s AI agents are becoming deeply embedded in large-scale, regulated environments, potentially increasing customer stickiness as organizations standardize core engagement, data, and automation workflows on its platform.

- With Salesforce now embedding Agentforce across major clients like Novartis and USDOT, we’ll examine how this deepening AI adoption shapes its investment narrative.

We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Salesforce Investment Narrative Recap

To own Salesforce, you need to believe its AI-first pivot, centered on Agentforce 360 and Data 360, keeps it differentiated even as CRM tools risk becoming more commoditized. The latest Novartis, Vonage, ZS, and USDOT wins reinforce that narrative by showcasing real-world, regulated deployments, but they do not remove the key short term swing factor: whether Agentforce and Data 360 adoption can scale fast enough to offset competitive pressure from hyperscalers and lower cost platforms.

Among the recent announcements, the agencywide USDOT rollout stands out as most relevant. It highlights Salesforce’s ability to land multi-year, mission critical workloads that rely heavily on Data 360 and government compliant Agentforce modules, which directly supports the current AI adoption catalyst. At the same time, deploying deeply into public sector and life sciences environments also brings stricter regulatory and data privacy requirements that could raise Salesforce’s ongoing compliance and integration costs.

Yet behind the optimism around AI and Agentforce momentum, investors should be aware that intensifying competition from hyperscalers could still...

Read the full narrative on Salesforce (it's free!)

Salesforce's narrative projects $51.9 billion revenue and $10.3 billion earnings by 2028. This requires 9.6% yearly revenue growth and about a $3.6 billion earnings increase from $6.7 billion today.

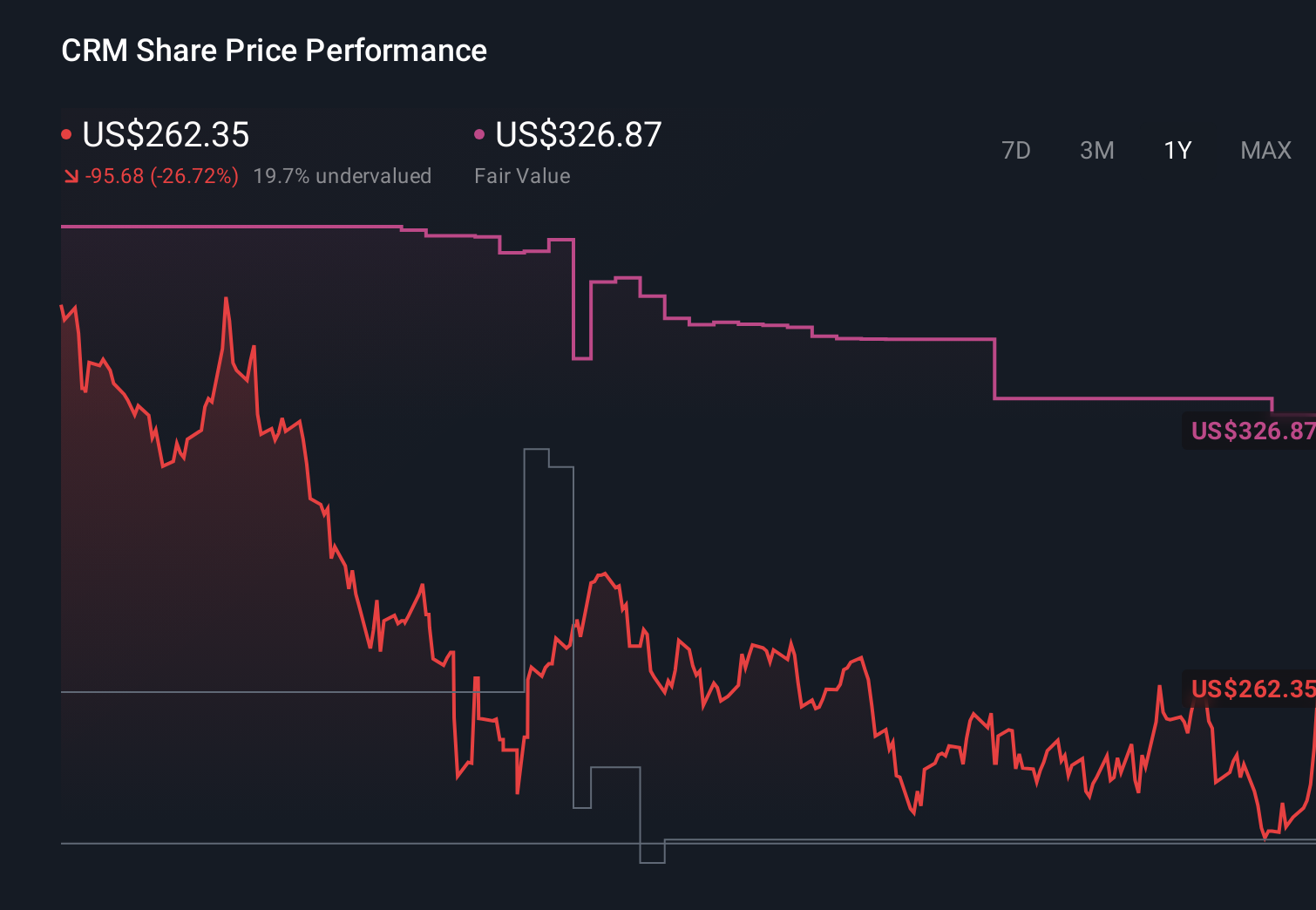

Uncover how Salesforce's forecasts yield a $330.06 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Forty one Simply Wall St Community members see Salesforce’s fair value between US$242 and US$430, showing wide disagreement on upside. As you weigh those views, remember that rising AI driven adoption also heightens the risk that hyperscalers bundle competing CRM and automation into their broader suites, with implications for Salesforce’s pricing power and long term growth profile.

Explore 41 other fair value estimates on Salesforce - why the stock might be worth as much as 62% more than the current price!

Build Your Own Salesforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Salesforce research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Salesforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Salesforce's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報