Does CubeSmart’s Higher Dividend Payout Shape a Stronger Income Narrative for CUBE Investors?

- Earlier this month, CubeSmart announced that its Board of Trustees declared a quarterly dividend of US$0.53 per common share for the period ending December 31, 2025, payable on January 16, 2026 to shareholders of record as of January 2, 2026.

- This higher quarterly payout underlines CubeSmart’s emphasis on returning cash to investors, which can be especially relevant for income‑focused REIT shareholders assessing the reliability of future distributions.

- Next, we’ll explore how this higher quarterly dividend commitment interacts with CubeSmart’s earnings outlook and capital allocation in the existing investment narrative.

We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CubeSmart Investment Narrative Recap

To own CubeSmart, you need to believe in steady, utility like demand for self storage and a REIT model that converts that demand into reliable cash flow. The higher US$0.53 quarterly dividend reinforces the income side of the thesis, but it does not materially change the near term earnings pressure from softer move in rates and negative same store comparisons, which remain the key short term catalyst and the biggest risk to watch.

Against this backdrop, the recent Q3 2025 results, where revenue grew year on year but net income and EPS declined, are particularly relevant to this dividend news. The higher payout now sits alongside moderating profit trends, so investors may want to think carefully about how ongoing capital needs for property upgrades and digital infrastructure could affect future payout capacity if revenue growth stays subdued.

However, investors should also be aware that higher recurring capital expenditures could eventually...

Read the full narrative on CubeSmart (it's free!)

CubeSmart’s narrative projects $1.3 billion revenue and $369.9 million earnings by 2028. This implies 4.5% yearly revenue growth but a modest earnings decrease of about $4.9 million from $374.8 million today.

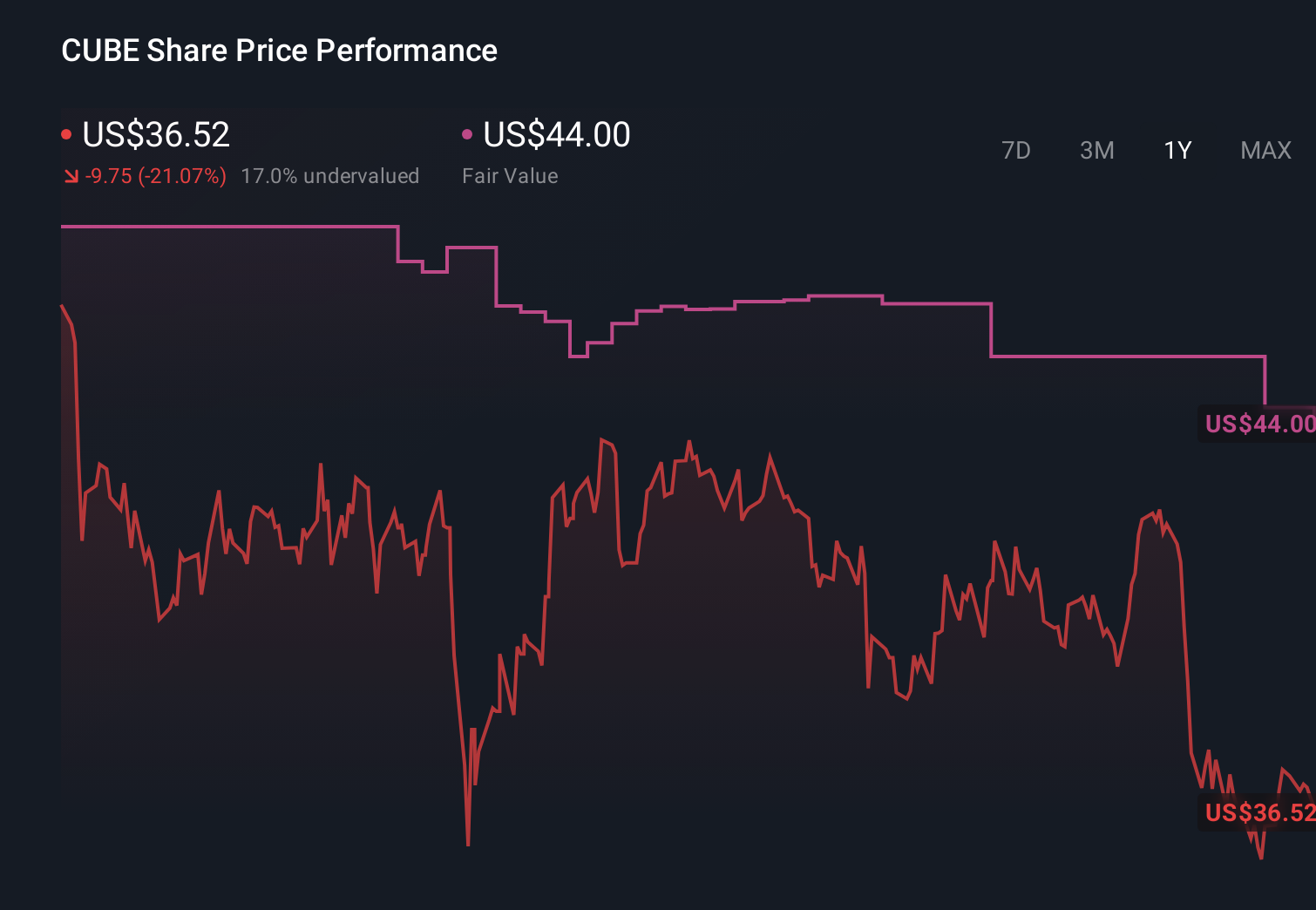

Uncover how CubeSmart's forecasts yield a $43.18 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$43.18 to US$57.44, showing how far apart individual views can be. You can set these side by side with the risk that persistent new supply in key Sunbelt markets could pressure occupancy and revenue for longer than expected, and then weigh how that might color your own expectations for CubeSmart’s performance.

Explore 2 other fair value estimates on CubeSmart - why the stock might be worth as much as 60% more than the current price!

Build Your Own CubeSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CubeSmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CubeSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CubeSmart's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報