Is It Too Late To Consider KLA After Its 100% Rally In 2025?

How Has KLA Performed Recently?

With KLA up 9.0% over the last week, 12.3% over the last month, and an eye catching 100.6% year to date, it is fair to ask whether the market has simply rerated the stock or is pricing in a much stronger long term outlook. Those moves sit on top of a 98.0% gain over the last year and a remarkable 418.0% return over five years, which puts KLA firmly in the market outperformer camp.

This kind of sustained performance often signals a mix of structural tailwinds in the underlying industry and rising confidence in the company specific strategy. The key question for investors now is whether those drivers are durable enough to justify the current price level, or whether sentiment has run ahead of fundamentals.

Recent news around KLA has largely focused on its role at the heart of the semiconductor equipment cycle, from expanding capacity for advanced process control to sharpening its position in front end inspection tools. As chipmakers ramp investment in leading edge nodes and mature processes alike, commentary has increasingly highlighted KLA as a critical enabler of yield and reliability, helping explain why investors have been willing to pay up for exposure to its part of the value chain.

At the same time, there has been growing discussion about supply chain resilience, government incentives for onshoring fabrication, and the longer term demand outlook for AI, high performance computing, and automotive chips. Taken together, these themes help contextualize both the strength and volatility in KLA shares, because they amplify the company sensitivity to each new datapoint on capex cycles and technology roadmaps.

Despite all of that momentum, our structured valuation checks currently give KLA a score of 1 out of 6, meaning it appears undervalued on only one of six core metrics. In the next sections we will unpack how different valuation approaches interpret KLA current share price, and later in the article we will explore an even more insightful way to think about valuation that ties the numbers back to the evolving narrative behind the stock.

KLA scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: KLA Discounted Cash Flow (DCF) Analysis

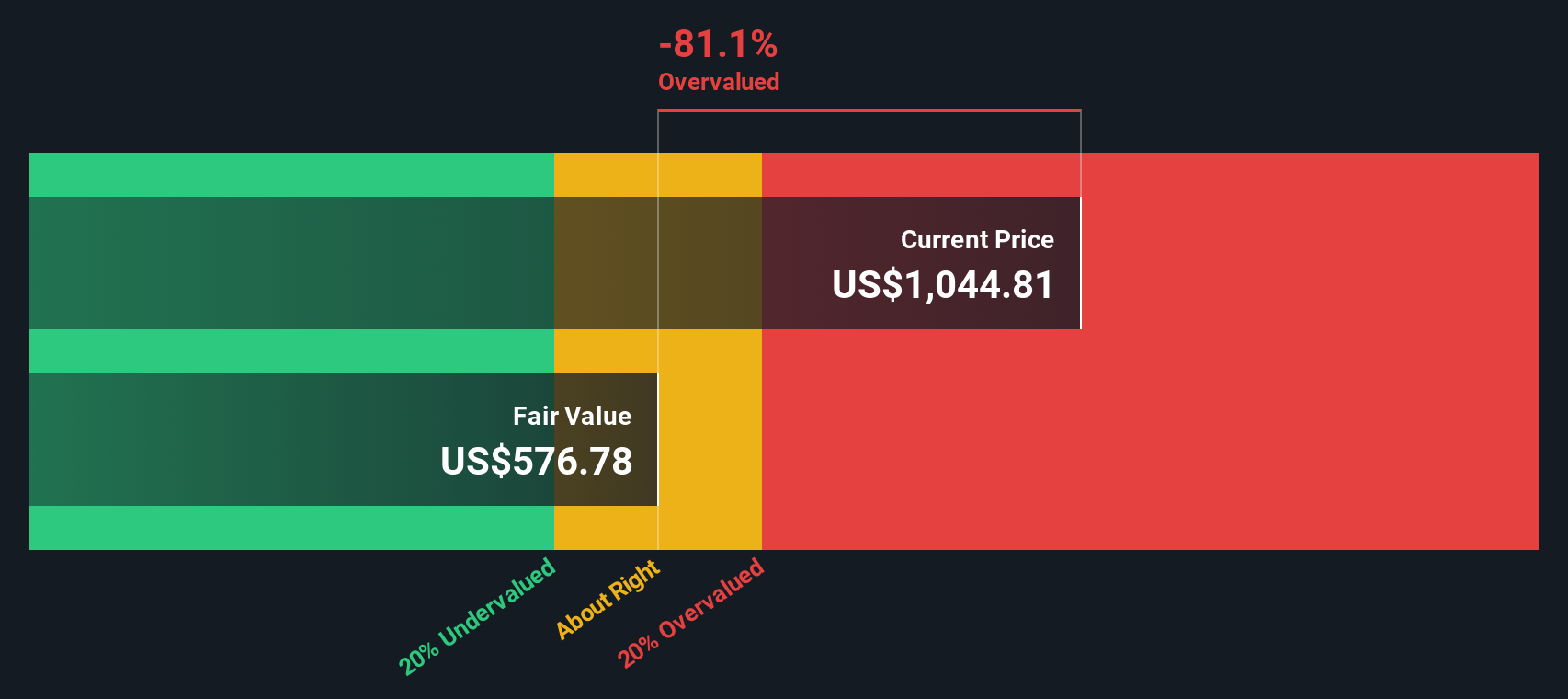

A Discounted Cash Flow model estimates what a business is worth by projecting future cash flows and then discounting them back to todays value using a required rate of return. For KLA, the model uses a 2 stage Free Cash Flow to Equity approach in $, starting from last twelve month free cash flow of about $3.9 billion and building out a path of growth.

Analyst forecasts and extrapolations point to free cash flow rising to roughly $8.8 billion by 2035, with intermediate projections such as $4.7 billion in 2026 and $6.7 billion by 2030. Simply Wall St uses analyst estimates for the next few years, then extends those trends at gradually slowing growth rates to avoid unrealistically aggressive long term assumptions.

When all those projected cash flows are discounted back, the model arrives at an intrinsic value of about $630.74 per share. Compared with the current market price, this implies KLA is around 102.5% overvalued, suggesting investors are paying well ahead of what the cash flow profile alone supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests KLA may be overvalued by 102.5%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: KLA Price vs Earnings

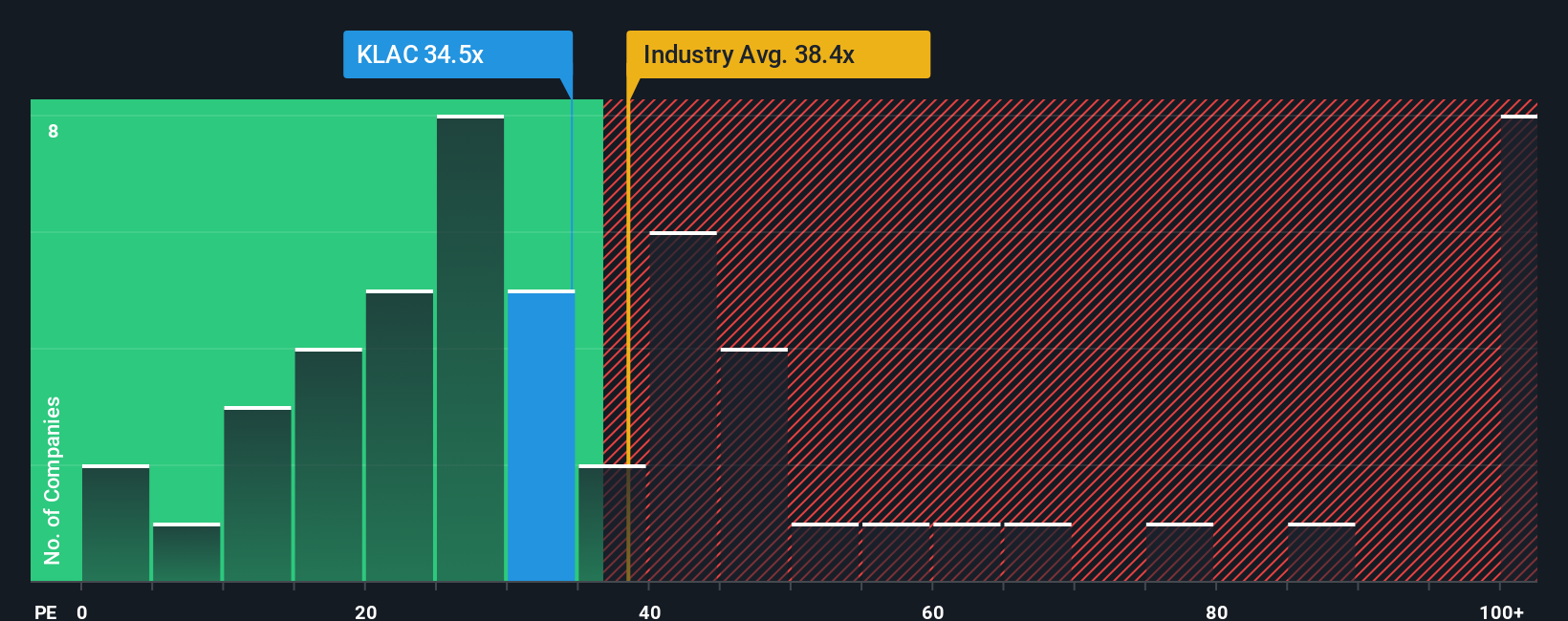

For a profitable, mature business like KLA, the price to earnings ratio is a useful way to judge valuation because it links what investors pay today directly to the profits the company is generating. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty argue for a lower, more conservative multiple.

KLA currently trades on a PE of about 39.6x, which is slightly above both the broader semiconductor industry average of roughly 36.6x and close to the peer group at about 39.9x. On those simple comparisons, the stock looks fairly fully valued rather than clearly cheap. However, Simply Wall St also calculates a Fair Ratio of 28.8x, which estimates the PE KLA should trade on given its specific earnings growth outlook, profitability, industry positioning, market cap, and risk profile.

This Fair Ratio is more tailored than a basic peer or industry comparison because it explicitly adjusts for company level strengths and weaknesses, rather than assuming all semiconductor names deserve the same multiple. With KLA trading well above the 28.8x Fair Ratio, the preferred multiple framework points to the shares being meaningfully overvalued on earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your KLA Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St Community pages you can use Narratives, where you write a simple story about KLA future, translate that story into specific forecasts for revenue, earnings and margins, and instantly see a Fair Value estimate that updates dynamically as new news or earnings arrive. This can help you decide when to buy or sell by comparing that Fair Value with the live share price. For example, one KLA Narrative might lean bullish, assuming AI and DRAM spending stay strong enough to justify something close to the higher end of current targets around $1,075. A more cautious Narrative might focus on tariffs, China weakness and cyclicality to arrive nearer the lower end near $745. The platform keeps both perspectives, their numbers and their resulting Fair Values visible and comparable so that any investor can quickly choose, adjust or build the Narrative that best reflects their own view of the company.

Do you think there's more to the story for KLA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報