Assessing First Solar (FSLR) Valuation After 52-Week High Volatility and Alphabet–Intersect Power Deal

First Solar (FSLR) just delivered a wild session, sliding about 6% after touching a fresh 52 week high as investors debated stretched valuations while digesting Alphabet’s planned acquisition of key customer Intersect Power.

See our latest analysis for First Solar.

Zooming out, the $272.21 share price sits on top of a powerful run, with a roughly 46 percent year to date share price return and an even stronger multi year total shareholder return that signals momentum is still building rather than fading.

If this kind of clean energy momentum has your attention, it could be a smart moment to compare First Solar with other high growth tech and AI stocks that are reshaping the future of power and infrastructure.

With First Solar now trading essentially in line with Wall Street targets but still showing hefty intrinsic upside, the key question is simple: are investors underestimating its earnings power, or is future growth already fully priced in?

Most Popular Narrative: 0% Overvalued

With First Solar trading almost exactly in line with the narrative fair value of about $271.61, investors are effectively endorsing a finely balanced outlook.

The steadily growing, visibility rich contracted backlog (currently at $18.5 billion and 64 GW, with price adjusters for tech milestones and tariffs) provides stability against industry volatility; this allows consistent revenue recognition and helps mitigate net margin compression, even amid cyclical and policy driven swings in global solar markets.

Curious how this backlog, ambitious profit expansion, and a surprisingly modest future earnings multiple all fit together? The full narrative lays out a very deliberate roadmap. Want to see which expectations must hold for this price to make sense?

Result: Fair Value of $271.61 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that roadmap could be disrupted if U.S. policy support weakens or if aggressive low cost competitors undercut First Solar’s pricing and margins.

Find out about the key risks to this First Solar narrative.

Another Lens On Value

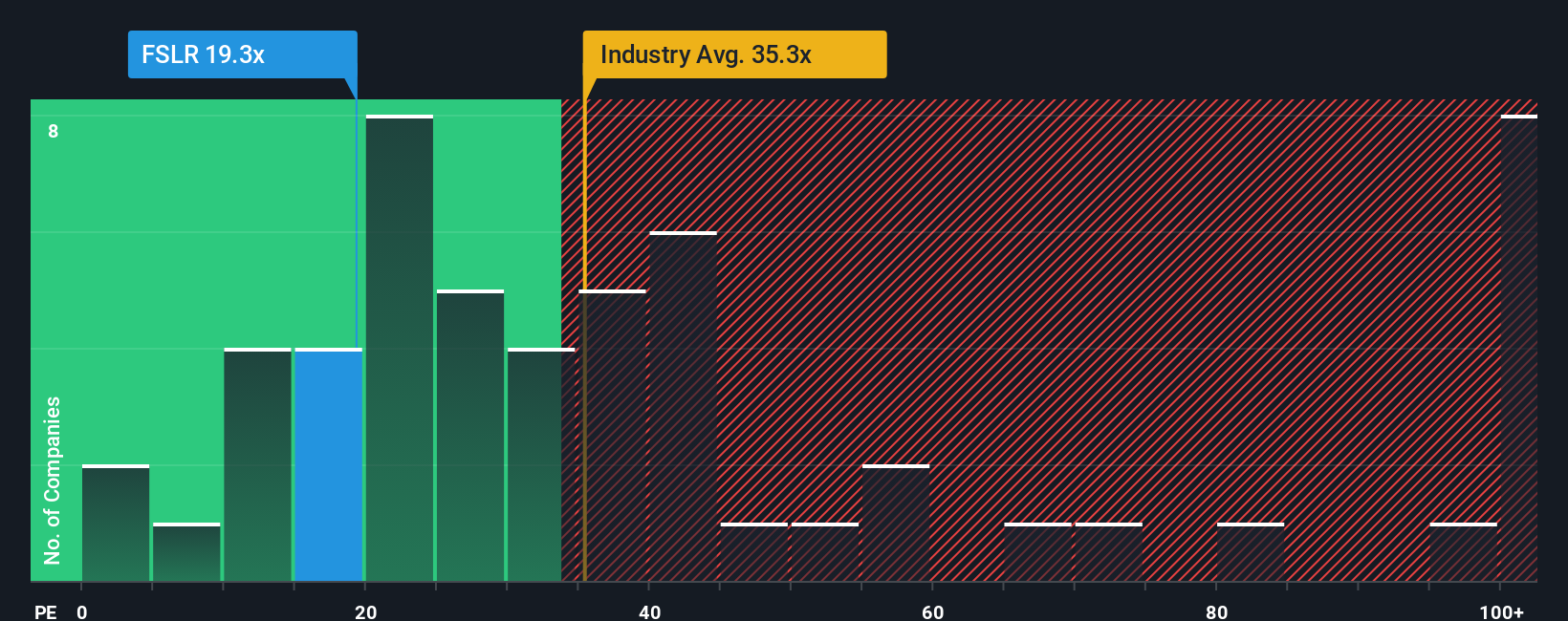

Step away from narratives and the numbers look starker. On a simple price to earnings yardstick, First Solar trades at about 20.9 times, far below peers at 66.5 times and even below a 41.1 times fair ratio that our models suggest the market could migrate toward. That gap suggests a potential opportunity. The question is whether sentiment will eventually align with the fundamentals or remain cautious.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Solar Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A great starting point for your First Solar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next move by hunting for fresh opportunities on the Simply Wall Street Screener so you do not miss what is breaking out next.

- Capitalize on potential price missteps by targeting companies trading below their cash flow value with these 904 undervalued stocks based on cash flows, tailored for value focused investors.

- Ride powerful innovation trends by zeroing in on these 24 AI penny stocks, where intelligent automation and data driven models could reshape entire industries.

- Boost your income stream by filtering for reliable payers using these 10 dividend stocks with yields > 3%, which highlights attractive yields with room for compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報