Assessing MS&AD Insurance Group Holdings (TSE:8725)’s Valuation After Its Strong Three-Year Shareholder Returns

MS&AD Insurance Group Holdings (TSE:8725) has quietly outperformed over the past 3 years, with total returns surging almost 189%, even as recent quarterly net income dipped slightly.

See our latest analysis for MS&AD Insurance Group Holdings.

Despite a softer 1 day share price return, MS&AD’s 30 day share price gain of 6.73% and its 3 year total shareholder return near 189% point to momentum that is still very much intact.

If that performance has you thinking about where else capital is flowing in financials, this could be a good moment to explore fast growing stocks with high insider ownership.

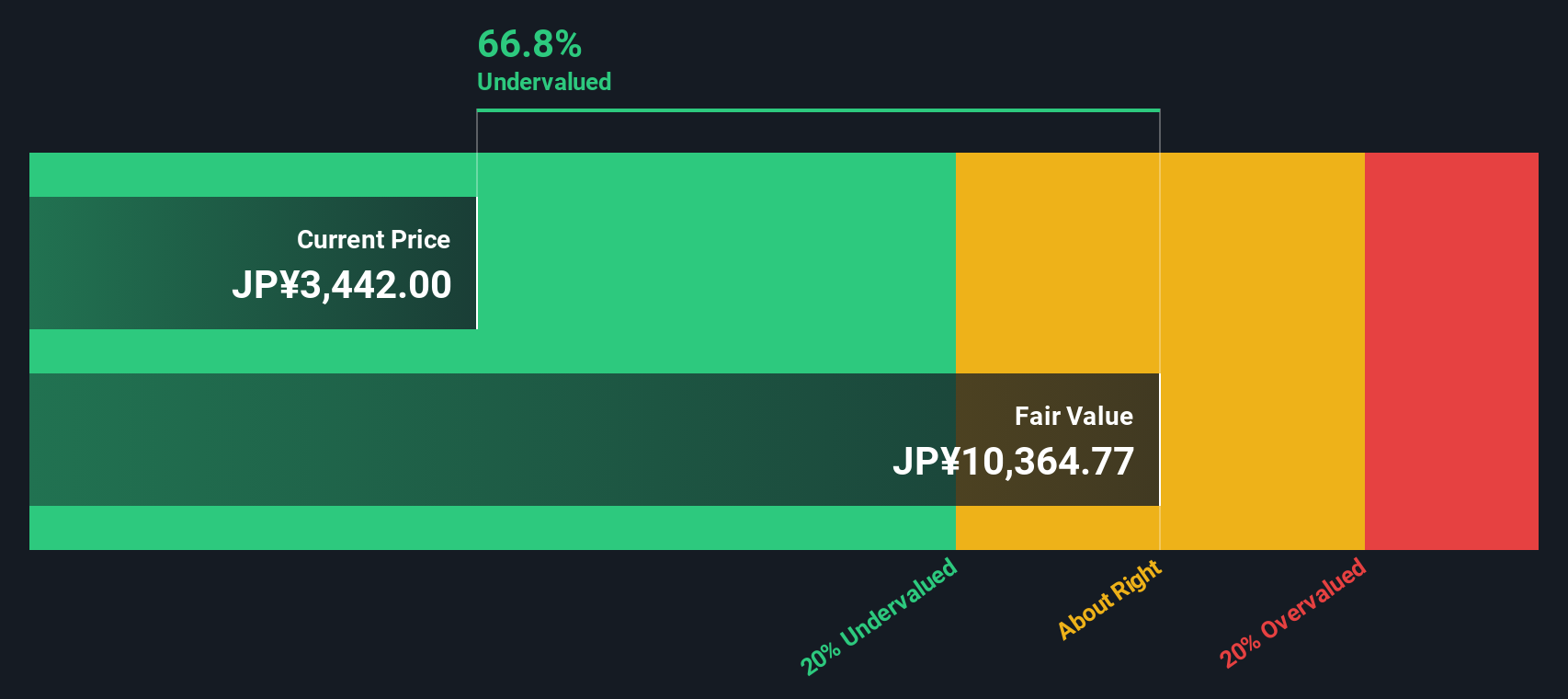

With shares trading below analyst targets and our model suggesting a sizable intrinsic discount, yet earnings growth looking patchy, investors now face a key question: is MS&AD undervalued or already pricing in its future growth?

Price-to-Earnings of 7.5x: Is it justified?

MS&AD Insurance Group Holdings last closed at ¥3,665, which equates to a price-to-earnings ratio of 7.5x and screens as materially undervalued against peers.

The price-to-earnings multiple compares what investors are paying today for each unit of current earnings, a core yardstick for mature, profitable insurers. For MS&AD, a 7.5x multiple looks conservative given its high quality earnings record and strong profit growth over the past five years.

Relative signals reinforce that impression, with the shares trading at good value versus peers and the wider industry, and notably below an estimated fair price-to-earnings ratio of 11.6x that the market could ultimately gravitate toward. In parallel, our DCF work suggests the stock, at ¥3,665, still sits around 61.7% below an intrinsic value estimate of roughly ¥9,564.94, underscoring how modest the current earnings multiple appears.

Explore the SWS fair ratio for MS&AD Insurance Group Holdings

Result: Price-to-Earnings of 7.5x (UNDERVALUED)

However, weaker annual net income growth and potential pressure on premium volumes or claims costs could challenge how long this valuation gap persists.

Find out about the key risks to this MS&AD Insurance Group Holdings narrative.

Another View: What Does Our DCF Say?

Our DCF model presents an even more dramatic picture, putting fair value near ¥9,565, which is roughly 62% above the current ¥3,665 share price. If that gap is even half right, are investors underestimating future cash flows or overpricing the risk of earnings decline?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MS&AD Insurance Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MS&AD Insurance Group Holdings Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your MS&AD Insurance Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh, data backed ideas that could reshape your portfolio faster than you expect.

- Capture potential mispricings early by scanning these 904 undervalued stocks based on cash flows that the market may be overlooking despite strong fundamentals.

- Position yourself ahead of structural healthcare shifts by targeting these 29 healthcare AI stocks harnessing data driven medicine.

- Ride the momentum of digital finance innovation by tracking these 80 cryptocurrency and blockchain stocks powering exchanges, payment rails, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報