DBS (SGX:D05): Valuation Check After RMB Clearing Bank Appointment and Multi‑Year Capital Return Plan

DBS Group Holdings (SGX:D05) is back in focus after being appointed Singapore's second renminbi clearing bank, a move that deepens its role in regional trade flows and cross border payments.

See our latest analysis for DBS Group Holdings.

That RMB clearing mandate and the S$8 billion capital return plan seem to be resonating with investors, with the share price at S$56.30, a strong year to date share price return of 28.07 percent and a five year total shareholder return of 219.46 percent. This suggests momentum is still building rather than fading.

If this kind of structural story appeals to you, it could be a good moment to explore other banks and financials with strong capital positions and growth plans using our fast growing stocks with high insider ownership.

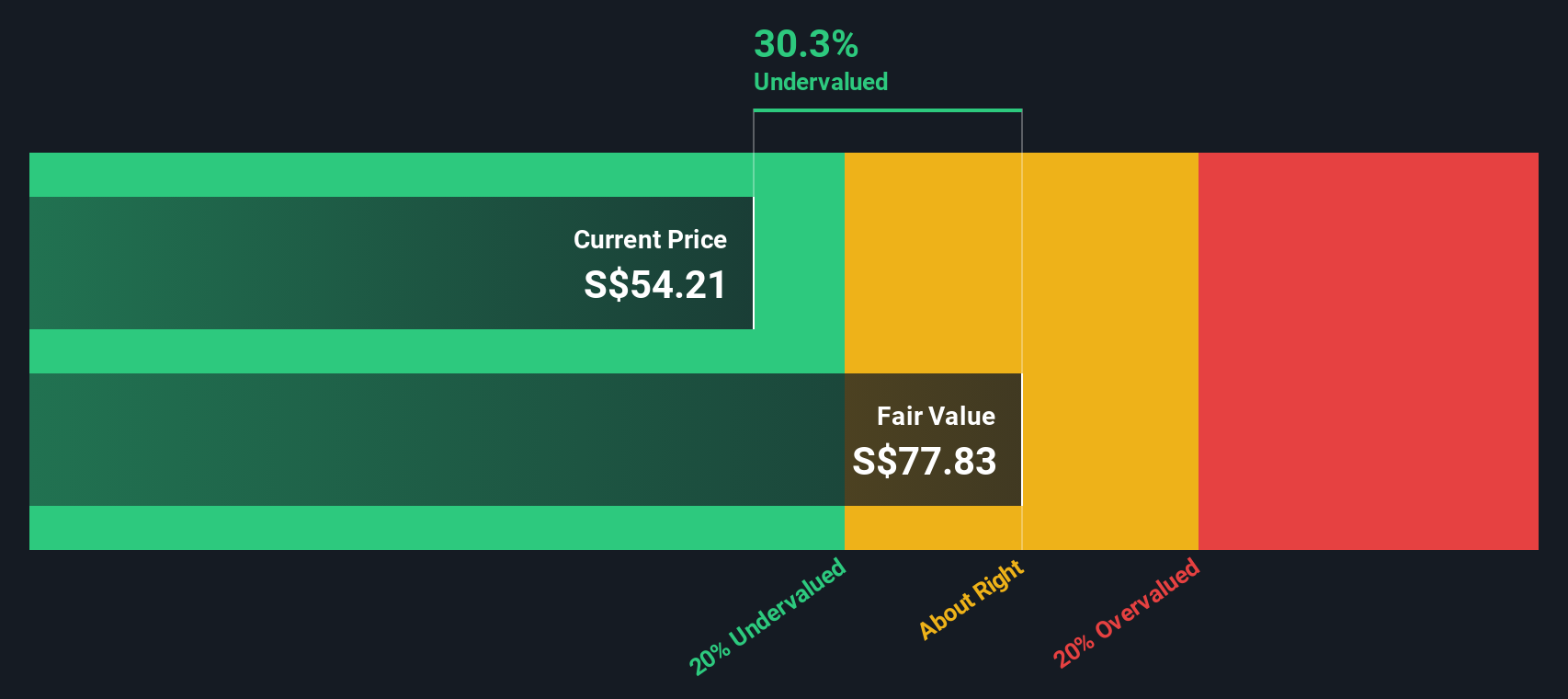

Yet with the share price sitting near record highs and consensus targets, the real question now is whether DBS still trades below its intrinsic value or if the market is already pricing in years of growth ahead.

Most Popular Narrative Narrative: 20% Overvalued

With DBS closing at S$56.30 against a narrative fair value of about S$56.17, the prevailing view is that upside from here is limited.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from 12.8x today. This future PE is greater than the current PE for the SG Banks industry at 10.3x.

Curious what kind of revenue trajectory, margin path and shrinking share count are required to support that richer earnings multiple on a regional bank? The full narrative breaks down the growth, profitability and valuation bridge that needs to fall into place to warrant this price.

Result: Fair Value of $56.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from lower interest rates or prolonged regulatory constraints on capital could quickly challenge the current fair value narrative.

Find out about the key risks to this DBS Group Holdings narrative.

Another View: Cash Flows Tell a Different Story

While the narrative model flags DBS as about 20 percent overvalued at S$56.17, our DCF model paints a different picture and suggests fair value closer to S$78.07. That implies the market could be underpricing long term cash flows. Which outlook do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DBS Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DBS Group Holdings Narrative

If you are not fully aligned with this view or simply want to test your own assumptions, you can build a complete narrative yourself in just a few minutes: Do it your way.

A great starting point for your DBS Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction opportunities?

Before you move on, explore your next set of ideas with focused screeners that surface quality opportunities others might overlook.

- Target income potential by reviewing companies in these 10 dividend stocks with yields > 3% that may help increase your portfolio's cash flow.

- Look for possible mispriced quality by scanning these 904 undervalued stocks based on cash flows where market pessimism may have gone too far.

- Explore the next wave of innovation with these 24 AI penny stocks positioned to participate in advances in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報