Ultra Clean Holdings (UCTT) Valuation After Zacks Rank #2 (Buy) Upgrade and Rising Earnings Estimates

Ultra Clean Holdings (UCTT) just picked up a Zacks Rank #2 (Buy) upgrade after analysts raised their earnings estimates, which is a clear signal that expectations for the company’s near term profit trajectory are improving.

See our latest analysis for Ultra Clean Holdings.

The upgrade lands after a choppy stretch, with the share price at 26.18 dollars and a 30 day share price return of 13.58 percent contrasting with a weaker year to date share price return and similarly negative one year total shareholder return. This hints that momentum may be turning after a tough year.

If this rebound has you rethinking where growth could come from next, it may be worth scanning high growth tech and AI stocks to see which other chip and AI names are starting to attract attention.

With Ultra Clean still trading well below analyst targets despite a sharp recent bounce, investors now face a key question: is this a discounted entry into a recovering semiconductor supplier, or is the market already pricing in the next leg of growth?

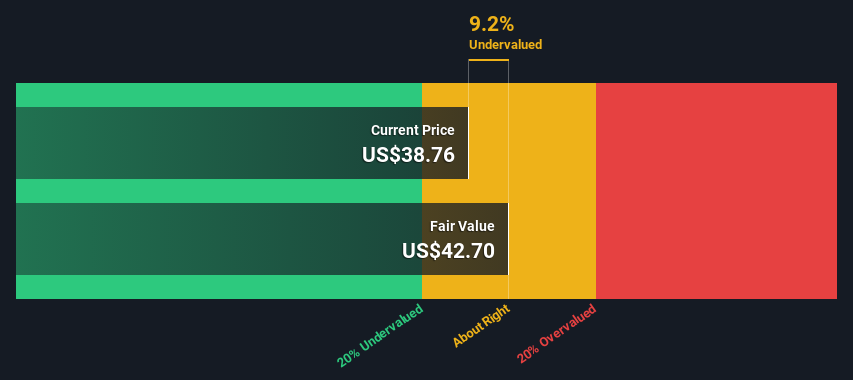

Most Popular Narrative: 25.2% Undervalued

With Ultra Clean shares at 26.18 dollars against a 35 dollar narrative fair value, the story rests on a powerful cyclical earnings reset.

Q3 earnings outperformance is seen as evidence that management is executing well on cost controls and mix, supporting a higher earnings base from which to compound growth in the next wafer fab equipment cycle.

Stronger gross margin performance, helped by higher volumes from key customers such as Lam Research, suggests better operating leverage and room for further margin expansion as utilization improves.

To review the details behind this optimism, from accelerating top line assumptions to a richer profit profile and expectations for a premium future multiple, see the full narrative.

Result: Fair Value of $35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry softness and Ultra Clean's dependence on a handful of major customers could quickly undermine the margin expansion story that investors are buying into.

Find out about the key risks to this Ultra Clean Holdings narrative.

Another Way To Look At Value

Our DCF model comes to a very different conclusion, putting fair value for Ultra Clean at approximately 18.17 dollars. This comparison makes the current 26.18 dollar share price appear overvalued rather than cheap. When two methods disagree this much, which story seems more credible?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ultra Clean Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ultra Clean Holdings Narrative

If you see the story differently or prefer to analyze the numbers on your own, you can build a complete view in minutes: Do it your way.

A great starting point for your Ultra Clean Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want a stronger watchlist and clearer conviction, use the Simply Wall St Screener now so you do not miss the next compelling opportunity.

- Capture potential mispricings early by scanning these 904 undervalued stocks based on cash flows that combine solid cash flows with attractive entry points.

- Position yourself ahead of the next tech wave by focusing on these 24 AI penny stocks pushing practical AI into real world products and services.

- Boost your income stream by targeting these 10 dividend stocks with yields > 3% that balance healthy payouts with sustainable business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報