Does Krystal Biotech Still Offer Value After Its Strong Share Price Run?

How does Krystal Biotech look on traditional valuation checks

To get a clearer handle on whether Krystal Biotech still offers value after such a strong run, it helps to strip things back to the fundamentals and run through a few well known valuation lenses. Here we will walk through how the stock stacks up on simple metrics like price to earnings, price to sales, and price to book, then layer in expectations of future growth to see if the current share price can be justified.

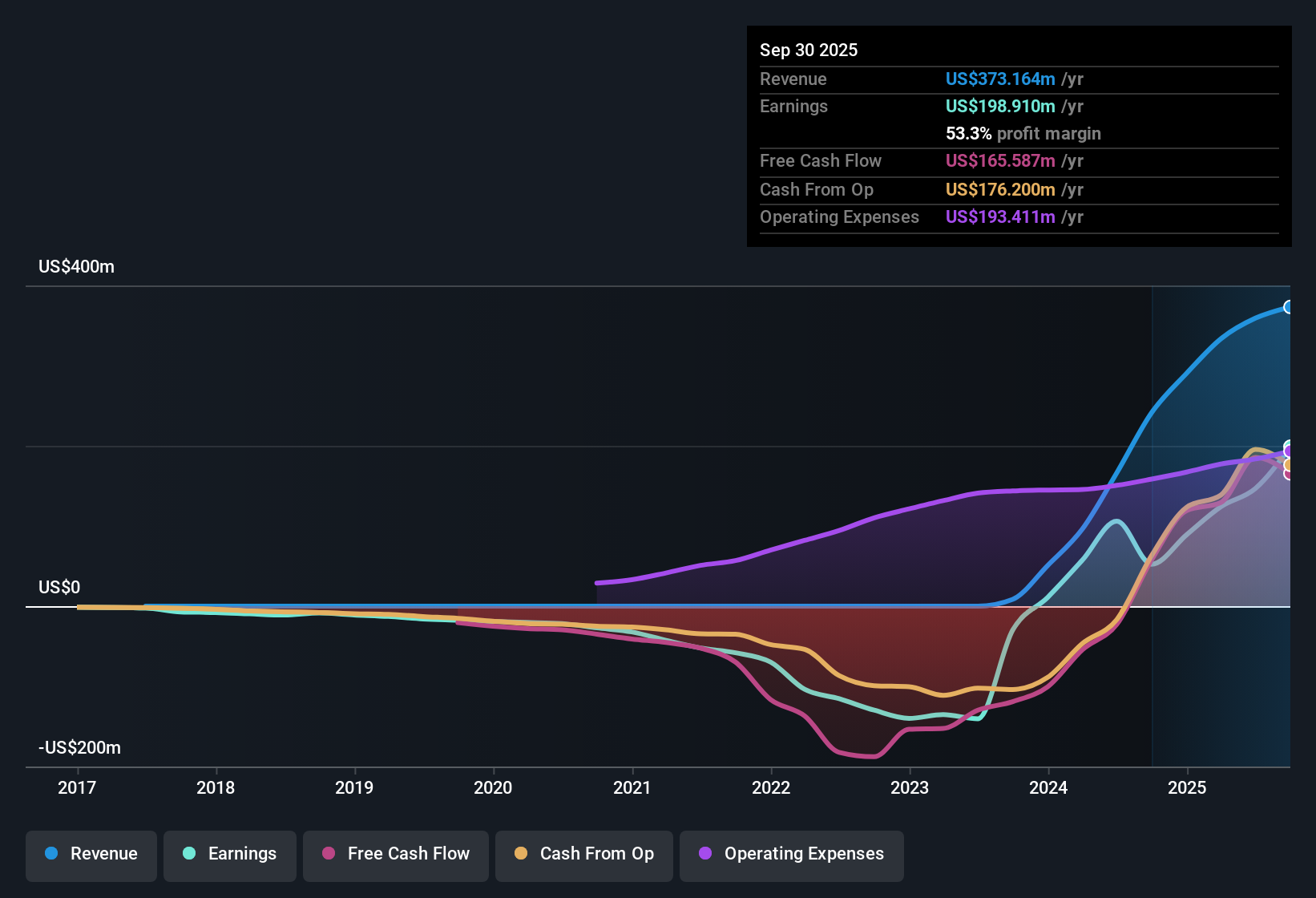

Starting with basic multiples against trailing fundamentals, Krystal Biotech screens as expensive relative to many traditional biotech peers that have steadier revenue profiles. That is not entirely surprising for a high growth, platform style business, but it does mean that simple backward looking ratios may overstate how stretched the valuation really is.

On a price to sales basis, the market is clearly baking in meaningful growth runway, reflecting optimism that the company can expand beyond its initial launches into a broader pipeline. When you compare Krystal Biotech to other fast growing gene therapy names, its revenue multiple is elevated, but not entirely out of line with companies that have already begun successfully commercializing products.

Price to earnings is less useful here, given the company is still transitioning from heavy investment mode toward more mature profitability. Investors are effectively being asked to look past near term accounting noise and focus instead on how operating leverage might play out as revenues scale over the next few years.

Because of this, cash flow based measures like discounted cash flow models and forward looking scenarios offer a more nuanced read than raw multiples alone. These approaches help translate expectations about product adoption, margins, and reinvestment needs into an implied fair value range. We will dig into that next, before circling back to an approach that can make these numbers easier to interpret over the long term.

Approach 1: Krystal Biotech Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present.

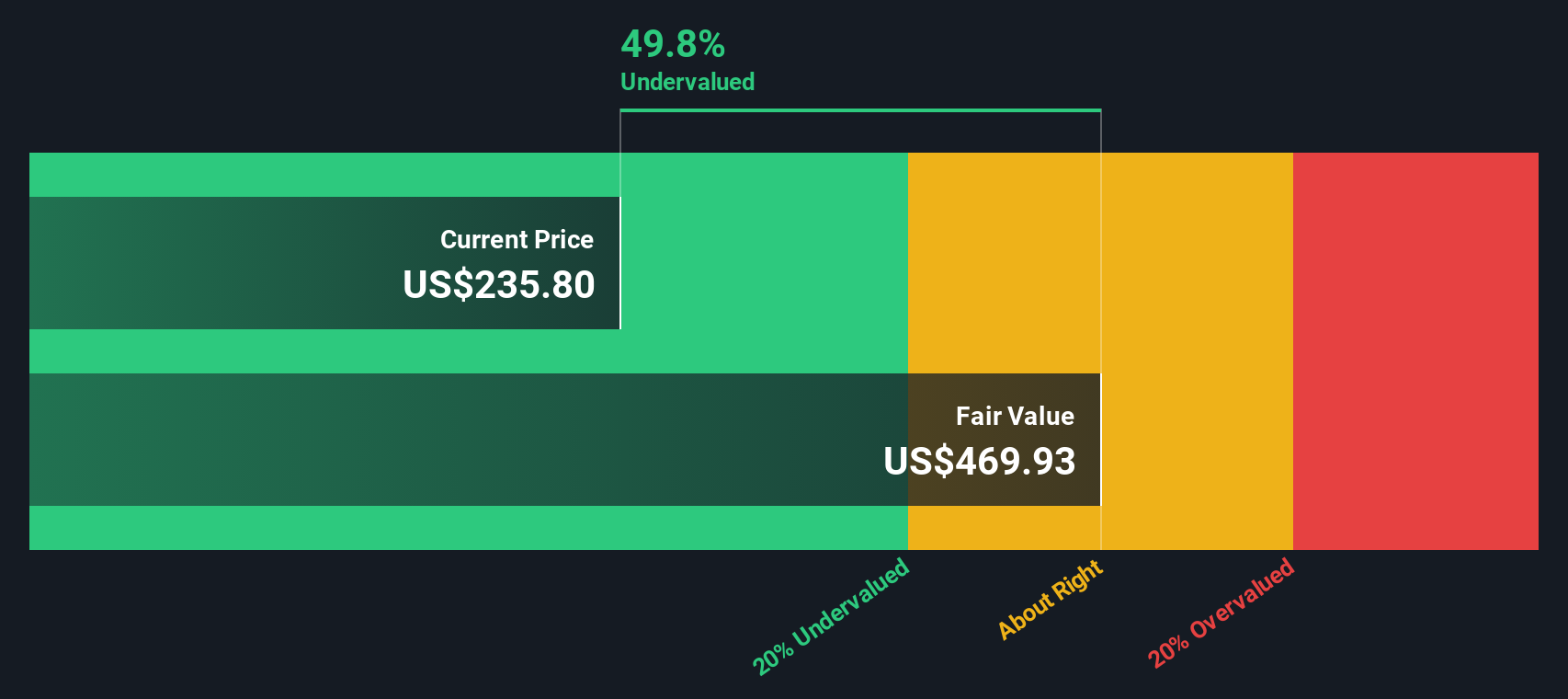

For Krystal Biotech, the starting point is last twelve month free cash flow of about $157.6 million. Analyst forecasts and subsequent extrapolations see free cash flow rising steadily, with projections reaching roughly $725.1 million by 2035 as new products scale and margins improve. These cash flows, all in dollars, are modeled using a 2 Stage Free Cash Flow to Equity framework. This approach captures a faster growth phase first, followed by a more mature phase beyond the explicit forecast horizon.

When these projected cash flows are discounted back to today, the DCF model produces an estimated intrinsic value of about $472.50 per share. At this level, the stock is trading at roughly a 46.8% discount to this fair value estimate, indicating that the market price is below the model’s assessment of the company’s cash generation potential over the next decade.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Krystal Biotech is undervalued by 46.8%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Krystal Biotech Price vs Earnings

For profitable companies, the price to earnings, or PE, ratio is a useful shorthand for how many dollars investors are willing to pay today for each dollar of current earnings. It ties valuation directly to the bottom line, which makes it easier to compare across businesses that are already generating consistent profits.

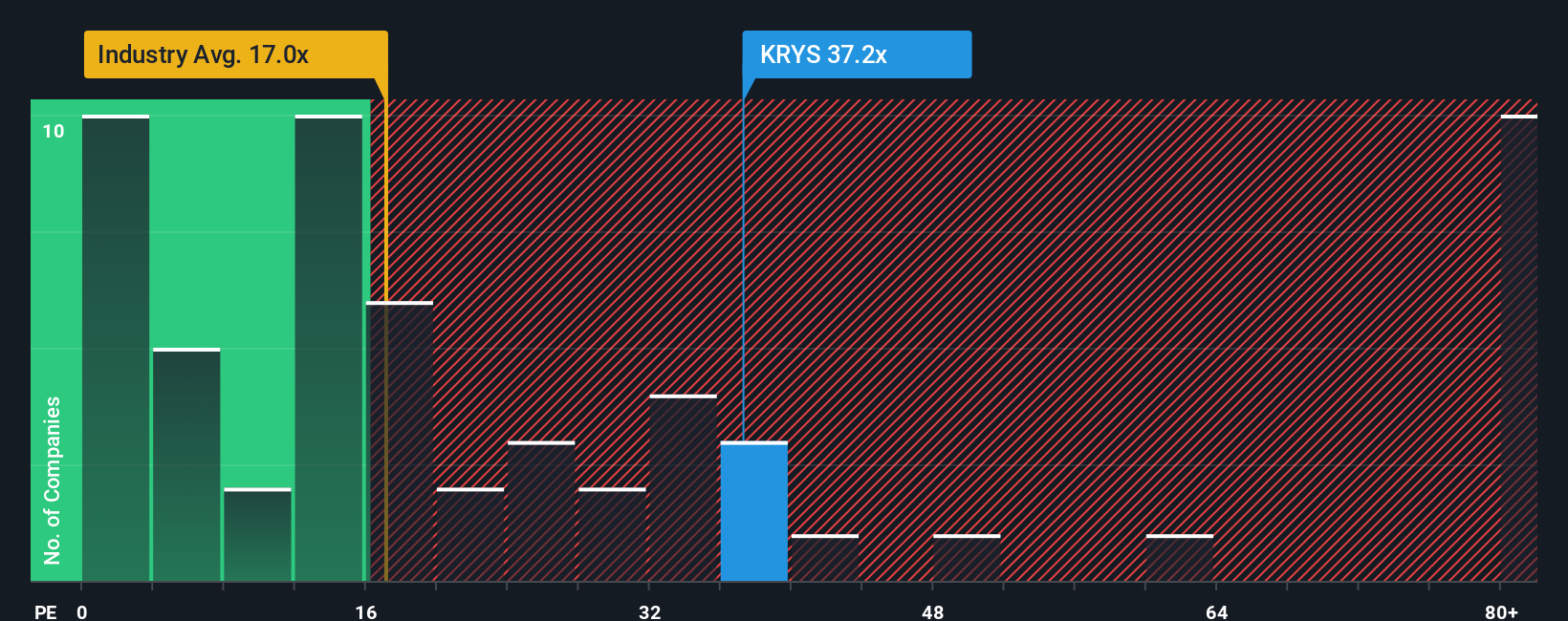

In practice, what counts as a normal or fair PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and stronger competitive positions can justify a higher multiple, while more uncertainty usually pulls it down. Krystal Biotech currently trades on a PE of about 36.6x, above the broader Biotechs industry average of roughly 21.6x but below the peer group average of around 61.8x.

Simply Wall St’s Fair Ratio for Krystal Biotech is 25.6x, a proprietary estimate of what the PE should be once factors like earnings growth, industry, profit margins, market cap, and specific risks are taken into account. Because it is tailored to the company’s fundamentals, the Fair Ratio provides a cleaner read than simple peer or industry comparisons. With the current PE sitting well above this 25.6x Fair Ratio, the stock screens as trading richer than what those fundamentals alone would suggest.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Krystal Biotech Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple stories investors create on Simply Wall St’s Community page to connect their view of a company’s future revenues, earnings, and margins to a financial forecast and an explicit fair value. Investors then compare that fair value to today’s share price to help decide whether to buy or sell. Each Narrative updates automatically as new news or earnings arrive so your view never goes stale. For Krystal Biotech, one bullish Narrative might lean toward the upper end of analyst expectations with strong international uptake, 96% like gross margins and a fair value closer to about $252 to $220. A more cautious Narrative could focus on concentration risk, pricing pressure, and pipeline uncertainty to anchor forecasts nearer the low end of analyst estimates and a fair value closer to about $166. This illustrates how different but clearly structured perspectives on the same facts can lead to very different, yet transparent, investment decisions.

Do you think there's more to the story for Krystal Biotech? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報