Is Bright Horizons’ Q3 Earnings Beat and Strong Core Operations Altering The Investment Case For Bright Horizons Family Solutions (BFAM)?

- Earlier this year, Bright Horizons Family Solutions posted a third-quarter revenue increase that surpassed analyst expectations by 2.9%, alongside stronger-than-expected organic revenue and adjusted operating income.

- This outperformance relative to forecasts underscores the strength of Bright Horizons’ core operations at a time when investors were closely watching its execution.

- We’ll now examine how this earnings beat, particularly the upside in adjusted operating income, may influence Bright Horizons’ broader investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bright Horizons Family Solutions Investment Narrative Recap

To own Bright Horizons, you need to believe that employer-sponsored childcare and workplace-dependent services will keep gaining traction with large corporate clients, supporting steady enrollment and margin improvement. The recent earnings beat and 10.1% share price move reinforce that margin expansion is the key short term catalyst, while persistent underperformance in a subset of centers and the risk of stalled occupancy remain the most important near term risks. Overall, this quarter’s upside does not remove those pressures, but it does ease them.

In the background, Bright Horizons has been actively repurchasing shares, buying back about US$341.3 million, or 5.75% of its stock, under the December 17, 2021 program. While buybacks do not directly address occupancy or center closures, they matter for investors who are focused on how management allocates capital while working to lift enrollment and improve margins in underperforming centers.

Yet beneath the upbeat headlines, investors should be aware of lingering enrollment and occupancy risks, especially in centers that remain stuck at...

Read the full narrative on Bright Horizons Family Solutions (it's free!)

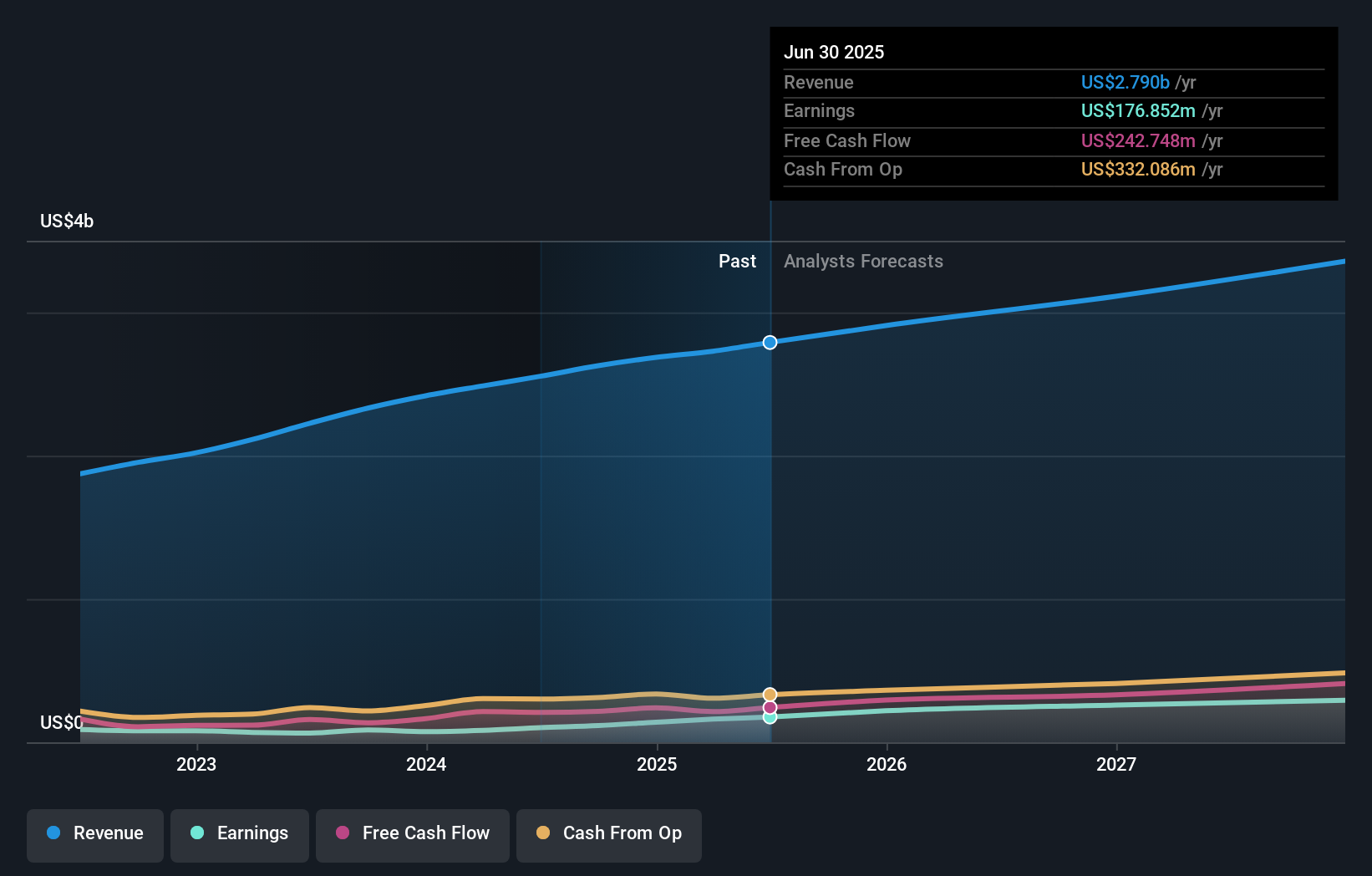

Bright Horizons Family Solutions' narrative projects $3.5 billion revenue and $329.7 million earnings by 2028. This requires 7.5% yearly revenue growth and a roughly $152.8 million earnings increase from $176.9 million today.

Uncover how Bright Horizons Family Solutions' forecasts yield a $128.78 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently place fair value for Bright Horizons in a wide band between US$88.59 and US$242.31, reflecting very different expectations. Against that spread, the recent upside surprise in organic revenue and adjusted operating income puts extra focus on whether center occupancy can keep improving and support the kind of earnings trajectory some of these investors are assuming.

Explore 4 other fair value estimates on Bright Horizons Family Solutions - why the stock might be worth over 2x more than the current price!

Build Your Own Bright Horizons Family Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bright Horizons Family Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bright Horizons Family Solutions' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報