Woodward (WWD) Is Up 9.0% After New Buyback, Governance Changes and 2026 Targets - What's Changed

- In December 2025, Woodward, Inc. proposed amending its Restated Certificate of Incorporation to remove certain supermajority voting requirements and eliminate cumulative voting in director elections, while reporting GAAP earnings per share of $7.19 on US$3.60 billion in revenue and announcing a US$1.80 billion share repurchase plan.

- Together with new sales growth targets for 2026 focused on automation and aerospace, these governance and capital allocation moves signal a clearer, more management-aligned framework for how Woodward plans to run and finance the business.

- Against this backdrop, we will examine how Woodward’s sizeable share repurchase authorization influences its existing investment narrative and risk-reward balance.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Woodward Investment Narrative Recap

To own Woodward, you need to believe it can keep turning its aerospace and automation exposure into growing earnings while managing heavy investment needs and industry change. The latest governance and buyback news does not materially alter the near term catalysts around execution on growth targets or the key risks tied to platform exposure and capex.

The US$1.80 billion share repurchase authorization is the most relevant recent development here, because it directly affects how existing and future shareholders participate in Woodward’s earnings and any swings in sentiment around its 2026 growth ambitions.

Yet investors should also be aware that execution risk around large manufacturing investments and acquisitions could...

Read the full narrative on Woodward (it's free!)

Woodward's narrative projects $4.1 billion revenue and $561.5 million earnings by 2028. This requires 6.5% yearly revenue growth and about a $173.7 million earnings increase from $387.8 million today.

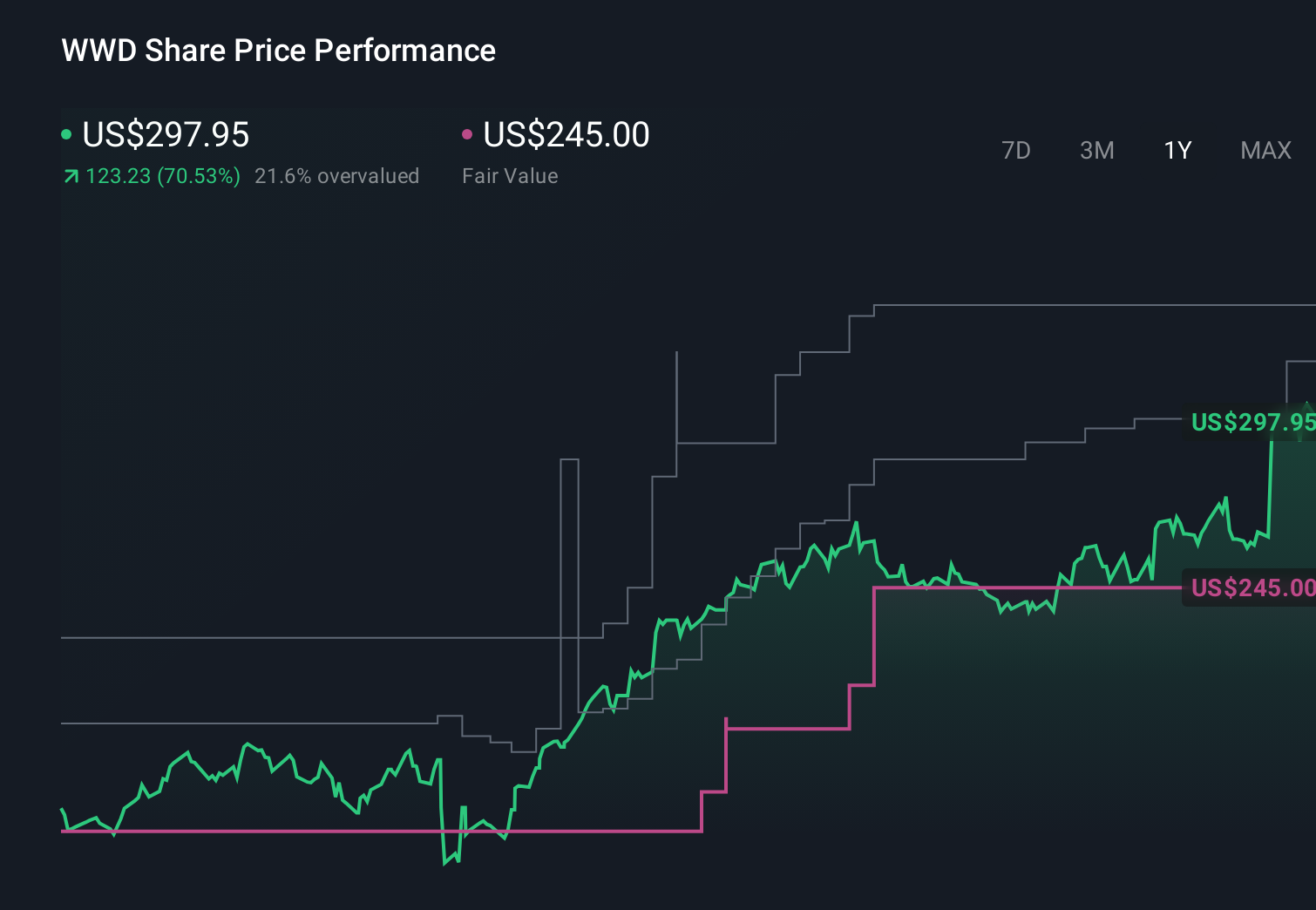

Uncover how Woodward's forecasts yield a $317.12 fair value, in line with its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community value Woodward between US$236 and US$317 per share, highlighting how far opinions can stretch. Set against that, Woodward’s sizeable buyback program and 2026 growth targets give you another lens on how its future performance could evolve.

Explore 4 other fair value estimates on Woodward - why the stock might be worth 25% less than the current price!

Build Your Own Woodward Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Woodward research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Woodward research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Woodward's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報