CIBC (TSX:CM) Valuation Check After 40% Year-to-Date Rally and Strengthening Earnings Momentum

Early share performance and recent momentum

Canadian Imperial Bank of Commerce TSX:CM has quietly put together a strong run this year, with shares up about 40% year to date and roughly 13% over the past 3 months.

See our latest analysis for Canadian Imperial Bank of Commerce.

At a share price of CA$126.61, that 40% year to date share price return and a robust 1 year total shareholder return of about 43% suggest investors are warming to CIBC again, helped by solid revenue and net income growth and easing concerns around credit quality and the economic outlook.

If CIBC’s rebound has your attention, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With CIBC’s share price now flirting with analyst targets despite impressive earnings momentum, the key question is whether its valuation still leaves room for upside or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 1.4% Overvalued

With Canadian Imperial Bank of Commerce closing at CA$126.61 versus a narrative fair value of CA$124.88, the story hinges on steady growth and disciplined margins.

The analysts have a consensus price target of CA$108.409 for Canadian Imperial Bank of Commerce based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$118.0, and the most bearish reporting a price target of just CA$78.0.

Want to know what earnings path and profit margins sit behind that near no gap to today’s price? The projections are precise, disciplined, and surprisingly ambitious. Curious which long term revenue assumptions and future valuation multiple keep this fair value just below market? Explore the full blueprint behind this call.

Result: Fair Value of $124.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising Canadian mortgage delinquencies and intensifying digital competition could challenge CIBC’s margin resilience and test how durable this valuation really is.

Find out about the key risks to this Canadian Imperial Bank of Commerce narrative.

Another View: Market Ratios Point To A Different Story

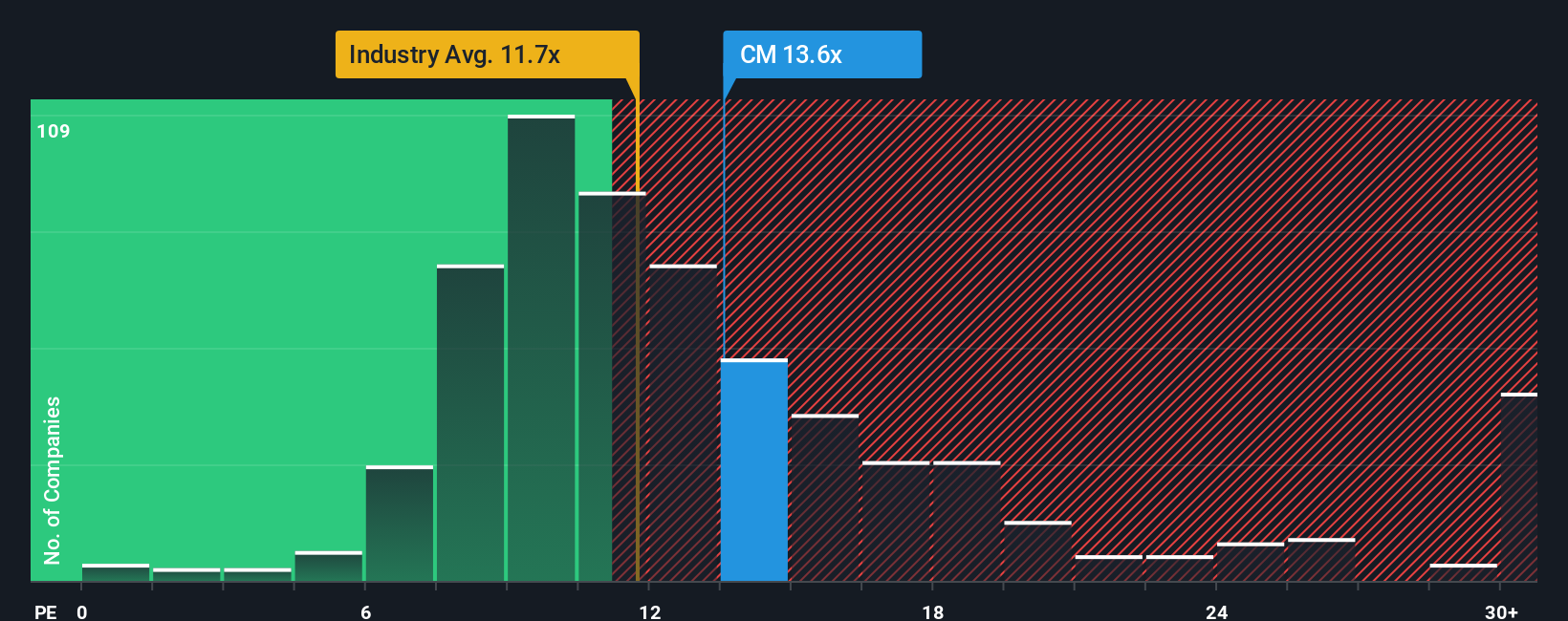

While the narrative fair value suggests CIBC is 1.4% overvalued, its current price to earnings ratio of 14.5 times tells a more nuanced story. The shares trade slightly above their fair ratio of 14 times and the North American banks average of 12 times, but below domestic peers at 15.3 times.

This mix of premium and discount signals that investors see CIBC as reasonably priced with some optimism built in, rather than clearly cheap or clearly stretched. Does that moderate valuation gap represent a cushion against disappointment or a ceiling on further rerating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canadian Imperial Bank of Commerce Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Canadian Imperial Bank of Commerce.

Looking for more investment ideas?

Set yourself up for the next opportunity by using powerful screeners that surface stocks most investors overlook, before the crowd catches on and prices move.

- Capture potential mispricings by scanning these 904 undervalued stocks based on cash flows that strong cash flow analysis suggests may not stay cheap for long.

- Capitalize on Wall Street’s hunt for innovation by targeting these 24 AI penny stocks at the forefront of intelligent software and automation.

- Seek dependable income streams by focusing on these 10 dividend stocks with yields > 3% that can play a role in total returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報