Is B2Gold (TSX:BTO) Still Undervalued After Its Strong Year-to-Date Share Price Rally?

B2Gold (TSX:BTO) has quietly turned into one of the stronger performers in the gold space this year, with shares up roughly 74% year to date even after a recent pullback.

See our latest analysis for B2Gold.

The recent pullback from its CA$6.47 share price looks more like a breather than a reversal. A strong year to date share price return of 74.39% and an 84.73% one year total shareholder return suggest momentum is still broadly intact as investors reassess both growth optionality and geopolitical risk.

If B2Gold’s run has you rethinking where the next leg of returns might come from, it is worth exploring fast growing stocks with high insider ownership for other fast moving ideas with skin in the game.

With analyst targets sitting well above today’s price and profits growing faster than revenue, investors now face a key question: Is B2Gold still trading at a discount, or is the market already pricing in its next chapter?

Most Popular Narrative Narrative: 24.8% Undervalued

With B2Gold closing at CA$6.47 against a narrative fair value of CA$8.60, the current price implies a meaningful gap to those projections.

The successful commissioning of new projects such as Goose Mine and ongoing development studies (e.g., Gramalote) align with rising institutional and portfolio demand for gold as a non-correlated hedge, positioning B2Gold for long-term production growth and margin expansion as industry-wide reserve depletion supports higher gold prices.

Curious how long term production growth, thicker margins, and a re rated earnings multiple all feed into that upside gap? The full narrative unpacks the entire math behind that valuation leap, step by step.

Result: Fair Value of CA$8.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical risk in Mali and potential cost overruns at Goose could quickly erode today’s optimistic assumptions about margins and growth.

Find out about the key risks to this B2Gold narrative.

Another Lens on Value

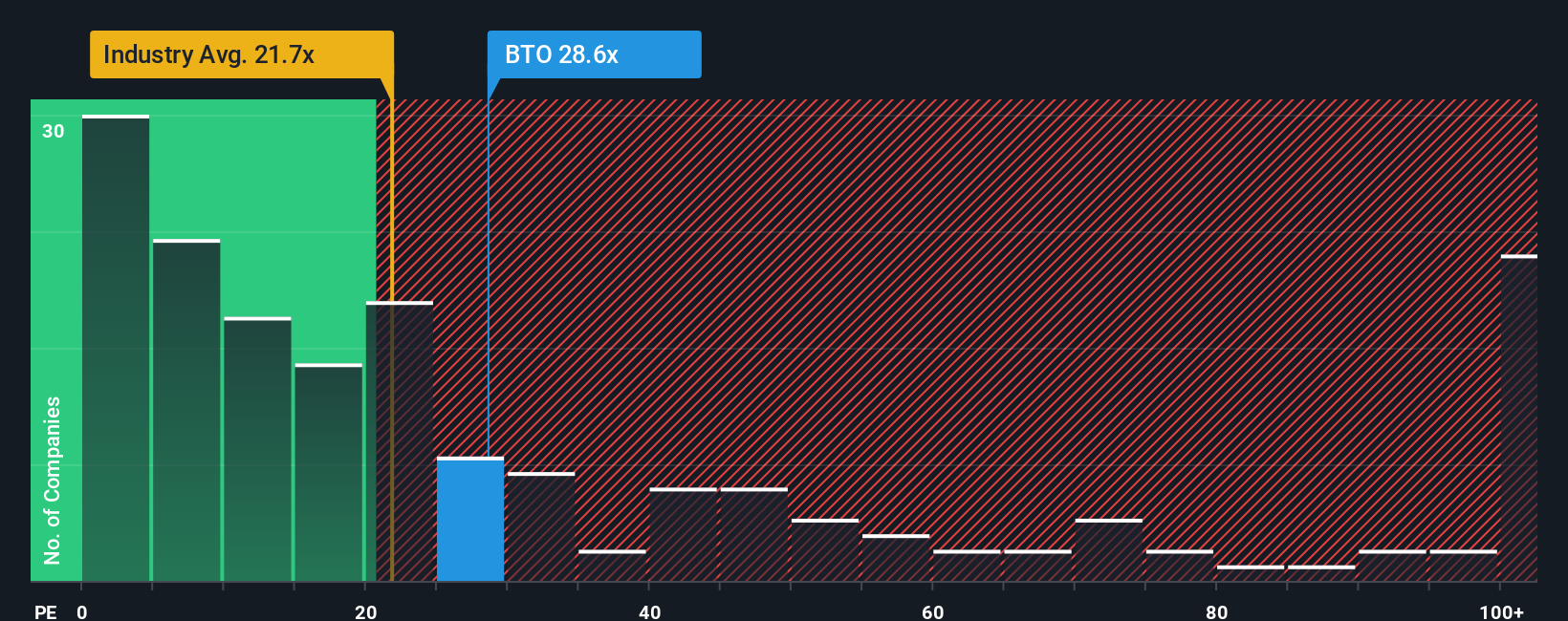

On earnings, B2Gold looks far less cheap. Its P E ratio sits around 28.8 times, richer than both the Canadian metals and mining average at 22.3 times and the peer average at 25.8 times, yet below a fair ratio of 44.7 times. This leaves investors weighing potential upside against the risk of a rerating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own B2Gold Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your B2Gold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to consider your next potential opportunity by using the Simply Wall St Screener to uncover fresh, data backed ideas beyond B2Gold.

- Support your income objectives with these 10 dividend stocks with yields > 3% that aim to balance attractive yields with solid business fundamentals and resilient cash flows.

- Explore cutting edge themes through these 24 AI penny stocks positioned at the intersection of artificial intelligence, innovation, and long term earnings potential.

- Reinforce your portfolio foundation by targeting these 904 undervalued stocks based on cash flows where prices may lag behind cash flow power and future growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報