Taking Stock of Fair Isaac (FICO) After Mortgage License Expansion and Fresh Credit Card Stress Data

Fair Isaac (FICO) quietly nudged its mortgage strategy forward, adding Cotality and Ascend Companies to its Mortgage Direct License Program, a move that tightens its grip on how FICO Scores reach lenders and borrowers.

See our latest analysis for Fair Isaac.

Those initiatives land at an interesting time for investors, with Fair Isaac’s share price now at $1,731.01 and a solid 90 day share price return of 11.8 percent contrasting with a weaker one year total shareholder return of negative 17.77 percent. This comes even after an impressive 185.25 percent total shareholder return over three years, which suggests the longer term momentum story is still very much intact.

If this kind of structural fintech story appeals to you, it may be worth scanning fast growing stocks with high insider ownership to see what other fast growing, management backed names are starting to build momentum.

With analysts still seeing upside to the current share price and fundamentals pointing to double digit growth, investors face a familiar question: is Fair Isaac quietly undervalued, or are markets already pricing in the next leg of expansion?

Most Popular Narrative Narrative: 15% Undervalued

With Fair Isaac last closing at $1,731.01 against a narrative fair value near $2,031, the story leans toward upside potential if the assumptions hold.

The analysts have a consensus price target of $1874.704 for Fair Isaac based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $2300.0, and the most bearish reporting a price target of just $1230.0.

Curious what kind of revenue climb, margin lift, and premium earnings multiple are baked into that fair value call? The narrative reveals a surprisingly aggressive glide path that could reshape how you see FICO's long term potential.

Result: Fair Value of $2,031.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory shifts around mortgage credit scores and slower software platform adoption could quickly challenge these upside assumptions and compress FICO’s premium valuation.

Find out about the key risks to this Fair Isaac narrative.

Another View: Rich Multiples Challenge The Undervaluation Story

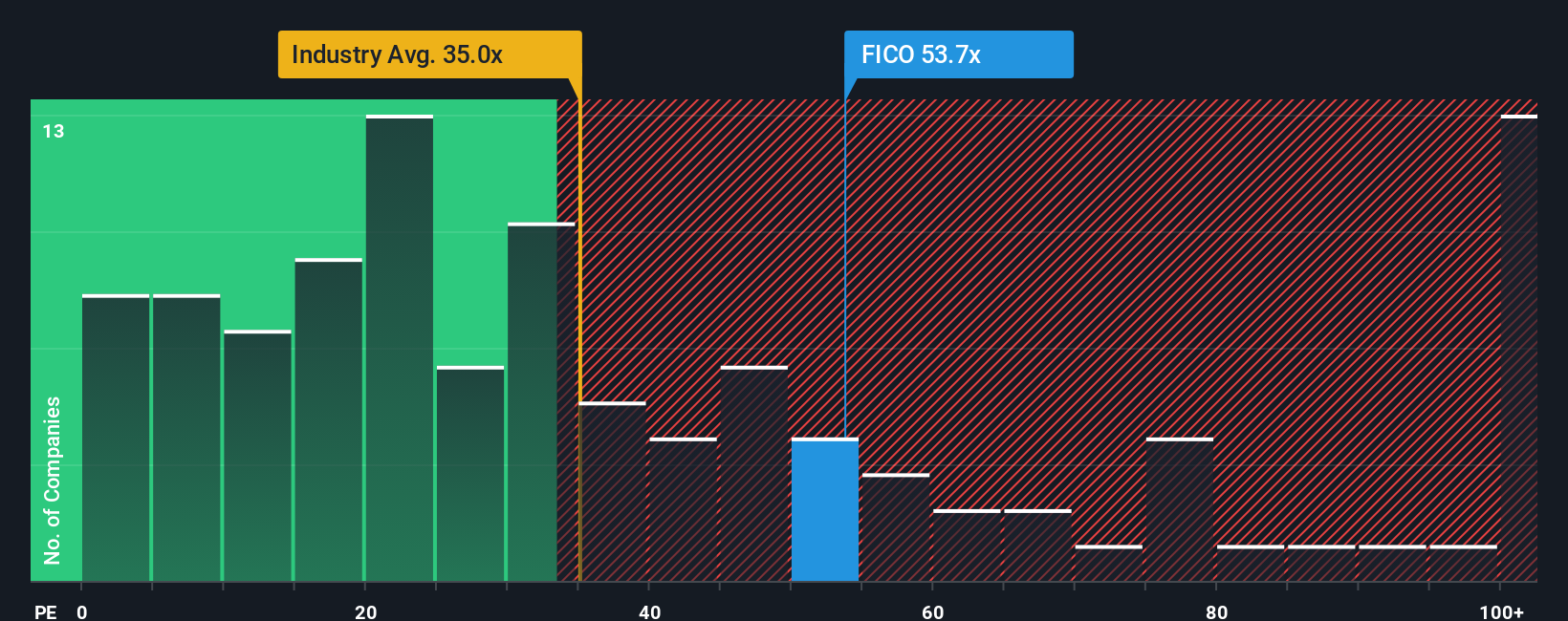

Our fair value narrative leans bullish, but the earnings multiple tells a tougher story. FICO trades on about 63 times earnings, nearly double the US software average of 31.9 times and well above a fair ratio of 38.4 times, which implies meaningful derating risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If this perspective does not fully match your view, or you would rather dig into the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh stocks that match your strategy before the market catches on.

- Capture mispriced opportunities early by scanning these 905 undervalued stocks based on cash flows that the market has not fully woken up to yet.

- Tap into the structural shift toward automation and data by targeting these 24 AI penny stocks shaping the next wave of intelligent platforms.

- Boost potential portfolio income by hunting through these 10 dividend stocks with yields > 3% that can steadily enhance your returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報