Is It Too Late to Invest in IAMGOLD After Its 195% 2025 Rally?

- Wondering if IAMGOLD has already run too far or if there is still value on the table? This article breaks down what the current share price really implies and whether the risk reward stacks up in your favor.

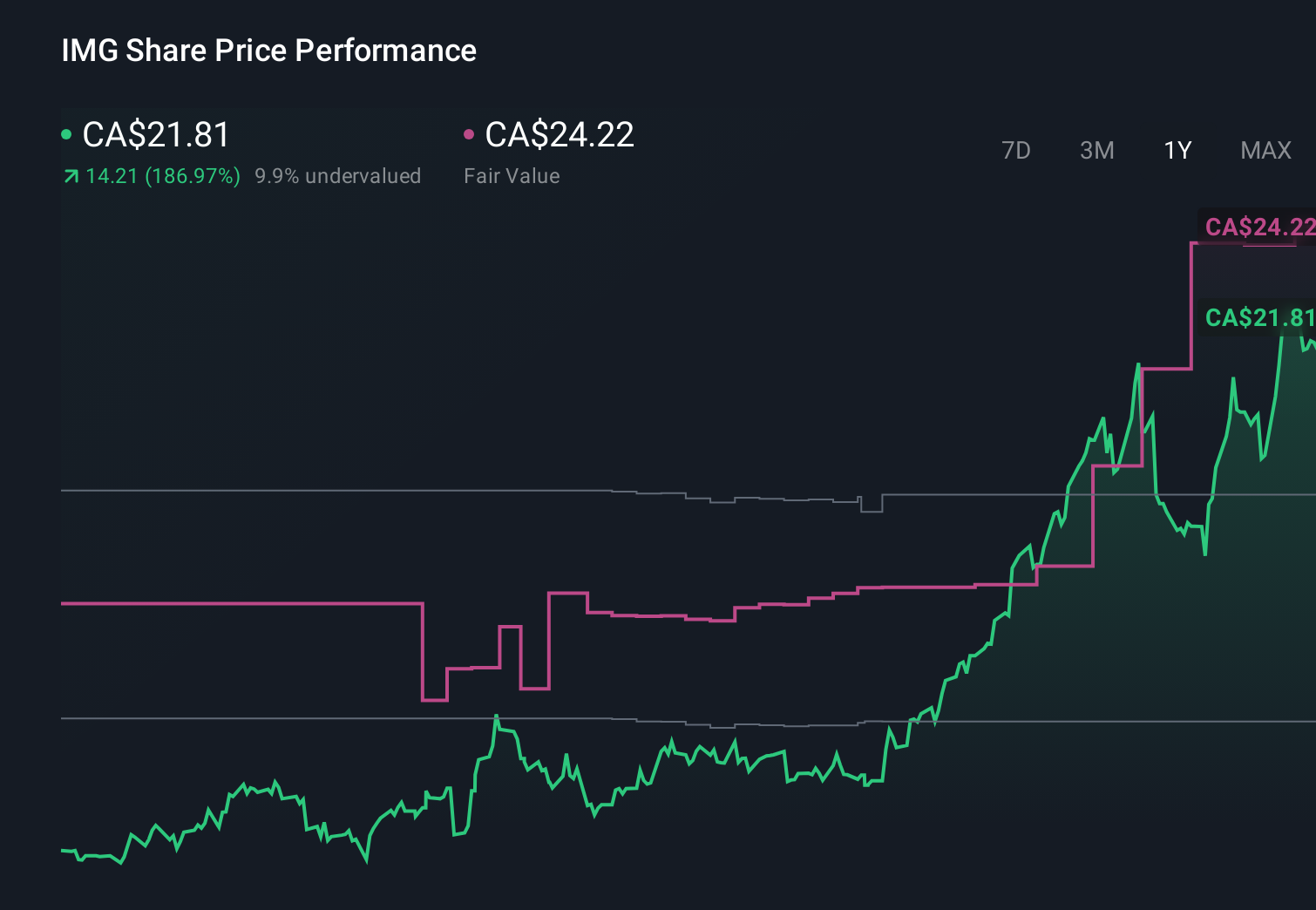

- The stock has been on a tear, climbing 7.0% over the last week, 20.2% in the last month, 195.1% year to date, 218.1% over the past year, 594.1% over three years, and 400.4% over five years. This naturally raises questions about how much upside is left.

- Much of this move has been driven by investors rotating into gold miners as bullion prices remain elevated and risk appetite shifts toward producers with expanding project pipelines. In addition, IAMGOLD has drawn attention for progressing key assets and strengthening its balance sheet, which together have helped reset the market's expectations for the business.

- Even after that rally, IAMGOLD scores a 4 out of 6 on our valuation checks, suggesting the market may not be fully pricing in its fundamentals yet. We will walk through different valuation approaches, before finishing with a more holistic way to think about what the shares are really worth.

Approach 1: IAMGOLD Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to a present value.

For IAMGOLD, the latest twelve month Free Cash Flow is roughly -$457.5 Million, reflecting heavy investment and ramp up rather than mature, steady cash generation. Analysts and model projections expect this to flip meaningfully, with Free Cash Flow rising to about $1.43 Billion by 2028 and continuing around the $1.39 Billion to $1.49 Billion range over the following years, based on a mix of analyst estimates and extrapolations.

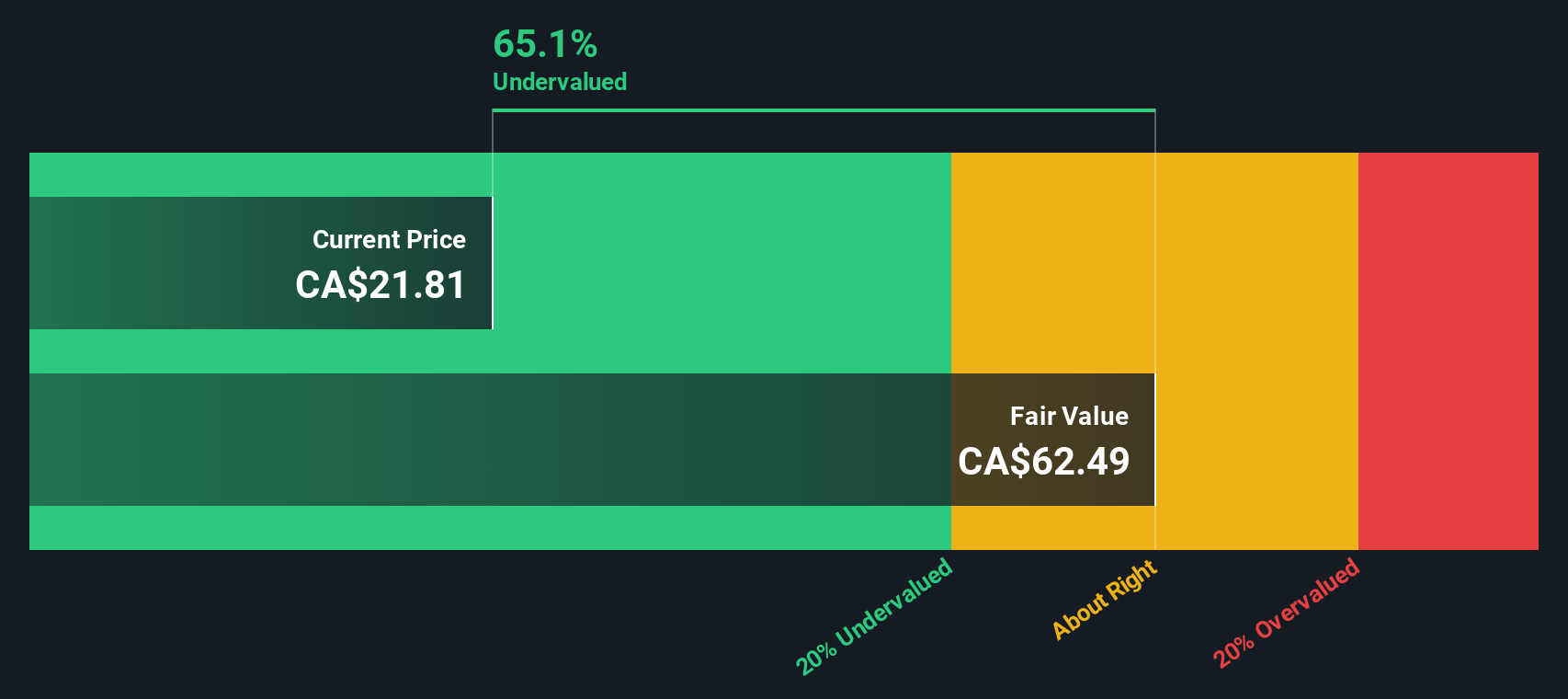

Using a 2 Stage Free Cash Flow to Equity model, Simply Wall St estimates an intrinsic value of about $62.16 per share. Compared with the current share price, this implies the stock is about 61.9% undervalued, which indicates that the market may not be fully pricing in the expected cash flow turnaround.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IAMGOLD is undervalued by 61.9%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: IAMGOLD Price vs Earnings

For profitable companies like IAMGOLD, the Price to Earnings (PE) ratio is a straightforward way to gauge how much investors are willing to pay today for each dollar of current earnings. It naturally blends what the market thinks about a company’s growth prospects and the risks around those earnings.

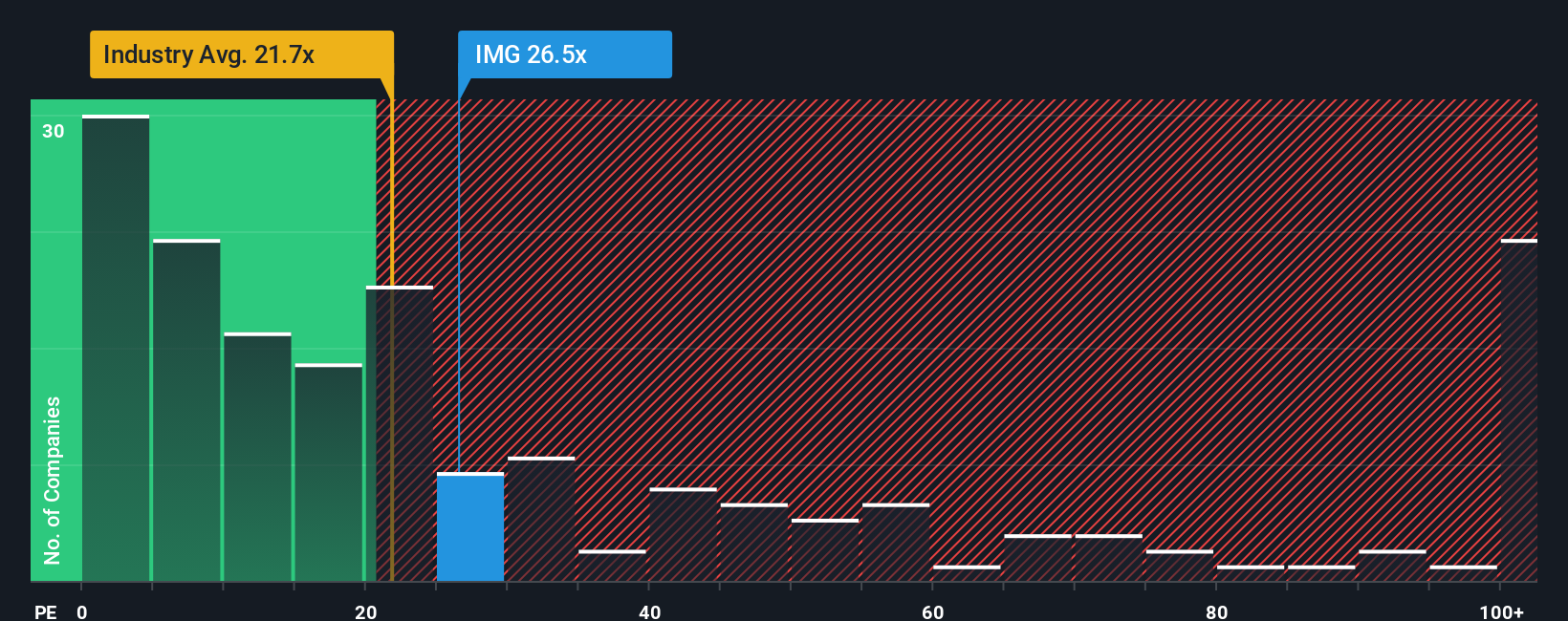

In general, higher expected growth and lower perceived risk justify a higher PE ratio, while slower growth or greater uncertainty should lead to a lower multiple. IAMGOLD currently trades on about 29.0x earnings, which is above the Metals and Mining industry average of roughly 22.3x but well below the peer group average near 66.3x.

Simply Wall St’s Fair Ratio framework estimates that, given IAMGOLD’s growth profile, margins, risk factors, industry positioning and market cap, a more appropriate PE would be around 38.8x. This Fair Ratio is more insightful than a simple comparison to peers or the industry because it adjusts for company specific qualities rather than assuming all miners deserve the same multiple. Since IAMGOLD’s present PE of 29.0x sits meaningfully below the 38.8x Fair Ratio, the shares appear undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IAMGOLD Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of IAMGOLD’s story to a concrete forecast for its future revenue, earnings and margins. You can then link this forecast to a Fair Value that you can compare with today’s share price to help you decide whether to buy, hold or sell. That Fair Value automatically updates as new news or earnings arrive. The framework also allows room for very different but equally valid perspectives. For example, one investor might build a bullish IAMGOLD Narrative around accelerating production, expanding resources, disciplined costs and the new buyback to arrive at a Fair Value near CA$24.69 per share. Another investor might focus on rising costs, asset concentration and geopolitical risk to justify a much lower Fair Value closer to the most cautious analyst target of CA$10.99. This shows you in one place how a change in the story directly changes the numbers and, ultimately, your decision.

Do you think there's more to the story for IAMGOLD? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報