Analog Devices (ADI): Reassessing Valuation After Strong Results, 2026 Price Hike Plans, and Growing AI Optimism

Analog Devices (ADI) just checked several important boxes for investors at once, with a strong fiscal Q4, upbeat guidance, and planned 2026 price hikes that together point to firmer demand and healthier margins.

See our latest analysis for Analog Devices.

The market seems to be catching on to that story, with a roughly 16 percent 1 month share price return helping lift the stock to about 31 percent year to date. A 5 year total shareholder return above 100 percent points to momentum that has been building rather than fading.

If ADI's renewed strength has you thinking more broadly about chip leaders, this is a good moment to explore other high growth tech and AI stocks that could benefit from similar demand and margin tailwinds.

Yet with shares near record highs, trading close to analyst targets and riding AI and industrial recovery optimism, investors have to ask themselves: is Analog Devices still a buy here, or is future growth already priced in?

Most Popular Narrative Narrative: 1.6% Undervalued

With Analog Devices last closing at $277.56 versus a narrative fair value of about $282, the story leans slightly positive and leans heavily on long term earnings power.

Street research remains broadly constructive on Analog Devices, with multiple firms lifting price targets on the back of autos strength, rising AI exposure, and confidence in a multi year cyclical recovery into 2026 and beyond. While some estimates have been trimmed at the margin, the overall message points to robust earnings power and a premium valuation supported by secular growth drivers.

Want to see what kind of revenue ramp, margin lift, and future earnings multiple are baked into that fair value call? The underlying projections may surprise you.

Result: Fair Value of $282.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that outlook could be challenged if Chinese competitors undercut pricing or if US China trade tensions disrupt ADI's supply chains and customer demand.

Find out about the key risks to this Analog Devices narrative.

Another Lens On Value

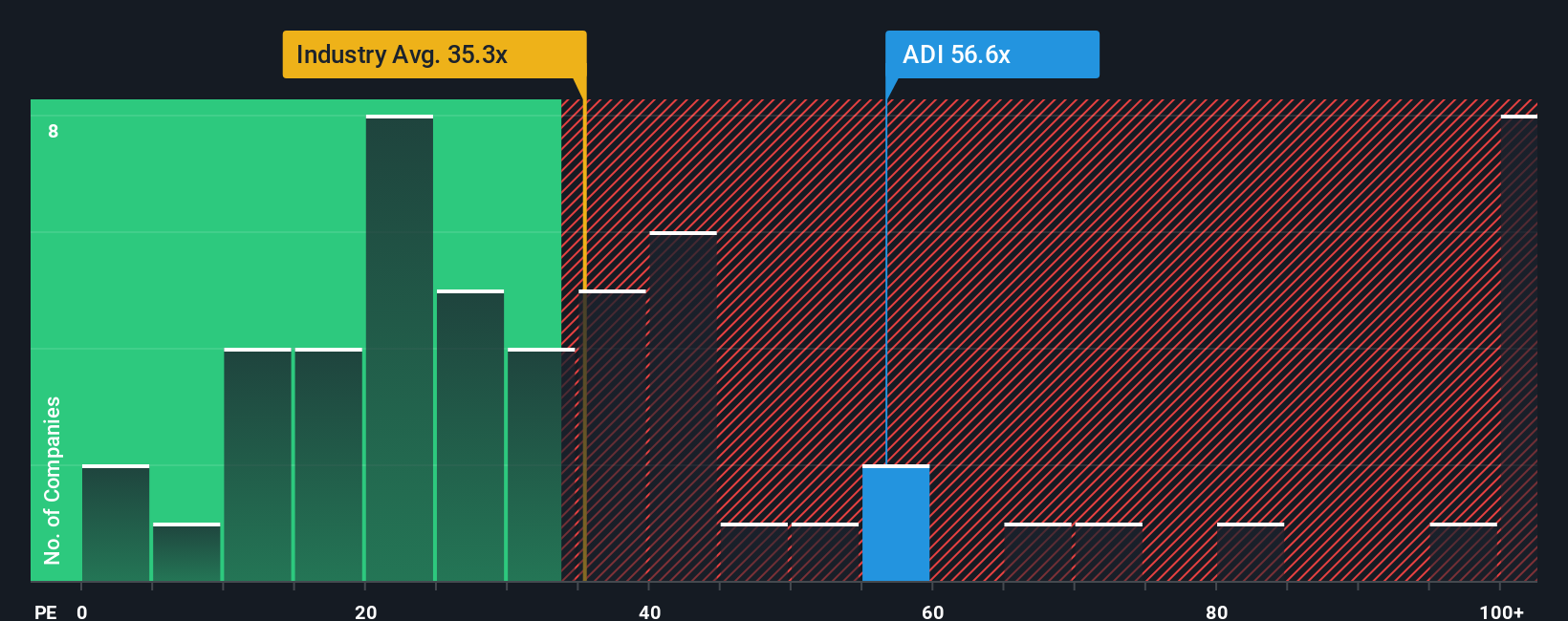

Step away from the narrative fair value and ADI suddenly looks much richer. At about 59.9 times earnings versus a US semiconductor average of 36.6 times, and a fair ratio of 31.4 times, the gap suggests valuation risk if growth wobbles or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Analog Devices Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your Analog Devices research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider hand picking a few fresh opportunities from powerful screeners that surface hidden potential and real long term upside.

- Capture under the radar value by targeting companies trading below their cash flow potential using these 905 undervalued stocks based on cash flows and avoid overpaying for hype.

- Explore secular trends in automation and machine learning by reviewing names within these 24 AI penny stocks that may play a role in reshaping industries.

- Strengthen your income stream by selecting reliable payers from these 10 dividend stocks with yields > 3% and seek steadier returns through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報