ImmunityBio (IBRX) Valuation Check After New ANKTIVA Bladder Cancer Data in The Journal of Urology

ImmunityBio (IBRX) just added another data point to ANKTIVA’s story, with new Journal of Urology results showing the ANKTIVA plus BCG combo holding up at 12 and 36 months in difficult bladder cancer.

See our latest analysis for ImmunityBio.

Against that backdrop, ImmunityBio’s latest ANKTIVA milestones and fresh EMA traction come as the 90 day share price return of minus 13.01 percent and one year total shareholder return of minus 18.63 percent show that momentum is still rebuilding from a deeply negative three year total shareholder return of minus 54.08 percent at a 2.14 dollar share price.

If ANKTIVA’s progress has you reassessing the space, it is a good moment to scan for other potential beneficiaries in bladder cancer and beyond using healthcare stocks.

With ANKTIVA’s data firming up and the stock still trading at a steep discount to analyst targets, is ImmunityBio a misunderstood growth story in bladder cancer, or is the market already baking in the next leg of upside?

Price-to-Sales of 25.5x: Is it justified?

ImmunityBio closed at 2.14 dollars, and that price currently embeds a rich 25.5 times price to sales multiple that screens as expensive against peers, even as some valuation models flag a deep discount to intrinsic value.

The price to sales ratio compares the company’s market value to its annual revenue, a common yardstick for high growth and still unprofitable biotech names where earnings are not yet a reliable anchor.

In ImmunityBio’s case, the 25.5 times price to sales looks stretched next to both its peer group average of 21.4 times and the broader US Biotechs industry at 12.4 times, suggesting investors are already paying up for ANKTIVA’s potential and the company’s forecast rapid top line expansion.

However, our DCF model paints a different picture, with shares at 2.14 dollars trading below an estimated 6.33 dollars fair value and the current price to sales ratio still below an estimated fair price to sales of 31.9 times. This implies room for the market multiple to migrate higher if execution matches growth expectations.

Explore the SWS fair ratio for ImmunityBio

Result: Price-to-Sales of 25.5x (OVERVALUED)

However, sustained heavy losses and any setback to ANKTIVA’s commercial ramp or regulatory progress could quickly outweigh today’s apparent valuation discount.

Find out about the key risks to this ImmunityBio narrative.

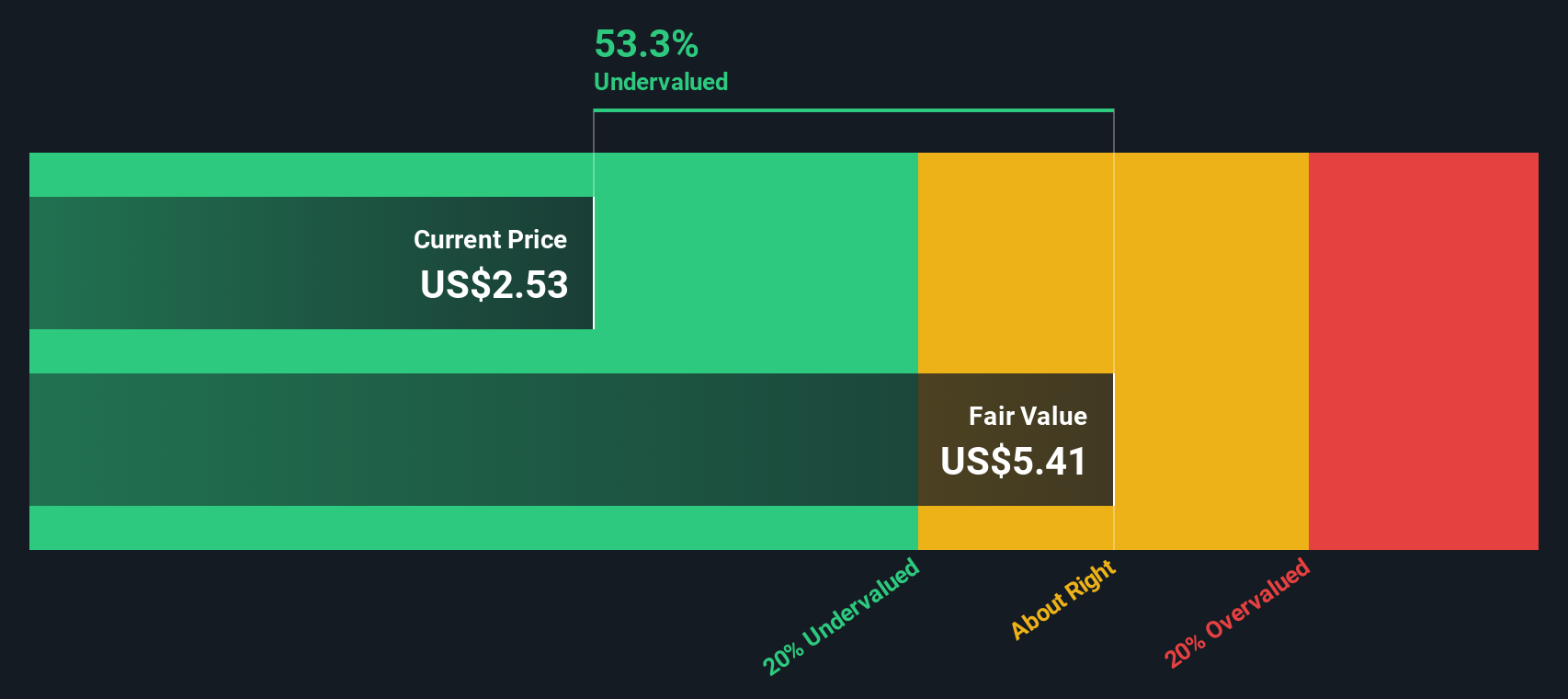

Another View: DCF Points the Other Way

While the current price to sales of 25.5 times screens as rich, our DCF model suggests ImmunityBio is trading well below an estimated 6.33 dollars fair value. This implies the shares could be meaningfully undervalued if ANKTIVA delivers as hoped.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ImmunityBio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ImmunityBio Narrative

If you see the numbers differently, or want to dig into the assumptions yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your ImmunityBio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investment move?

Put your research edge to work now by tapping into curated stock ideas on Simply Wall Street’s Screener, before the rest of the market catches up.

- Capture potential bargains early by targeting companies trading below their long term cash flow potential through these 905 undervalued stocks based on cash flows.

- Position yourself at the forefront of intelligent automation by focusing on innovators powering smarter medicine via these 29 healthcare AI stocks.

- Strengthen your portfolio’s income engine by zeroing in on companies with reliable payouts using these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報