On Holding (NYSE:ONON): Revisiting Valuation After a 14% Share Price Rebound

On Holding (NYSE:ONON) has quietly staged a comeback, with the stock up roughly 14% over the past month, even as year to date performance and 1 year returns remain in negative territory.

See our latest analysis for On Holding.

The recent 30 day share price return of about 14% suggests momentum is rebuilding after a softer patch, even though year to date share price performance and the 1 year total shareholder return are still in the red, while the three year total shareholder return remains very strong.

If On Holding’s rebound has you rethinking growth potential in your portfolio, this could be a good moment to explore fast growing stocks with high insider ownership.

With revenue and earnings still growing briskly and the share price trading at a notable discount to analyst targets, the key question now is whether On Holding is undervalued or if the market already reflects that future growth.

Most Popular Narrative Narrative: 25.1% Undervalued

With On Holding last closing at $46.49 versus a narrative fair value near $62, the market’s skepticism collides with an aggressive long term growth blueprint.

The company's ability to launch and quickly scale new product franchises (nine now >5% of revenue), expand beyond running into tennis, trail, lifestyle, and fast-growing apparel, demonstrates successful product innovation and diversification, supporting both average selling price increases and higher future revenue per customer.

Investment in innovative, automated manufacturing processes such as LightSpray is expected to materially improve supply chain efficiency, reduce production costs, and support localized supply, which, over time, should enhance gross margins and bolster scalability as demand grows.

Want to see how rapid global expansion, rising margins, and a premium future earnings multiple all fit together into that valuation gap? The full narrative unpacks the bold revenue ramp, the profit transformation, and the rich multiple investors are assumed to pay for On Holding’s 2028 earnings, step by step.

Result: Fair Value of $62.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on premium pricing and aggressive expansion plans could backfire if consumer demand softens, squeezing margins and challenging today’s upbeat growth assumptions.

Find out about the key risks to this On Holding narrative.

Another Angle on Valuation

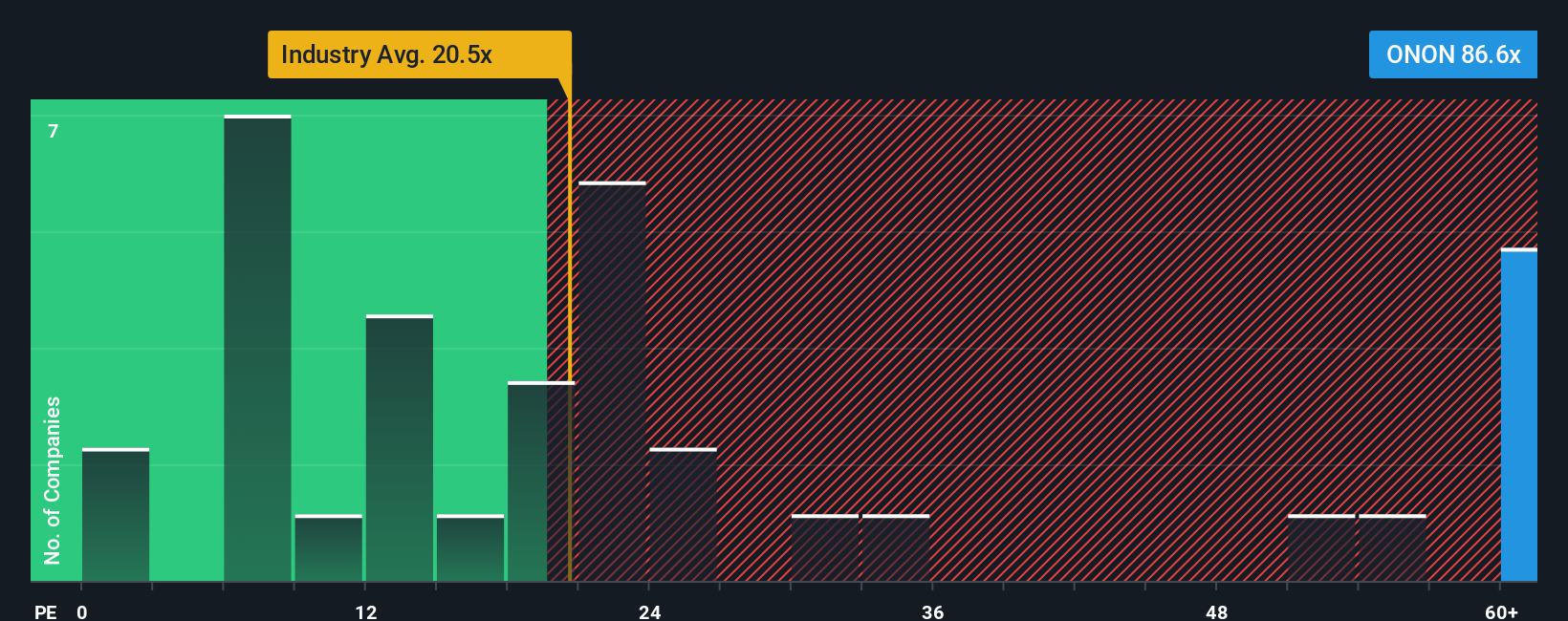

That narrative fair value of about $62 leans heavily on rapid growth and expanding margins, but today’s 54.5x earnings multiple looks stretched versus the US Luxury industry at 19.9x, peers at 28.6x, and a fair ratio of 30.8x. This points to meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom view in minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding On Holding.

Ready for more high conviction ideas?

Before momentum moves elsewhere, tap into fresh opportunities with targeted stock screens on Simply Wall Street that surface compelling setups you might otherwise miss.

- Capture early-stage potential by reviewing these 3629 penny stocks with strong financials that already back strong financial foundations instead of just speculative hype.

- Capitalize on structural growth by scanning these 24 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Lock in dependable income streams by targeting these 10 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報