Asian Growth Companies With Significant Insider Ownership

As Asian markets navigate through a period of mixed economic signals and policy shifts, the focus on growth companies with substantial insider ownership becomes increasingly relevant. In such an environment, stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the company best, aligning management's interests closely with shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Techwing (KOSDAQ:A089030) | 19.1% | 96.3% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Here's a peek at a few of the choices from the screener.

Quick Intelligent EquipmentLtd (SHSE:603203)

Simply Wall St Growth Rating: ★★★★☆☆

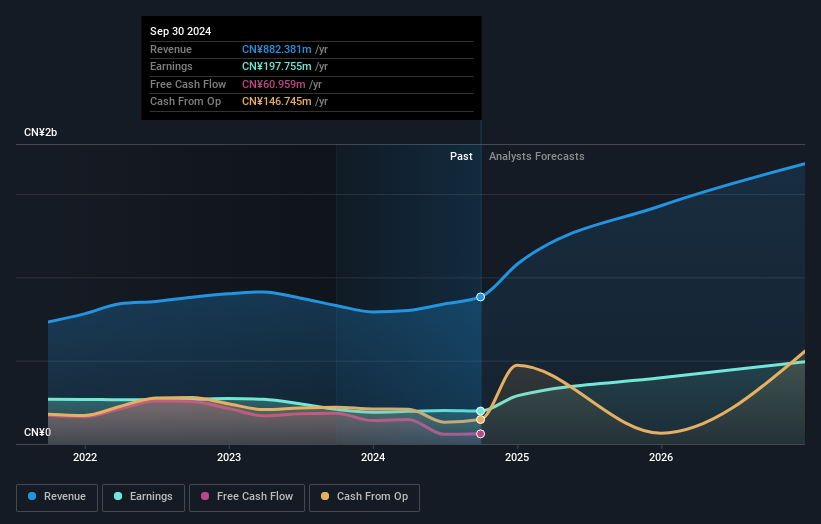

Overview: Quick Intelligent Equipment Co., Ltd. specializes in the R&D, manufacturing, and sale of precision assembly technology for electronics both in China and internationally, with a market cap of CN¥9.54 billion.

Operations: The company generates revenue from the Special Equipment Manufacturing Industry, totaling CN¥1.07 billion.

Insider Ownership: 33.3%

Quick Intelligent Equipment Ltd. exhibits robust growth prospects with revenue projected to increase 24.1% annually, outpacing the Chinese market's 14.5%. Despite a lower earnings growth forecast of 22.5% compared to the market's 27.4%, its price-to-earnings ratio of 38.5x is attractive relative to peers at 44.1x, suggesting good value potential. Recent financials show sales rising from CNY 683 million to CNY 808 million over nine months, reflecting strong operational performance despite limited insider trading activity recently.

- Click to explore a detailed breakdown of our findings in Quick Intelligent EquipmentLtd's earnings growth report.

- According our valuation report, there's an indication that Quick Intelligent EquipmentLtd's share price might be on the expensive side.

Southchip Semiconductor Technology(Shanghai) (SHSE:688484)

Simply Wall St Growth Rating: ★★★★★☆

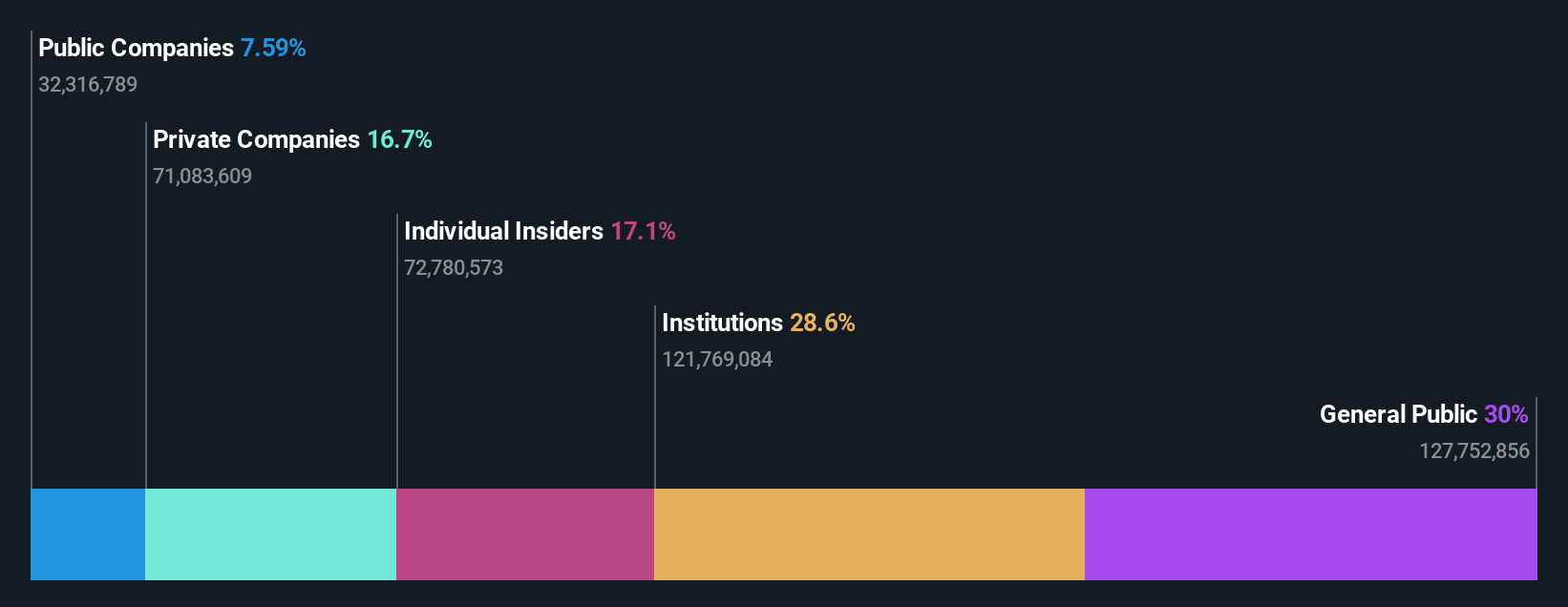

Overview: Southchip Semiconductor Technology(Shanghai) Co., Ltd. operates in the research, design, development, and sale of analog and embedded chips both in China and internationally, with a market cap of CN¥17.78 billion.

Operations: Southchip Semiconductor Technology(Shanghai) Co., Ltd. generates revenue through its operations in the research, design, development, and sale of analog and embedded chips across domestic and international markets.

Insider Ownership: 17.1%

Southchip Semiconductor Technology (Shanghai) demonstrates strong growth potential with earnings expected to rise substantially at 42.4% annually, surpassing the Chinese market's 27.4%. Revenue is also forecast to grow rapidly at 24.7% per year. However, recent financials reveal a decline in net income from CNY 271.78 million to CNY 191.17 million over nine months despite an increase in sales from CNY 1,899.1 million to CNY 2,380.41 million, indicating pressure on profit margins and earnings quality concerns due to high non-cash earnings levels and reduced profit margins compared to last year.

- Get an in-depth perspective on Southchip Semiconductor Technology(Shanghai)'s performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Southchip Semiconductor Technology(Shanghai)'s shares may be trading at a discount.

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Simply Wall St Growth Rating: ★★★★☆☆

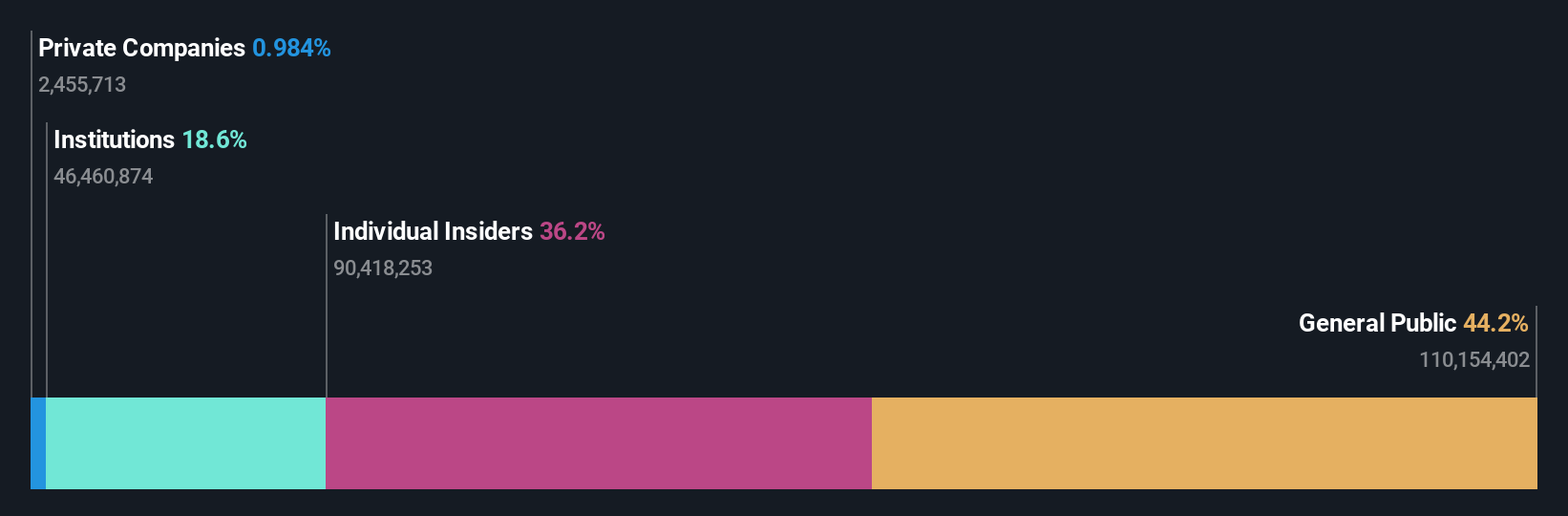

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market capitalization of approximately CN¥12.97 billion.

Operations: Suzhou Hengmingda Electronic Technology Co., Ltd. does not currently have specific revenue segments disclosed in the provided text.

Insider Ownership: 36.2%

Suzhou Hengmingda Electronic Technology shows promising growth prospects, with earnings having increased by 39.5% over the past year and forecasted to grow at 20.4% annually, though slower than the broader Chinese market. Revenue is expected to rise significantly at 25.8% per year, outpacing market averages. Recent earnings reported CNY 407.9 million net income for nine months ending September 2025, up from CNY 310.81 million prior year, highlighting profitability improvement amidst a share buyback initiative aimed at enhancing investor confidence and operational stability.

- Delve into the full analysis future growth report here for a deeper understanding of Suzhou Hengmingda Electronic Technology.

- Insights from our recent valuation report point to the potential undervaluation of Suzhou Hengmingda Electronic Technology shares in the market.

Taking Advantage

- Access the full spectrum of 631 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Interested In Other Possibilities? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報