Undiscovered Gems in Asia to Watch This December 2025

As the Asian markets navigate a landscape marked by Japan's highest interest rates in three decades and mixed economic signals from China, investors are keenly observing the impact on small-cap stocks. While broader market sentiment remains cautious amid these developments, identifying potential opportunities often involves looking for companies with strong fundamentals and resilience in dynamic economic environments.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 0.97% | 1.03% | ★★★★★★ |

| GakkyushaLtd | 15.92% | 3.67% | 11.14% | ★★★★★★ |

| Top Union Electronics | 2.04% | 8.70% | 18.11% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Zhongyeda Electric | 0.41% | -0.88% | -14.90% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 11.75% | 17.91% | -3.17% | ★★★★★☆ |

| Praise Victor Industrial | 46.95% | 8.93% | 39.31% | ★★★★★☆ |

| Palasino Holdings | 8.57% | 4.07% | -18.45% | ★★★★★☆ |

| Zhejiang Jinghua Laser TechnologyLtd | 45.75% | 3.45% | -2.64% | ★★★★★☆ |

| Sichuan Zigong Conveying Machine Group | 54.32% | 21.85% | 16.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

GRIPM Advanced Materials (SHSE:688456)

Simply Wall St Value Rating: ★★★★★☆

Overview: GRIPM Advanced Materials Co., Ltd. specializes in the design, research and development, production, and sales of advanced non-ferrous metal powder materials both in China and internationally, with a market capitalization of CN¥6.65 billion.

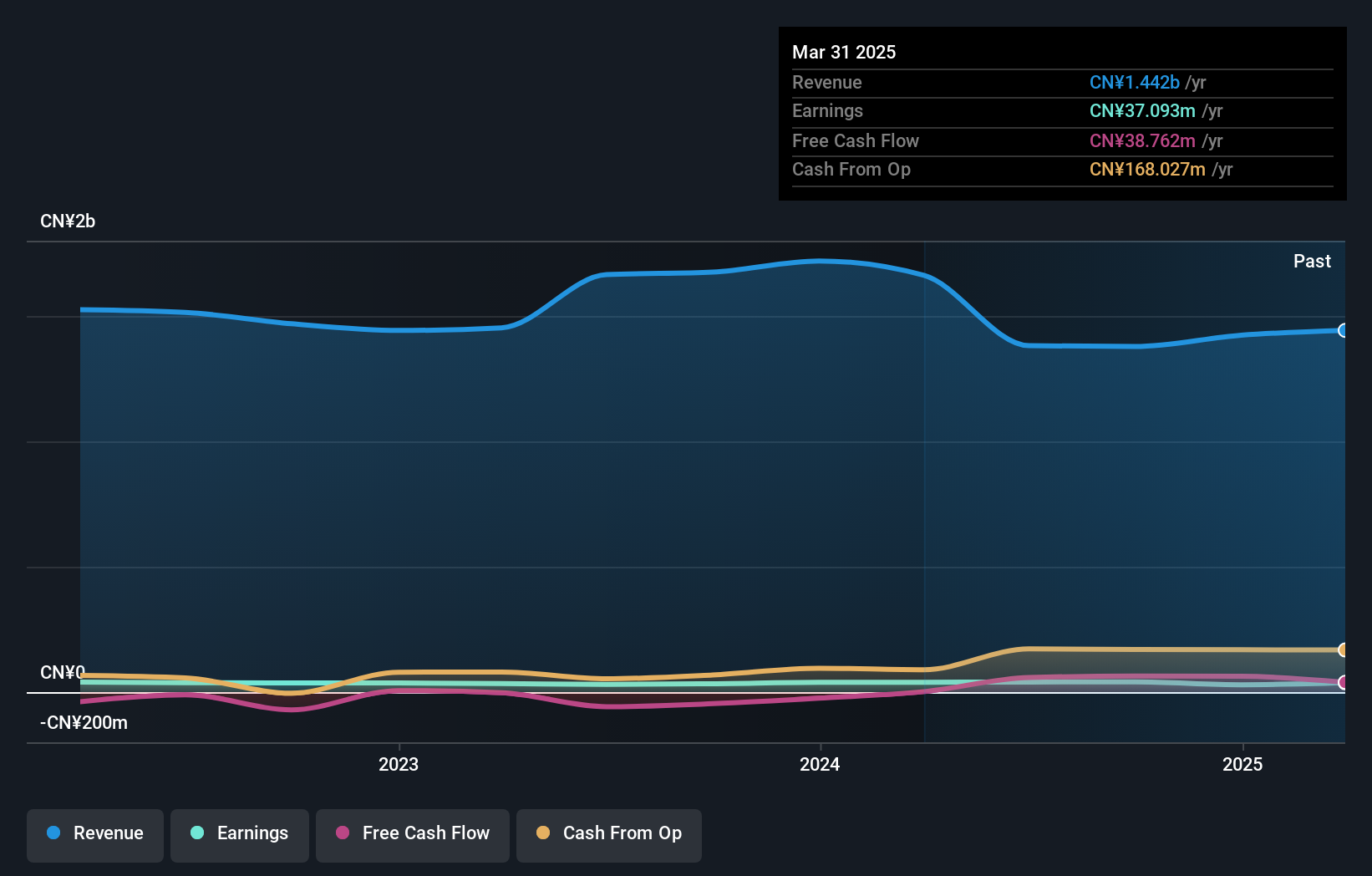

Operations: GRIPM Advanced Materials generates revenue through the production and sales of advanced non-ferrous metal powder materials. The company's net profit margin is 15.3%, reflecting its profitability in this niche market.

GRIPM Advanced Materials, a nimble player in the metals and mining sector, reported sales of CN¥2.85 billion for the first nine months of 2025, up from CN¥2.36 billion the previous year. Net income rose to CN¥51.66 million from CN¥40.36 million, reflecting a solid earnings growth of 23.3%, outpacing the industry average of 8.4%. Despite a debt-to-equity ratio increase to 16.2% over five years, interest payments are well-covered with an EBIT coverage of 8.1x, suggesting financial resilience amidst market volatility and positioning it for future growth with projected earnings expansion at 44% annually.

Jiangsu Jiuding New Material (SZSE:002201)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Jiuding New Material Co., Ltd. is engaged in the production and sale of glass fiber yarn, fabrics, and FRP products in China with a market cap of CN¥6.71 billion.

Operations: Jiangsu Jiuding New Material derives its revenue primarily from the sale of glass fiber yarn, fabrics, and FRP products. The company's net profit margin has shown fluctuations over recent periods.

Jiangsu Jiuding New Material, a nimble player in the chemicals sector, has shown impressive earnings growth of 92.7% over the past year, significantly outpacing the industry average of 6.8%. Despite a CN¥34.5 million one-off loss impacting recent financial results, its net debt to equity ratio stands at a satisfactory 38.5%, reflecting prudent financial management. The company's interest payments are well covered by EBIT at 6.7 times coverage, underscoring its solid operational footing. Recent reports indicate sales surged to CN¥1.22 billion for the nine months ending September 2025 from CN¥897 million in the previous year, highlighting robust revenue expansion amidst industry challenges.

- Get an in-depth perspective on Jiangsu Jiuding New Material's performance by reading our health report here.

Gain insights into Jiangsu Jiuding New Material's past trends and performance with our Past report.

Fulltech Fiber Glass (TPEX:1815)

Simply Wall St Value Rating: ★★★★☆☆

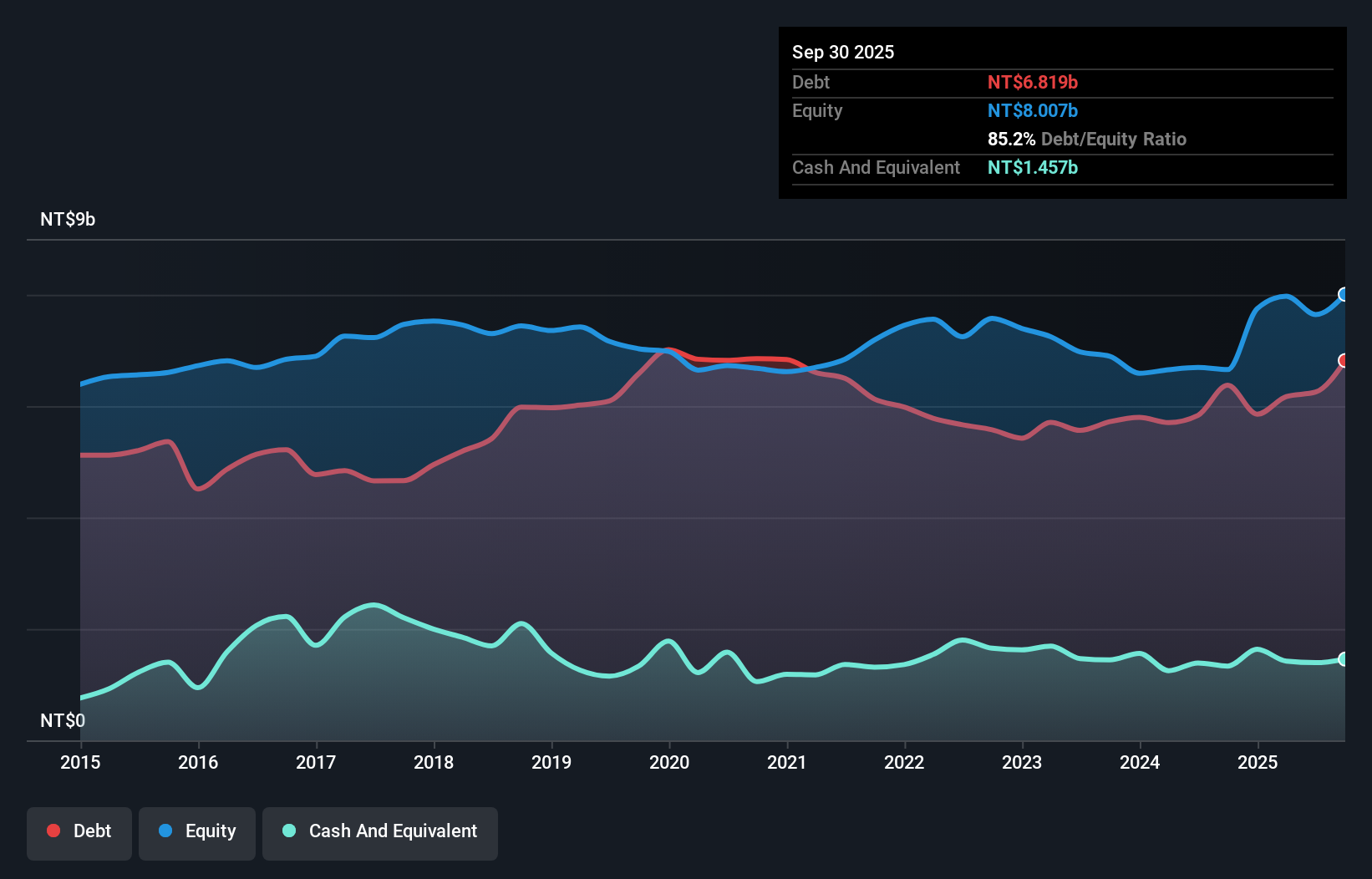

Overview: Fulltech Fiber Glass Corp. operates in Taiwan and China, producing and selling fiberglass yarns and fabrics, with a market capitalization of NT$47.50 billion.

Operations: Fulltech Fiber Glass generates revenue primarily from its Fiber Glass Yarn Department and Fiber Glass Fabric Segment, with NT$3.80 billion and NT$3.27 billion respectively.

Fulltech Fiber Glass has shown notable improvement, with third-quarter sales reaching TWD 1.53 billion, up from TWD 1.12 billion the previous year. The company turned around its net income to TWD 282.94 million from a loss of TWD 12.95 million, highlighting a strong recovery phase. Earnings per share improved significantly to TWD 0.54 compared to a loss of TWD 0.03 last year, reflecting operational efficiency gains and market demand strength. However, its debt remains high with a net debt-to-equity ratio at 67%, though interest payments are well covered by EBIT at over five times coverage, suggesting manageable financial obligations despite volatility in share price recently observed over three months.

- Take a closer look at Fulltech Fiber Glass' potential here in our health report.

Assess Fulltech Fiber Glass' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2491 more companies for you to explore.Click here to unveil our expertly curated list of 2494 Asian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報