TSX Penny Stocks Spotlight: Fox River Resources And Two Others

As the Canadian market navigates a noisy finish to 2025, with encouraging signs of easing inflation and stabilizing labor markets, investors are considering broader equity diversification and potential shifts in market leadership. In this context, penny stocks remain an intriguing investment area, often representing smaller or newer companies that can offer a blend of affordability and growth potential. Despite being considered somewhat outdated as a term, penny stocks backed by strong financials continue to attract attention for their ability to provide unique opportunities for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.12 | CA$52.58M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.47 | CA$250.45M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.16 | CA$116.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$3.76M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.33 | CA$50.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.35 | CA$891.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.13 | CA$159.27M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.99 | CA$184.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 395 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Fox River Resources (CNSX:FOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fox River Resources Corporation focuses on the acquisition, exploration, evaluation, and development of mineral and natural resources properties, with a market cap of CA$43.85 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$43.85M

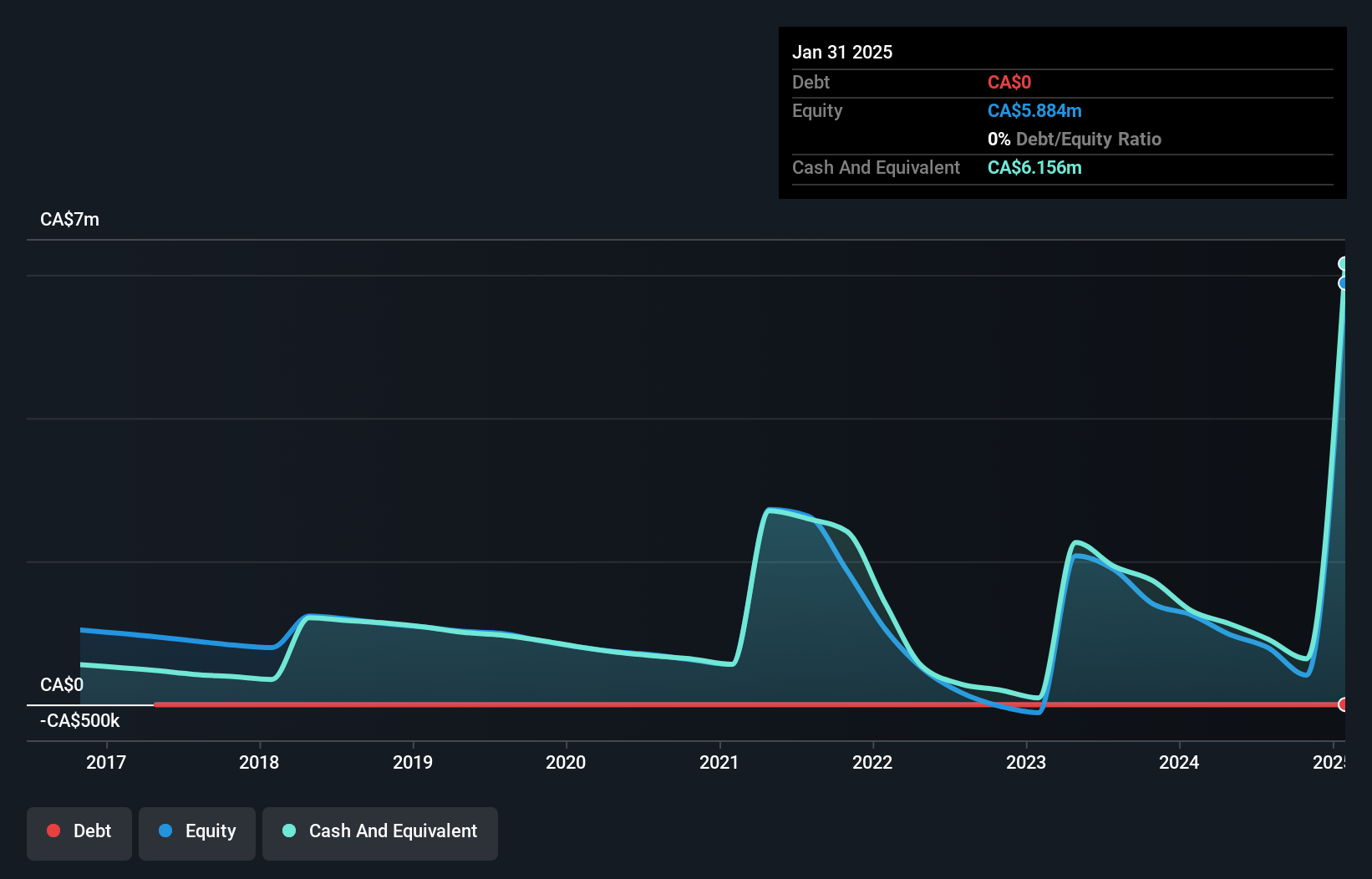

Fox River Resources, with a market cap of CA$43.85 million, operates as a pre-revenue entity in the mineral and natural resources sector. Despite being debt-free with sufficient cash runway exceeding three years, the company has faced increasing losses over the past five years. Recent developments include successful production of purified phosphoric acid (PPA), integral to lithium-iron-phosphate battery supply chains, potentially positioning Fox River for future growth opportunities within this market. However, it remains unprofitable with growing net losses reported in recent earnings announcements. The board is experienced but management tenure data is insufficient for evaluation.

- Click here to discover the nuances of Fox River Resources with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Fox River Resources' track record.

McCoy Global (TSX:MCB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McCoy Global Inc. offers equipment and technologies for tubular running operations to improve wellbore integrity and data collection in the energy industry across multiple regions, with a market cap of CA$77.99 million.

Operations: The company generates revenue of CA$83.45 million from its Energy Products & Services (EP&S) segment, which focuses on enhancing wellbore integrity and data collection in the energy sector.

Market Cap: CA$78M

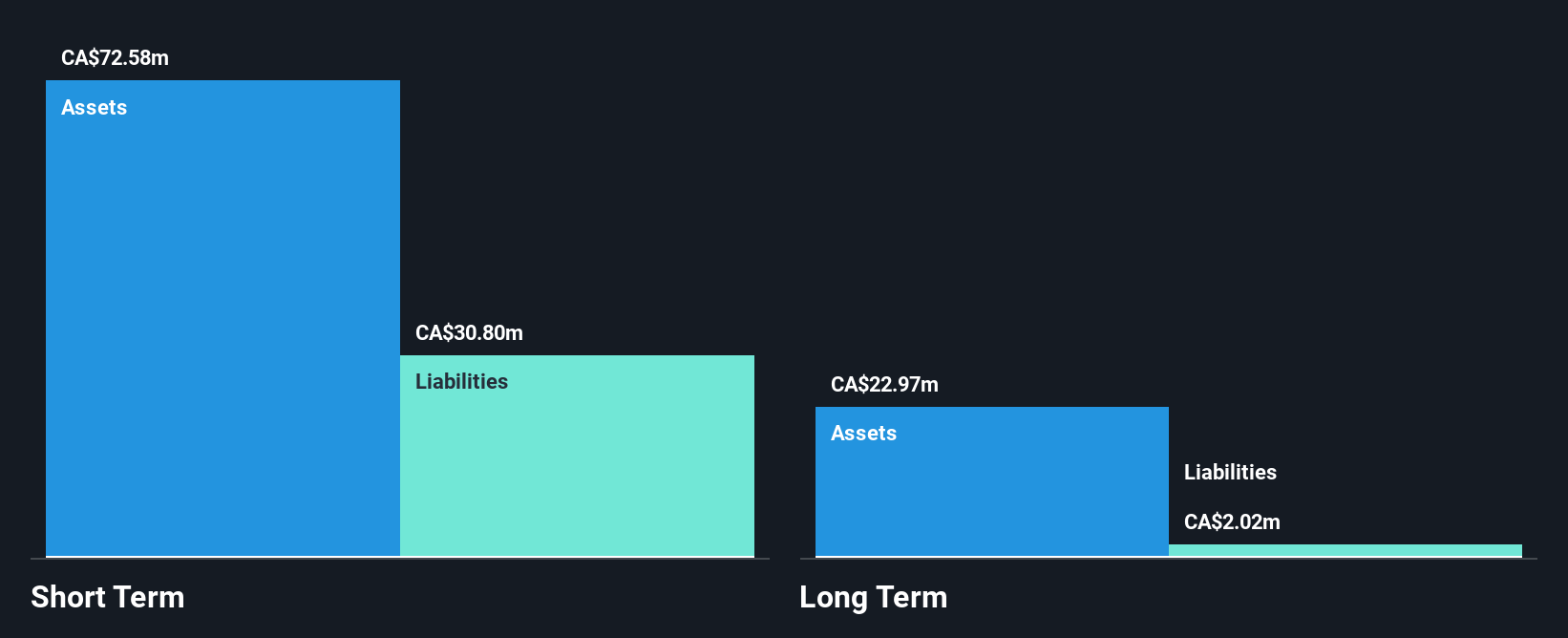

McCoy Global, with a market cap of CA$77.99 million, is debt-free and has stable weekly volatility. The company's short-term assets significantly exceed both its short- and long-term liabilities, indicating solid financial health. Despite a forecasted revenue growth of 12.96% annually, recent earnings show mixed results with decreased sales but slightly increased net income for the third quarter compared to the previous year. While McCoy's return on equity is considered low at 11.1%, it maintains high-quality earnings and has not diluted shareholders recently. A regular dividend was affirmed, though not well-covered by free cash flows.

- Take a closer look at McCoy Global's potential here in our financial health report.

- Gain insights into McCoy Global's outlook and expected performance with our report on the company's earnings estimates.

Atlas Engineered Products (TSXV:AEP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atlas Engineered Products Ltd. designs, manufactures, and sells engineered roof trusses, floor trusses, and wall panels in Canada with a market cap of CA$44.96 million.

Operations: The company generates revenue of CA$60.07 million from its building products segment, which includes engineered roof trusses, floor trusses, and wall panels in Canada.

Market Cap: CA$44.96M

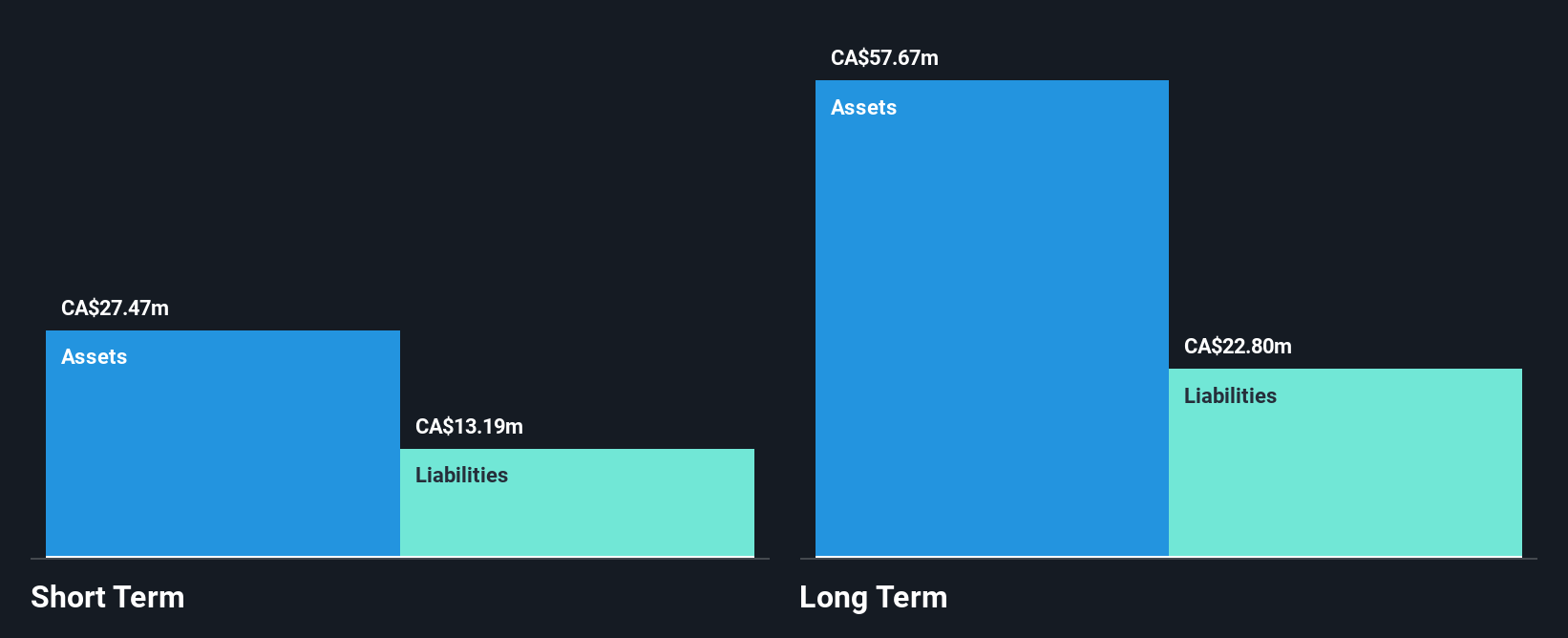

Atlas Engineered Products Ltd., with a market cap of CA$44.96 million, reported third-quarter sales of CA$20.33 million, an increase from the previous year. Despite revenue growth, the company remains unprofitable, with earnings declining by 19.2% annually over five years. Its net debt to equity ratio stands at a satisfactory 24.2%, though interest coverage is weak at 0.6 times EBIT. Short-term assets exceed both short- and long-term liabilities, reflecting some financial stability despite operational challenges. The board's average tenure suggests experienced oversight as the company navigates its growth trajectory in the building products sector.

- Dive into the specifics of Atlas Engineered Products here with our thorough balance sheet health report.

- Gain insights into Atlas Engineered Products' future direction by reviewing our growth report.

Summing It All Up

- Click through to start exploring the rest of the 392 TSX Penny Stocks now.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報