Discover 3 Stocks Including Atour Lifestyle Holdings That May Be Trading Below Estimated Value

As the U.S. stock market continues to reach new heights with the S&P 500 hitting an all-time high, investors are keenly observing opportunities that might be trading below their estimated value. In such a vibrant market environment, identifying undervalued stocks requires careful analysis of fundamentals and market positioning, making it essential to consider companies like Atour Lifestyle Holdings that may offer potential value at current prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.79 | $52.64 | 49.1% |

| UMB Financial (UMBF) | $119.21 | $233.51 | 48.9% |

| Sportradar Group (SRAD) | $23.11 | $45.57 | 49.3% |

| SmartStop Self Storage REIT (SMA) | $31.23 | $61.55 | 49.3% |

| Gold Royalty (GROY) | $4.20 | $8.38 | 49.9% |

| Firefly Aerospace (FLY) | $26.46 | $51.58 | 48.7% |

| Community West Bancshares (CWBC) | $22.64 | $44.11 | 48.7% |

| Columbia Banking System (COLB) | $28.61 | $57.00 | 49.8% |

| Clearfield (CLFD) | $29.63 | $58.38 | 49.2% |

| BioLife Solutions (BLFS) | $25.46 | $49.96 | 49% |

We'll examine a selection from our screener results.

Atour Lifestyle Holdings (ATAT)

Overview: Atour Lifestyle Holdings Limited, with a market cap of $5.87 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People’s Republic of China.

Operations: The company generates revenue primarily from its Atour Group segment, which reported CN¥9.09 billion.

Estimated Discount To Fair Value: 29.2%

Atour Lifestyle Holdings is trading at US$42.67, significantly below its estimated fair value of US$60.24, highlighting potential undervaluation based on cash flows. The company's revenue is projected to grow by 20.7% annually, outpacing the broader U.S. market growth rate of 10.7%. Recent earnings reports show strong performance with net income rising to CNY 1,140.65 million for the first nine months of 2025 from CNY 945.2 million a year ago, reinforcing its robust financial health amidst strategic dividend distributions totaling approximately US$108 million in 2025.

- The analysis detailed in our Atour Lifestyle Holdings growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Atour Lifestyle Holdings.

Fifth Third Bancorp (FITB)

Overview: Fifth Third Bancorp is a bank holding company for Fifth Third Bank, National Association, providing a variety of financial products and services in the United States, with a market cap of approximately $31.79 billion.

Operations: Fifth Third Bank generates revenue through its segments of Commercial Banking ($3.37 billion), Wealth and Asset Management ($633 million), and Consumer and Small Business Banking ($4.84 billion).

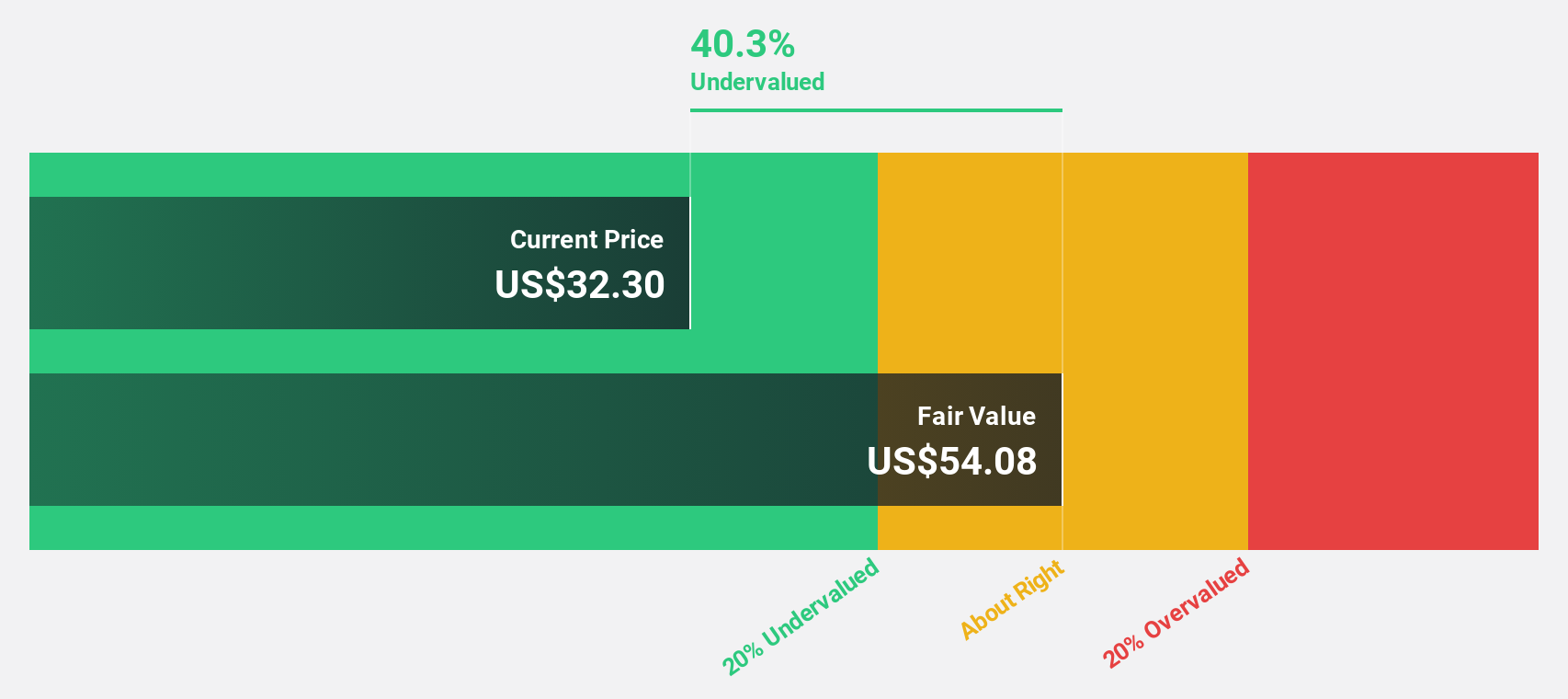

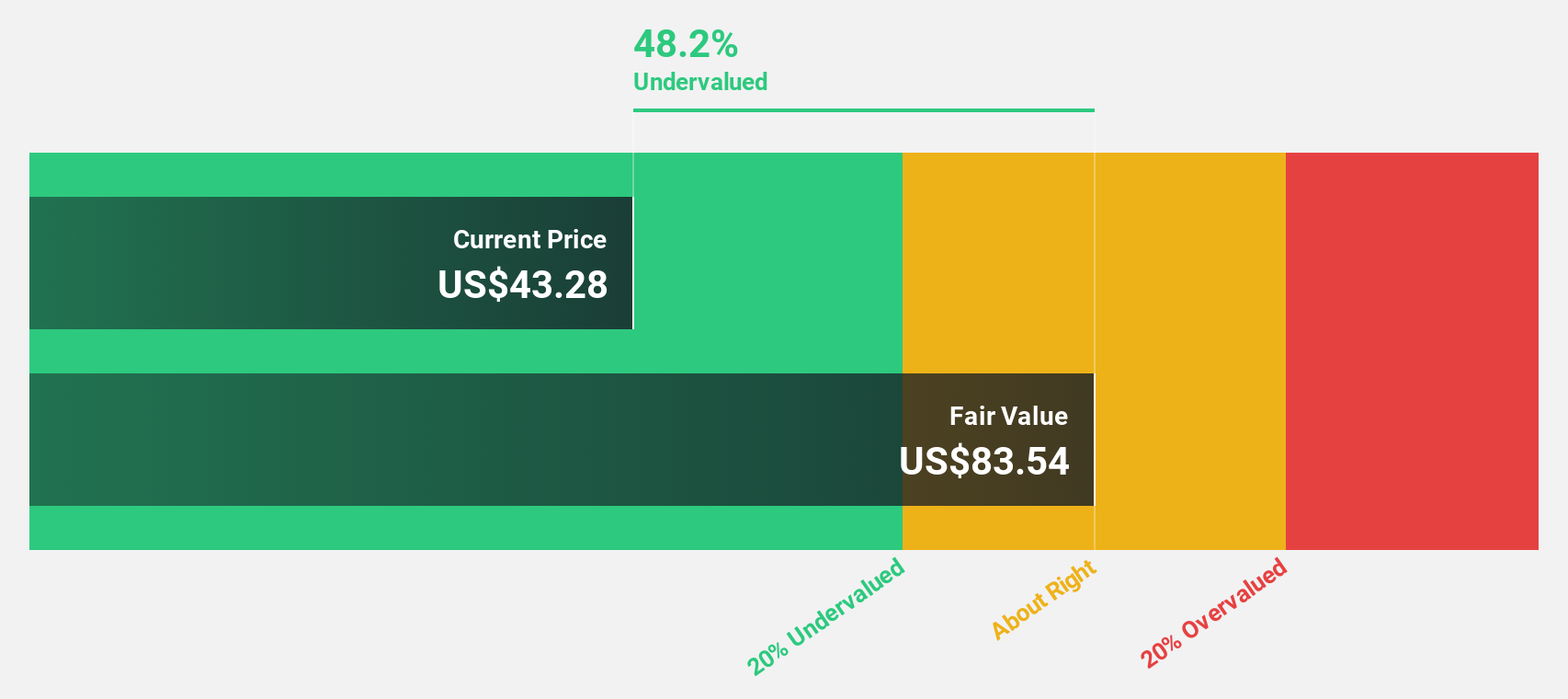

Estimated Discount To Fair Value: 42.8%

Fifth Third Bancorp is trading at US$48.1, significantly below its fair value estimate of US$84.06, suggesting it may be undervalued based on cash flows. With earnings forecasted to grow 29.2% annually, outpacing the broader U.S. market's 16.2%, and revenue expected to rise by 24.2% per year, the bank shows strong growth potential. Recent board changes and continued expansion efforts in high-growth markets further support its strategic positioning for future growth.

- Our comprehensive growth report raises the possibility that Fifth Third Bancorp is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Fifth Third Bancorp stock in this financial health report.

Comstock Resources (CRK)

Overview: Comstock Resources, Inc. is an independent energy company focused on acquiring, exploring, developing, and producing natural gas and oil properties in the United States with a market cap of $6.39 billion.

Operations: The company's revenue is primarily derived from the exploration and production of North American natural gas and oil, amounting to $1.80 billion.

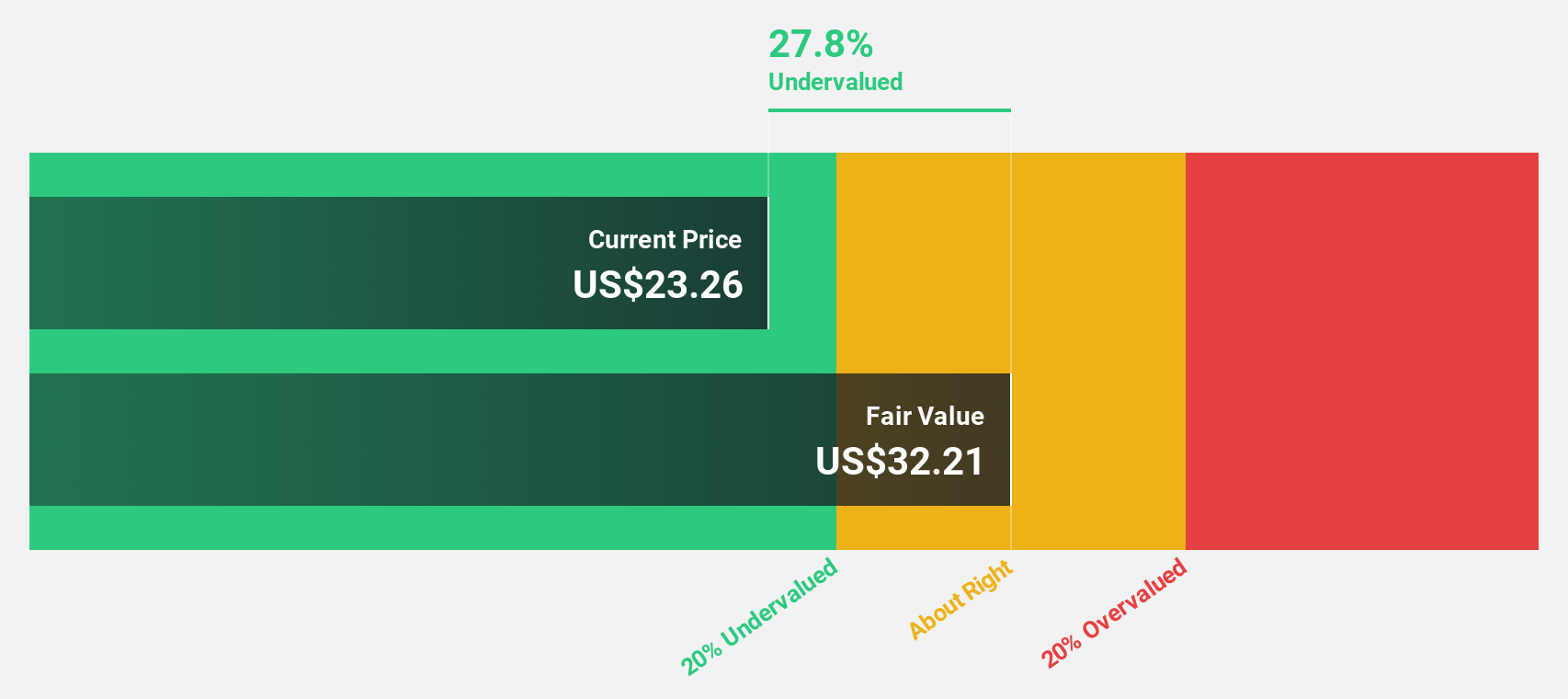

Estimated Discount To Fair Value: 24.3%

Comstock Resources is trading at US$23.06, below its estimated fair value of US$30.44, highlighting potential undervaluation based on cash flows. Despite a decline in production volumes, the company reported significant revenue growth to US$449.85 million for Q3 2025 from US$304.47 million a year ago and turned profitable with net income of US$111.13 million compared to a prior loss. Earnings are forecasted to grow significantly at 46.36% annually, outpacing the U.S market's growth rate.

- The growth report we've compiled suggests that Comstock Resources' future prospects could be on the up.

- Click here to discover the nuances of Comstock Resources with our detailed financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 210 Undervalued US Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報