December 2025's Top Penny Stocks With Financial Strength

As the S&P 500 reaches record highs, investors are increasingly looking beyond large-cap stocks to diversify their portfolios. Penny stocks, a term that may seem outdated but still relevant, often represent smaller or newer companies that can offer unique opportunities. By focusing on those with strong financial health and potential for growth, investors might uncover promising options among these lesser-known equities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.72 | $552.91M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8699 | $148.77M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.43 | $577.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.36B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.51 | $601.05M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.47 | $362.82M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.905 | $6.57M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.77 | $85.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Solid Power (SLDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid Power, Inc. focuses on developing solid-state battery technologies for electric vehicles and other markets in the United States, with a market cap of approximately $861.52 million.

Operations: The company generates revenue from its Auto Parts & Accessories segment, totaling $19.80 million.

Market Cap: $861.52M

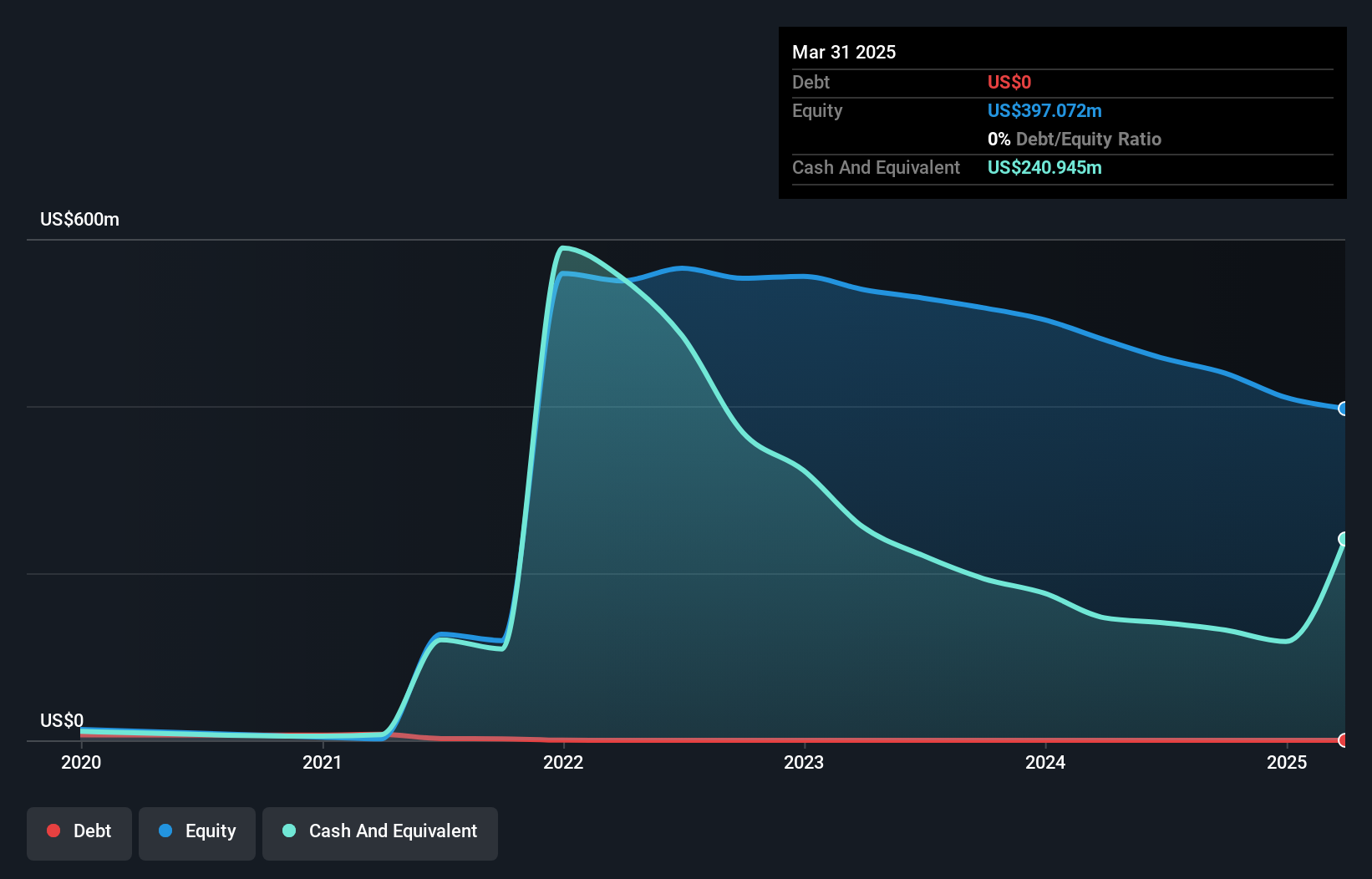

Solid Power, Inc. is navigating the penny stock landscape with a focus on solid-state battery technology for electric vehicles. Despite being unprofitable and reporting a net loss of US$66.36 million for the first nine months of 2025, it has no debt and significant short-term assets of US$262.2 million, which cover both its short- and long-term liabilities comfortably. The company recently entered a strategic collaboration with Samsung SDI and BMW to advance its all-solid-state battery technology, aiming to leverage their combined expertise for commercial success in this innovative energy segment while maintaining sufficient cash runway exceeding three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Solid Power.

- Gain insights into Solid Power's future direction by reviewing our growth report.

Waterdrop (WDH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Waterdrop Inc. operates as an online insurance brokerage in the People’s Republic of China, connecting users with insurance products, and has a market cap of approximately $687.16 million.

Operations: The company's revenue is primarily derived from its insurance segment, generating CN¥3.04 billion, supplemented by CN¥153.50 million from crowdfunding activities.

Market Cap: $687.16M

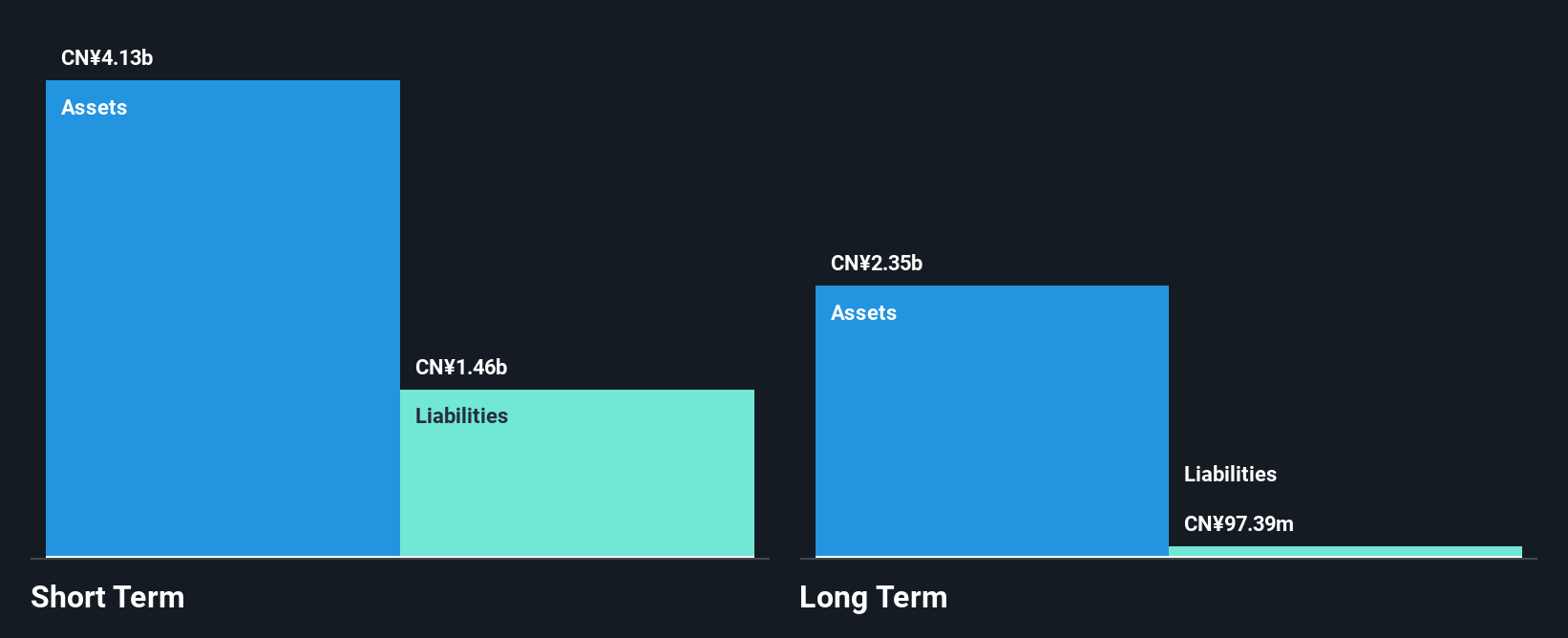

Waterdrop Inc. demonstrates a robust financial position with short-term assets of CN¥3.8 billion exceeding both short and long-term liabilities, while maintaining more cash than total debt. The company reported significant earnings growth, with net income for the third quarter reaching CN¥158.47 million, up from CN¥98.97 million year-over-year, driven by sales of CN¥974.86 million compared to CN¥704.14 million previously. Recent strategic actions include share buybacks totaling 7,300,252 shares for US$9.9 million and management changes enhancing board expertise as they navigate the competitive online insurance brokerage market in China effectively.

- Click to explore a detailed breakdown of our findings in Waterdrop's financial health report.

- Assess Waterdrop's future earnings estimates with our detailed growth reports.

Next Steps

- Get an in-depth perspective on all 343 US Penny Stocks by using our screener here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報