Lionsgate Studios Corp.'s (NYSE:LION) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Lionsgate Studios Corp. (NYSE:LION) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

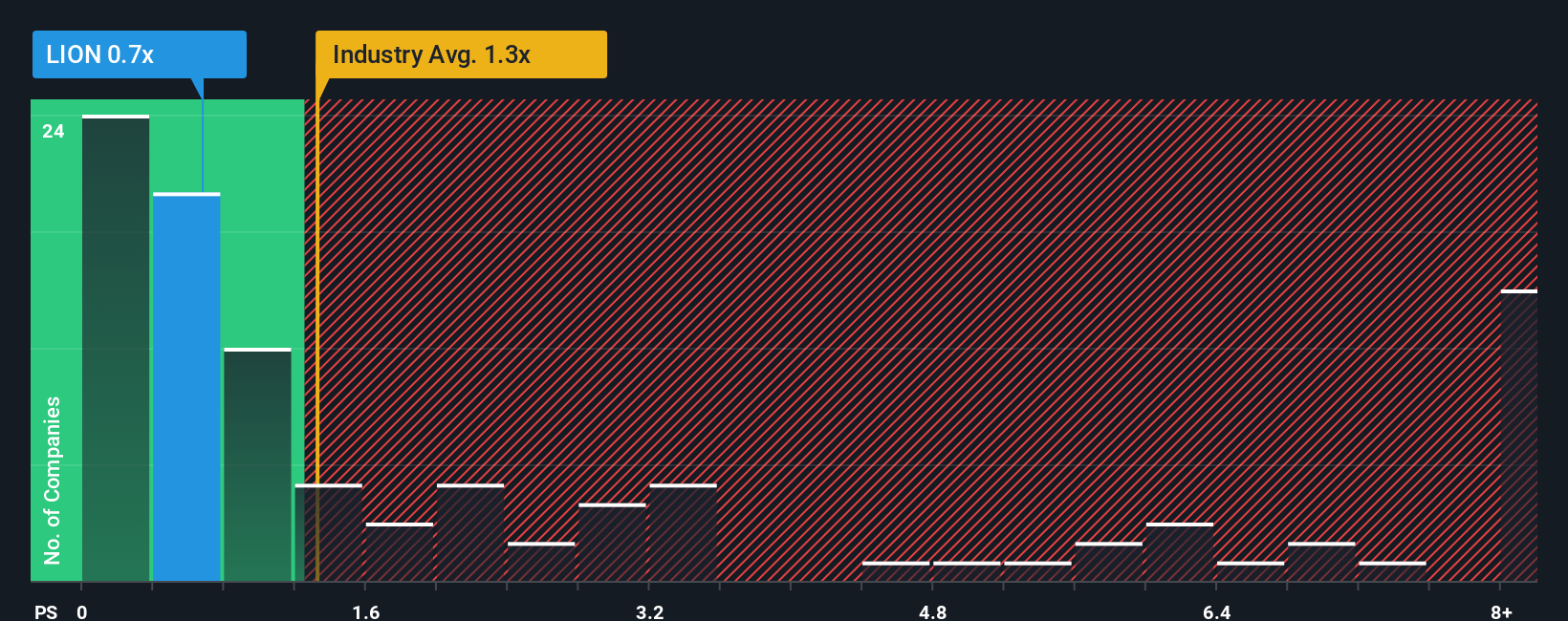

In spite of the firm bounce in price, Lionsgate Studios may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Entertainment industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Lionsgate Studios

What Does Lionsgate Studios' Recent Performance Look Like?

Recent times have been advantageous for Lionsgate Studios as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Lionsgate Studios' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Lionsgate Studios?

The only time you'd be truly comfortable seeing a P/S as low as Lionsgate Studios' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Revenue has also lifted 7.6% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 26% as estimated by the nine analysts watching the company. With the industry predicted to deliver 19% growth, that's a disappointing outcome.

With this information, we are not surprised that Lionsgate Studios is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Lionsgate Studios' P/S?

Lionsgate Studios' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Lionsgate Studios maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Lionsgate Studios that you should be aware of.

If you're unsure about the strength of Lionsgate Studios' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報