Global Undervalued Small Caps With Insider Buying In December 2025

As global markets navigate a complex landscape marked by mixed performance in major indices and fluctuating economic signals, small-cap stocks have faced particular challenges. The Russell 2000 Index's recent decline highlights the cautious sentiment surrounding smaller companies amid concerns about valuations and economic growth. In this environment, identifying promising small-cap stocks often involves looking for those with strong fundamentals and insider buying activity, as these factors can signal confidence from within the company despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.1x | 0.9x | 28.85% | ★★★★★★ |

| Norcros | 13.7x | 0.7x | 41.20% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 41.75% | ★★★★★☆ |

| Eurocell | 17.0x | 0.3x | 38.40% | ★★★★☆☆ |

| Chinasoft International | 21.2x | 0.7x | -1186.43% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.02% | ★★★★☆☆ |

| Nickel Asia | 12.2x | 1.9x | 12.82% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.2x | 0.4x | -398.97% | ★★★☆☆☆ |

| PSC | 9.8x | 0.4x | 19.61% | ★★★☆☆☆ |

| CVS Group | 47.5x | 1.3x | 23.88% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Forterra (LSE:FORT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Forterra is a UK-based manufacturer specializing in bricks, blocks, and bespoke building products, with a market cap of £0.42 billion.

Operations: The company generates revenue primarily from Bricks and Blocks (£300.70 million) and Bespoke Products (£80 million). The gross profit margin shows a declining trend, reaching 28.73% by mid-2025, indicating increasing cost pressures or pricing challenges over time.

PE: 24.6x

Forterra, a company with external borrowing as its sole funding source, recently saw insider confidence when Nigel Lingwood purchased 50,000 shares for approximately £89,900 in November 2025. Despite the higher risk associated with its funding structure, Forterra forecasts earnings growth of 23.82% annually. The company's recent guidance suggests stable revenue levels for the second half of 2025 compared to H1. This blend of insider activity and growth potential positions it intriguingly within small cap opportunities.

- Click here to discover the nuances of Forterra with our detailed analytical valuation report.

Evaluate Forterra's historical performance by accessing our past performance report.

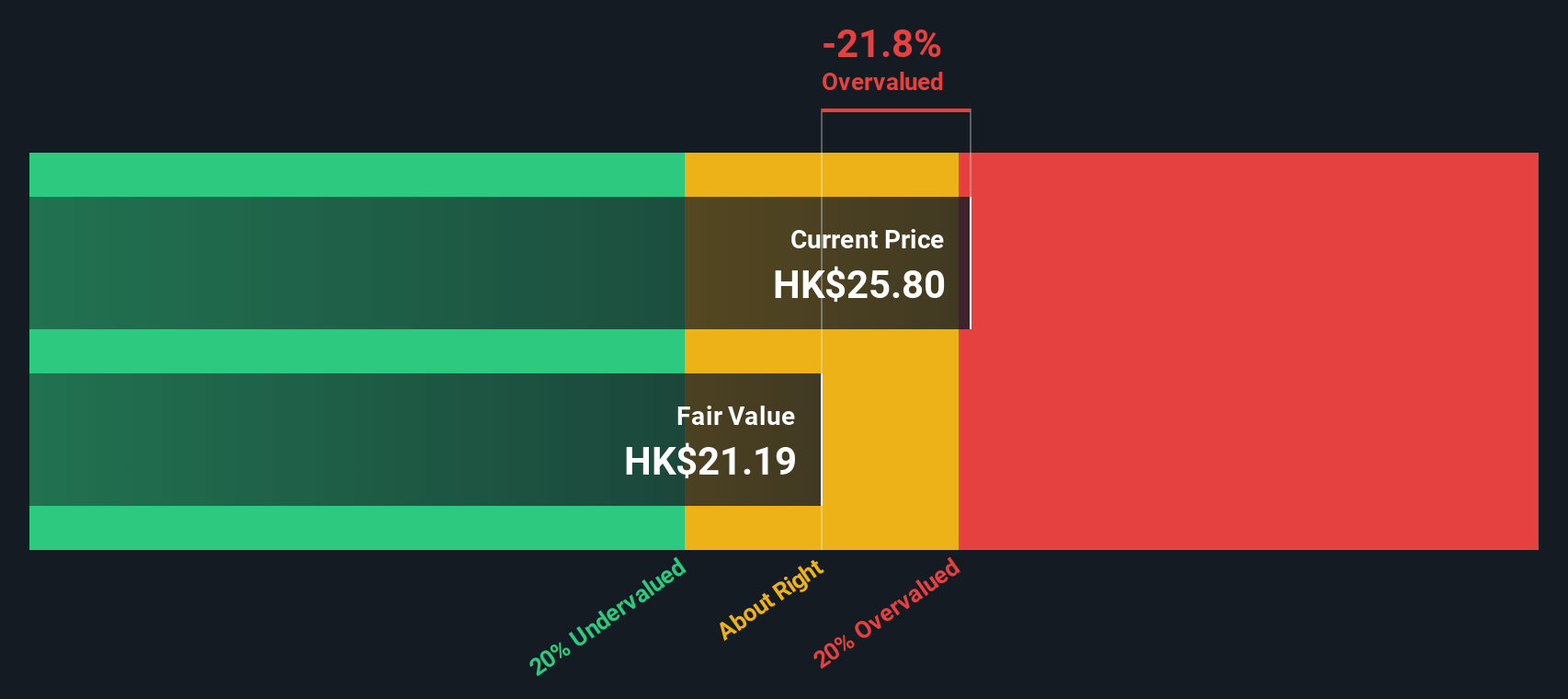

Luk Fook Holdings (International) (SEHK:590)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Luk Fook Holdings (International) is a company engaged in licensing, retailing, and wholesaling jewelry primarily in Hong Kong, Macau, Mainland China, and overseas markets with a market capitalization of HK$8.37 billion.

Operations: Luk Fook Holdings generates revenue primarily through retailing in Hong Kong, Macau, and overseas markets, contributing significantly to its overall earnings. The company's cost of goods sold (COGS) forms the major portion of expenses impacting gross profit. Over recent periods, the gross profit margin has shown a notable upward trend, reaching 33.99% by September 2025. Operating expenses include significant allocations for sales and marketing activities.

PE: 11.4x

Luk Fook Holdings, a smaller company in the jewelry industry, recently reported sales of HK$6.84 billion for the half-year ending September 2025, up from HK$5.45 billion the previous year. Net income rose to HK$619 million from HK$434 million, reflecting effective product differentiation and sales strategies. Despite relying solely on external borrowing for funding, insider confidence is evident with recent share purchases by company executives. The board declared an interim dividend of HK$0.55 per share, maintaining shareholder returns amidst rising gold prices and increased fixed-price jewelry sales contributing to profit growth expectations between 40% and 50%.

Mullen Group (TSX:MTL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mullen Group operates as a diversified logistics company providing services in less-than-truckload, logistics and warehousing, U.S. and international logistics, and specialized industrial services with a market cap of CA$1.92 billion.

Operations: The company generates revenue primarily from its Less-Than-Truckload and Logistics & Warehousing segments. Over recent periods, the gross profit margin has shown a trend of fluctuation, reaching 30.10% in the latest quarter. Operating expenses are a significant cost factor, with general and administrative expenses consistently forming a substantial portion of these costs.

PE: 14.8x

Mullen Group, a smaller company in its sector, faces challenges with high debt levels and reliance on external borrowing. Despite this, they are pursuing growth through acquisitions, aiming to expand into new markets as economic conditions improve. Recent earnings show a slight dip in net income but steady sales growth, with CAD 561.72 million reported for Q3 2025. The company consistently pays monthly dividends of CAD 0.07 per share and maintains insider confidence through strategic leadership decisions focused on future expansion opportunities.

Next Steps

- Delve into our full catalog of 147 Undervalued Global Small Caps With Insider Buying here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報