Global Penny Stocks Spotlight Fujian Start GroupLtd And Two More Contenders

As global markets navigate a landscape marked by mixed signals from major indices and central banks adjusting interest rates, investors are increasingly exploring diverse opportunities. Penny stocks, though often viewed as relics of past market trends, remain an intriguing area for those willing to look beyond the mainstream. These smaller or newer companies can offer unique value propositions that larger firms might overlook, making them worth considering for their potential financial strength and growth prospects.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.22 | £484.13M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$471.83M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.47 | SGD13.66B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.71 | $412.74M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.215 | MYR331.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,642 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Start Group Co. Ltd specializes in providing anti-intrusion detection systems in China, with a market capitalization of approximately CN¥10.33 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥10.33B

Fujian Start Group Co. Ltd has experienced significant revenue growth, with sales reaching CN¥134.59 million for the nine months ending September 2025, up from CN¥63.49 million a year earlier. Despite this increase in revenue, the company reported a net loss of CN¥87.57 million compared to a net income previously recorded, indicating ongoing profitability challenges. The company's short-term assets exceed both its short and long-term liabilities, suggesting solid liquidity management. However, its high share price volatility and relatively inexperienced management team present potential risks for investors considering this stock within their portfolio strategy.

- Click to explore a detailed breakdown of our findings in Fujian Start GroupLtd's financial health report.

- Evaluate Fujian Start GroupLtd's historical performance by accessing our past performance report.

Quzhou DFP New Material Group (SHSE:601515)

Simply Wall St Financial Health Rating: ★★★★☆☆

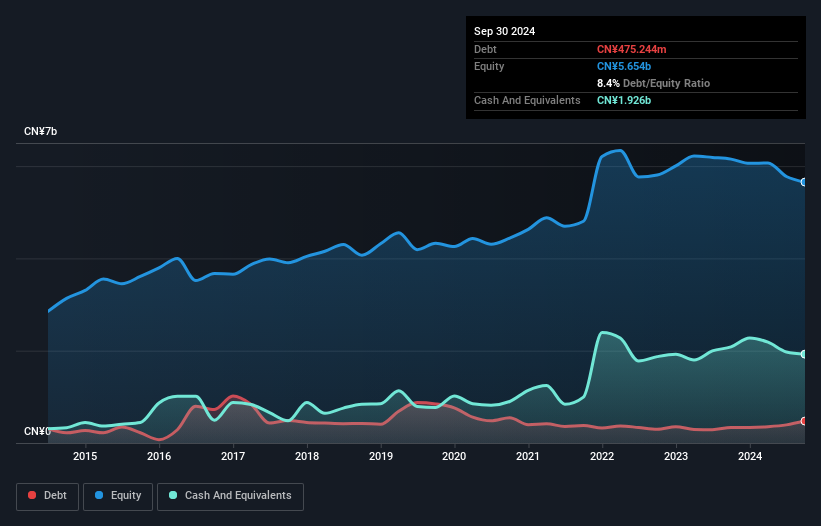

Overview: Quzhou DFP New Material Group Co., Ltd. specializes in the research, development, design, manufacture, and sale of printing and paper packaging products both in China and internationally with a market cap of CN¥7.81 billion.

Operations: Quzhou DFP New Material Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥7.81B

Quzhou DFP New Material Group Co., Ltd. has demonstrated a capacity to manage its liabilities effectively, with short-term assets of CN¥3.3 billion surpassing both short-term and long-term liabilities. Despite being unprofitable, the company has reduced its debt-to-equity ratio over five years and maintains more cash than total debt, indicating prudent financial management. However, negative operating cash flow suggests challenges in covering debt through operations. The board's experience is an asset, though profitability remains elusive with net losses narrowing but still significant at CN¥95.5 million for the nine months ending September 2025 compared to the previous year’s figures.

- Take a closer look at Quzhou DFP New Material Group's potential here in our financial health report.

- Learn about Quzhou DFP New Material Group's future growth trajectory here.

Jiangsu Skyray Instrument (SZSE:300165)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Skyray Instrument Co., Ltd. specializes in providing instruments for the spectroscopy and chromatography fields, with a market cap of CN¥2.31 billion.

Operations: No specific revenue segments have been reported for Jiangsu Skyray Instrument Co., Ltd.

Market Cap: CN¥2.31B

Jiangsu Skyray Instrument Co., Ltd. shows a mixed financial picture with a market cap of CN¥2.31 billion and recent sales of CN¥434.87 million for the first nine months of 2025, down from the previous year. Despite being unprofitable, net losses have decreased to CN¥1.22 million from CN¥6.84 million over the same period last year, while maintaining a stable cash runway due to positive free cash flow growth at 18.2% annually. The company's seasoned management team and board offer stability; however, high debt levels present challenges as their debt-to-equity ratio has increased significantly over five years.

- Jump into the full analysis health report here for a deeper understanding of Jiangsu Skyray Instrument.

- Gain insights into Jiangsu Skyray Instrument's historical outcomes by reviewing our past performance report.

Next Steps

- Take a closer look at our Global Penny Stocks list of 3,642 companies by clicking here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報