Middle Eastern Penny Stocks With Market Caps Up To US$400M

Most Gulf markets have recently gained momentum, buoyed by stabilizing oil prices and expectations of future U.S. Federal Reserve rate cuts. For investors willing to explore beyond the major players, penny stocks—often smaller or newer companies—can present intriguing opportunities. Although the term might seem outdated, these stocks continue to offer a mix of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.26 | SAR1.3B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.414 | ₪173.07M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.02 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.24 | AED670.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.91 | SAR980M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.22 | AED389.24M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.70 | AED15.77B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.85 | AED517.02M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.58 | ₪202.53M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Union Insurance Company P.J.S.C (ADX:UNION)

Simply Wall St Financial Health Rating: ★★★★★☆

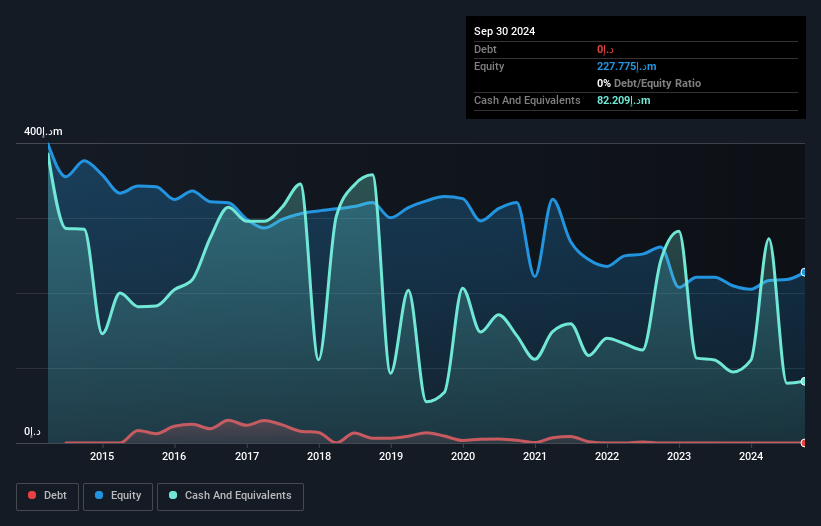

Overview: Union Insurance Company P.J.S.C. provides insurance products in the United Arab Emirates, Gulf Cooperation Council, and internationally with a market cap of AED276 million.

Operations: The company's revenue is derived from two main segments: Life Insurance, generating AED19.2 million, and General Insurance, contributing AED214.72 million.

Market Cap: AED276M

Union Insurance Company P.J.S.C. has demonstrated significant earnings growth, with a 173.5% increase over the past year, outpacing the broader insurance industry. Despite a low return on equity at 17.9%, its price-to-earnings ratio of 5.6x suggests it may be undervalued compared to the AE market average of 11.7x. The company is debt-free and maintains strong short-term asset coverage but faces challenges with long-term liabilities exceeding AED1 billion not covered by short-term assets of AED717.5 million. Recent earnings were impacted by a large one-off gain, and management remains relatively inexperienced with an average tenure under two years.

- Unlock comprehensive insights into our analysis of Union Insurance Company P.J.S.C stock in this financial health report.

- Gain insights into Union Insurance Company P.J.S.C's historical outcomes by reviewing our past performance report.

Thob Al Aseel (SASE:4012)

Simply Wall St Financial Health Rating: ★★★★★★

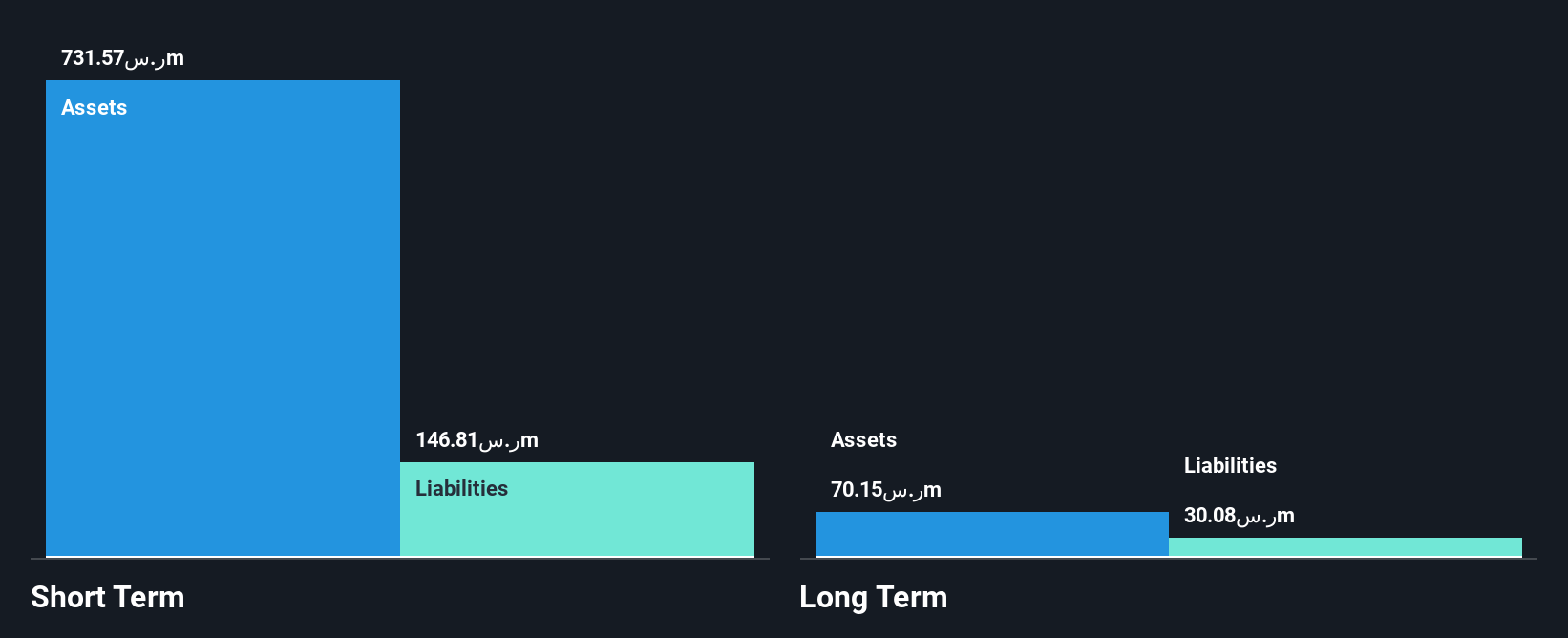

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market cap of SAR1.30 billion.

Operations: The company's revenue is primarily derived from its Thobs segment at SAR369.43 million and Fabrics segment at SAR129.35 million.

Market Cap: SAR1.3B

Thob Al Aseel Company, with a market cap of SAR1.30 billion, operates debt-free and demonstrates stable earnings growth, having increased by 7.2% over the past year. The company’s short-term assets significantly exceed both its short and long-term liabilities, indicating robust financial health. Despite a low return on equity at 15.2%, Thob Al Aseel trades at a substantial discount to its estimated fair value. Recent quarterly results show modest sales growth to SAR81 million and improved net income of SAR5.99 million compared to the previous year, while its dividend history remains unstable amidst an inexperienced board averaging 2.8 years in tenure.

- Click here to discover the nuances of Thob Al Aseel with our detailed analytical financial health report.

- Explore historical data to track Thob Al Aseel's performance over time in our past results report.

PlantArc Bio (TASE:PLNT)

Simply Wall St Financial Health Rating: ★★★★★★

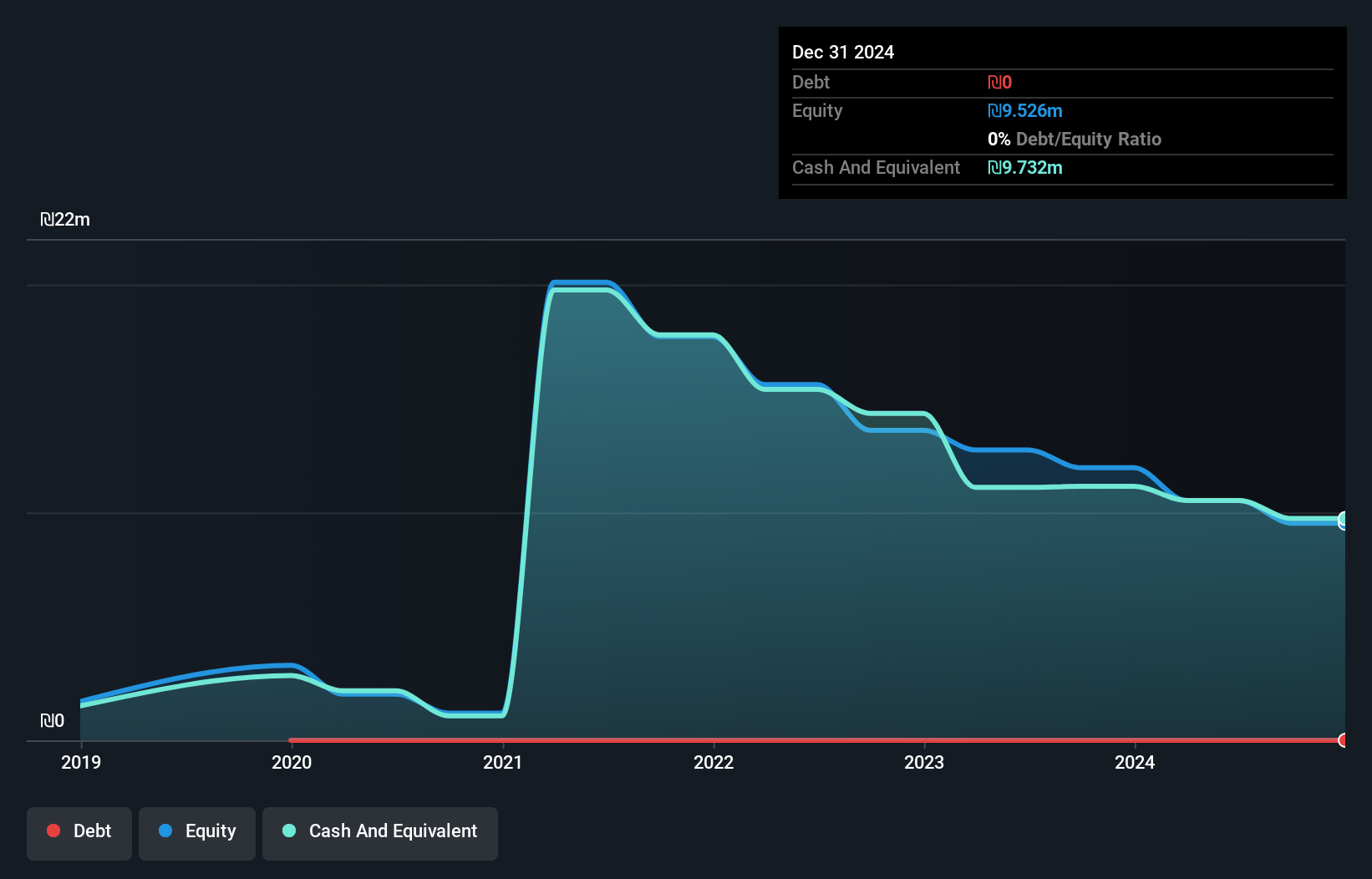

Overview: PlantArc Bio Ltd. is an Ag-Bio company focused on crop protection and yield enhancement, with a market cap of ₪7.33 million.

Operations: The company generates revenue from its Agricultural Biotech segment, amounting to ₪3.07 million.

Market Cap: ₪7.33M

PlantArc Bio Ltd., with a market cap of ₪7.33 million, operates debt-free and maintains a cash runway exceeding three years based on current free cash flow. Despite being pre-revenue with less than US$1 million in revenue, the company has reduced losses by 7.6% annually over the past five years and its weekly volatility has decreased significantly from 11% to 6%. Its short-term assets of ₪8 million comfortably cover both short- and long-term liabilities. The management team is seasoned, averaging 5.3 years in tenure, while shareholders have not experienced significant dilution recently.

- Click here and access our complete financial health analysis report to understand the dynamics of PlantArc Bio.

- Examine PlantArc Bio's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Get an in-depth perspective on all 81 Middle Eastern Penny Stocks by using our screener here.

- Contemplating Other Strategies? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報