Celestica (TSX:CLS): Rethinking Valuation After a Sharp Multi‑Year Share Price Surge

Celestica (TSX:CLS) has quietly become one of the TSX’s standout performers, with shares more than tripling over the past year. That kind of move naturally raises a key question for investors.

See our latest analysis for Celestica.

Backed by strong revenue and earnings growth, Celestica’s momentum has not cooled, with a roughly 18% 3 month share price return adding to an exceptional multi year total shareholder return that has massively rewarded patient investors.

If Celestica’s run has you rethinking what growth can look like, it might be a good time to explore high growth tech and AI stocks for other potential standouts.

With analysts still seeing upside and earnings growing fast, investors now face a pivotal question: Is Celestica’s soaring share price still underestimating its future potential, or has the market already priced in the next leg of growth?

Most Popular Narrative: 26% Undervalued

With Celestica last closing at CA$421.73 against a narrative fair value near CA$570, the story hinges on aggressive growth and richer future earnings multiples.

Analysts have raised their price target on Celestica, citing a slightly higher assumed discount rate and marginally stronger long term revenue growth expectations. Together, these factors support a modest increase in the company’s projected fair value, now effectively unchanged at about $570.00 per share but with a richer future earnings multiple embedded in their models.

Curious why this narrative backs a lofty future earnings multiple, despite only a modest tweak to growth and discount assumptions? Unpack the projections and see what really drives that gap.

Result: Fair Value of $569.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, revenue concentration among a few hyperscaler customers and potential slowdowns in AI focused cloud spending could quickly challenge this bullish narrative.

Find out about the key risks to this Celestica narrative.

Another View: Rich Multiples Raise the Bar

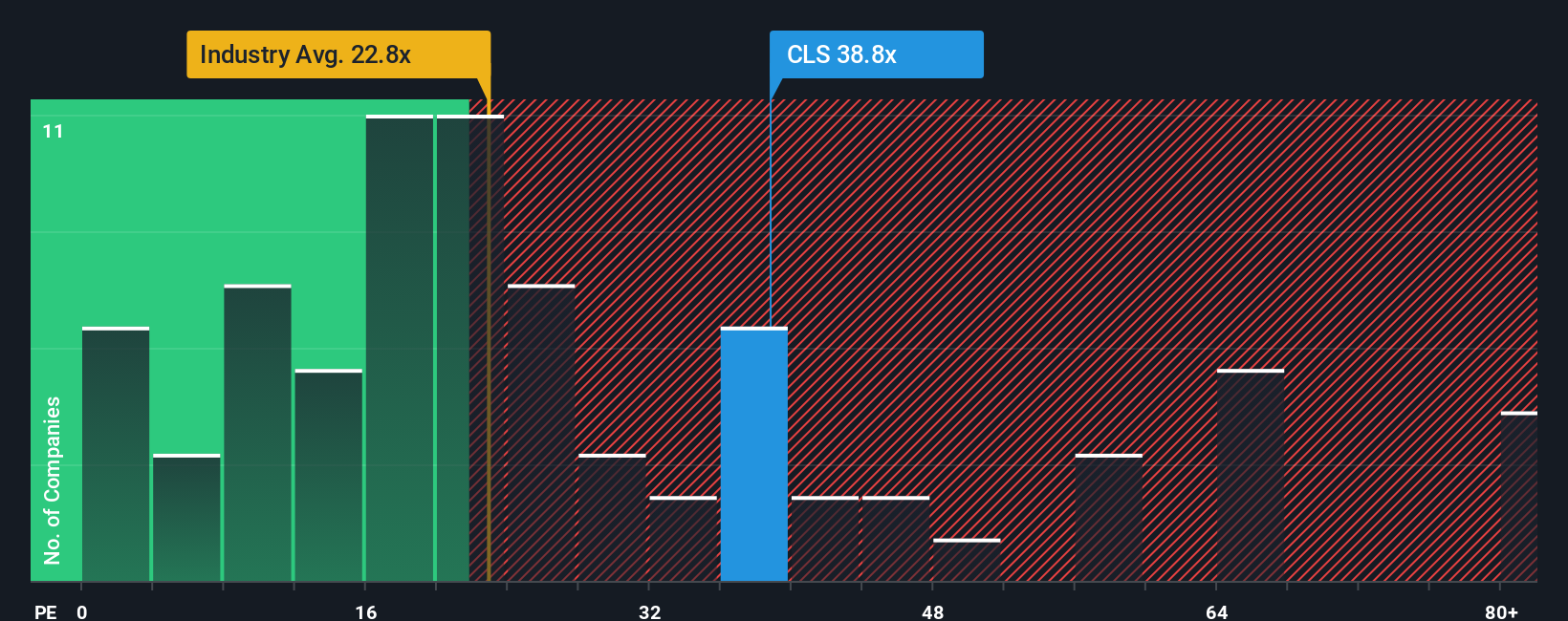

While the narrative fair value suggests upside, Celestica already trades on a steep 49.2x earnings multiple versus a 24.7x industry average and a 33.1x peer average, above its own 48.1x fair ratio. If sentiment cools, this premium could potentially compress faster than growth delivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celestica Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Celestica.

Looking for more investment ideas?

Before you move on, consider your next move by scanning fresh opportunities from powerful screeners that surface stocks most investors have not fully appreciated yet.

- Strengthen your portfolio’s foundation by assessing reliable income opportunities through these 10 dividend stocks with yields > 3% that could support steady cash flow over the long term.

- Explore powerful structural trends by targeting innovation leaders using these 24 AI penny stocks before the broader market recognizes their potential.

- Position yourself for the next wave in digital finance by reviewing future focused names via these 79 cryptocurrency and blockchain stocks that could influence how money moves globally.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報