3 Growth Companies With Insider Ownership Up To 37%

As the U.S. market experiences a fourth consecutive session of gains, buoyed by better-than-expected GDP data and a strong tech sector performance, investors are increasingly focusing on growth companies with significant insider ownership. In this context, stocks with high levels of insider investment can be particularly appealing as they often indicate confidence in the company's future prospects amidst an evolving economic landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Here's a peek at a few of the choices from the screener.

ImmunityBio (IBRX)

Simply Wall St Growth Rating: ★★★★★☆

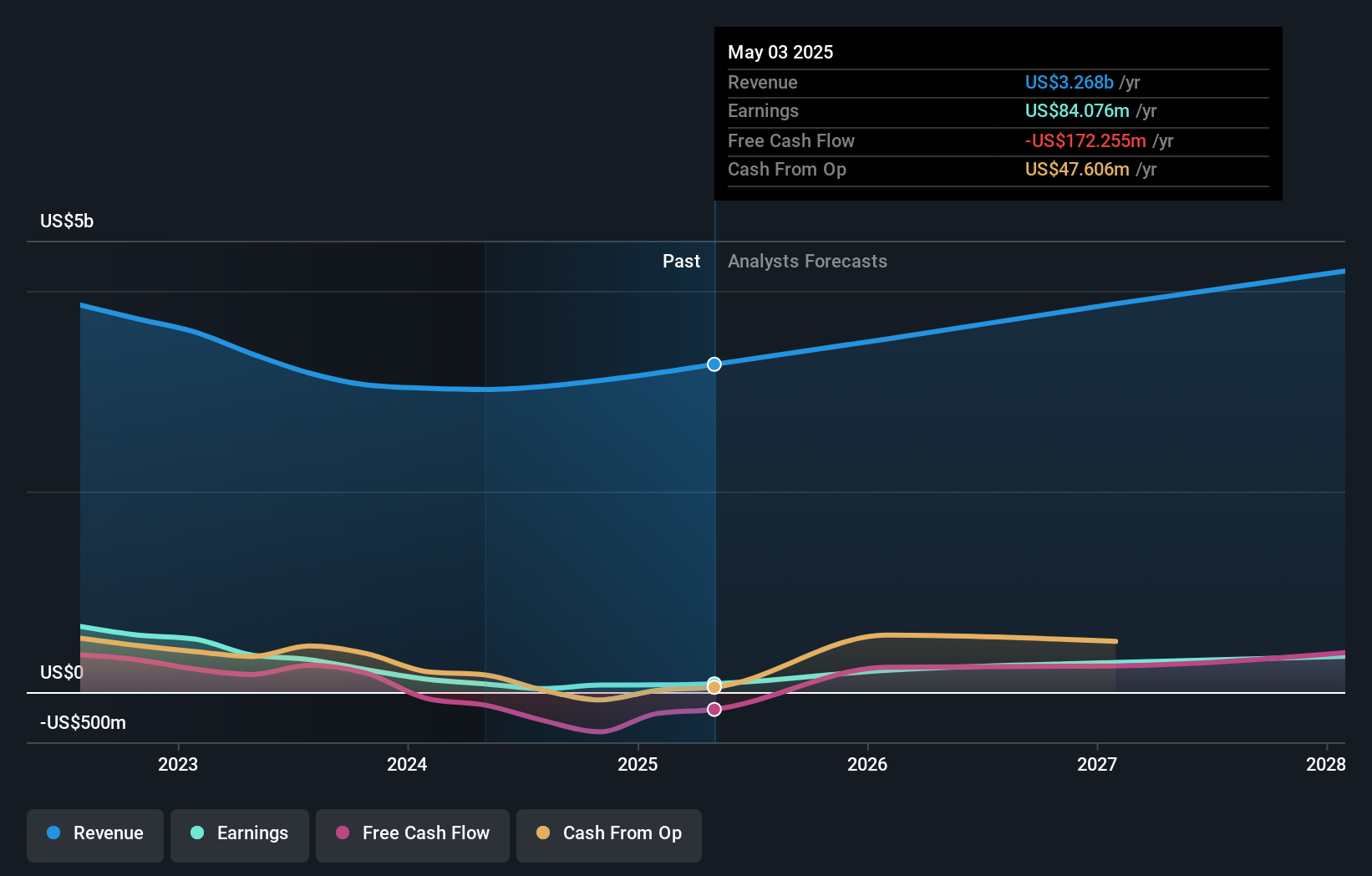

Overview: ImmunityBio, Inc. is a commercial-stage biotechnology company focused on developing next-generation therapies to enhance the natural immune system against cancers and infectious diseases, with a market cap of $2.05 billion.

Operations: The company generates revenue of $82.56 million from its focus on developing advanced therapies that enhance the immune system to combat cancers and infectious diseases.

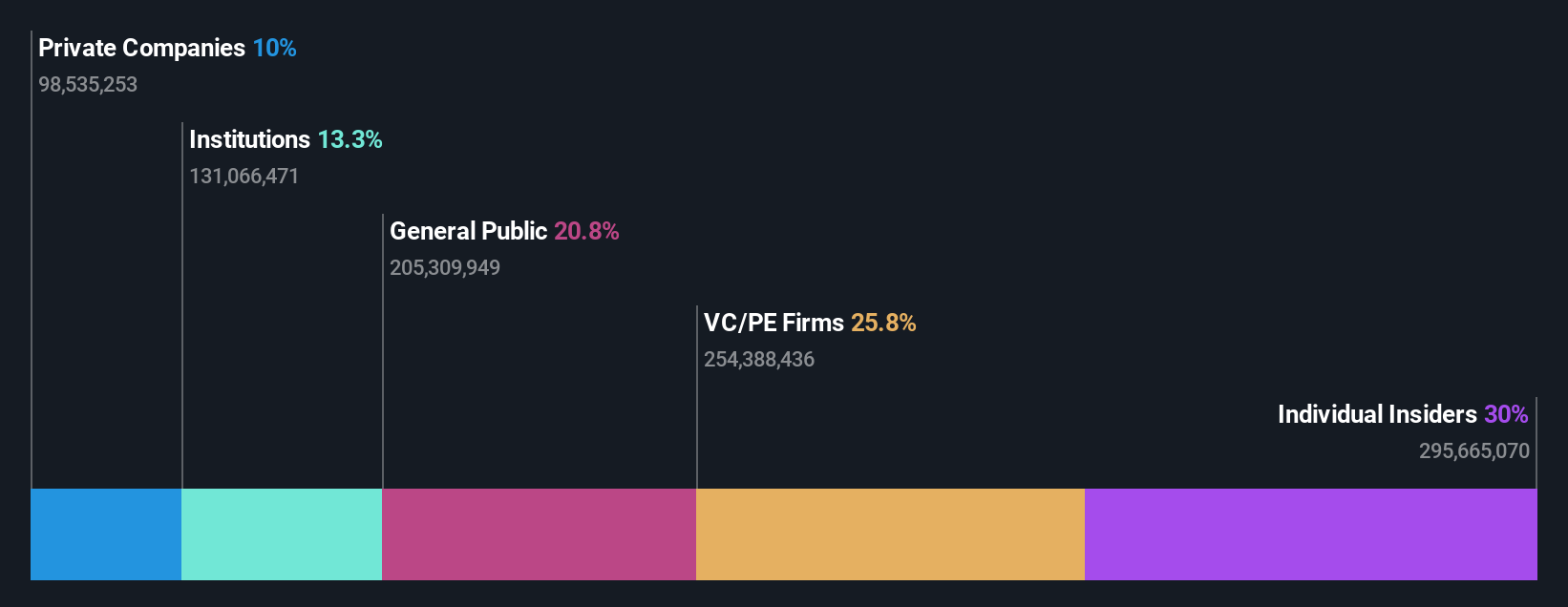

Insider Ownership: 30%

ImmunityBio, with significant insider ownership, is a growth-focused company in the biotech sector. Recent announcements highlight the potential of ANKTIVA® for bladder cancer treatment, supported by promising clinical data and European regulatory progress. The company reported substantial revenue growth to US$32.06 million in Q3 2025 but faces challenges with negative equity and limited cash runway. Despite past shareholder dilution, ImmunityBio's projected revenue growth of 58.5% annually positions it above market averages, aiming for profitability within three years.

- Click here to discover the nuances of ImmunityBio with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that ImmunityBio is priced lower than what may be justified by its financials.

Uxin (UXIN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Uxin Limited is a used car retailer operating in the People's Republic of China with a market cap of approximately $703.04 million.

Operations: Uxin's revenue is primarily generated from its operations as a used car retailer in China.

Insider Ownership: 37.3%

Uxin, with substantial insider ownership, is expanding its used car superstore network in China. Recent openings in Jinan and strategic partnerships for new locations like Tianjin and Yinchuan underscore its growth strategy. The company expects 2025 revenues to exceed RMB 3.2 billion, reflecting strong market positioning. Uxin's revenue is forecast to grow at 35.5% annually, surpassing the US market average growth rate of 10.7%. However, the stock has experienced high volatility recently.

- Get an in-depth perspective on Uxin's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Uxin's shares may be trading at a premium.

RH (RH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RH, along with its subsidiaries, operates as a retailer and lifestyle brand in the home furnishings market across the United States, Canada, the United Kingdom, Germany, Belgium, and Spain with a market cap of approximately $3.21 billion.

Operations: The company's revenue is primarily derived from its Restoration Hardware (RH) segment, generating $3.21 billion, and its Waterworks segment, contributing $200.02 million.

Insider Ownership: 16.7%

RH demonstrates strong insider ownership, aligning management interests with shareholders. The company reported increased earnings and revenue for Q3 2025, with net income rising to US$36.27 million. Despite revenue growth lagging behind the broader market, RH's earnings are forecast to grow significantly at 33.1% annually over the next three years, outpacing the US market average. Recent expansions in Detroit and Manhasset highlight its commitment to immersive retail experiences, potentially enhancing long-term growth prospects.

- Click to explore a detailed breakdown of our findings in RH's earnings growth report.

- Our comprehensive valuation report raises the possibility that RH is priced higher than what may be justified by its financials.

Key Takeaways

- Unlock our comprehensive list of 208 Fast Growing US Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報