Royalty Pharma (RPRX): Reassessing Valuation After MYQORZO’s FDA Approval Unlocks New Royalty Cash Flows

The FDA approval of MYQORZO for obstructive hypertrophic cardiomyopathy has initiated Royalty Pharma (RPRX)'s royalty stream and repayment terms, a material catalyst that strengthens its long-term cash flow profile.

See our latest analysis for Royalty Pharma.

This latest FDA milestone lands on top of a strong run, with the share price up 50.68 percent year to date and a 12 month total shareholder return of 57.78 percent. This suggests momentum is building as investors reassess Royalty Pharma’s growth and cash flow visibility.

If MYQORZO has you rethinking healthcare royalties as a theme, it could be worth exploring other potential compounders across healthcare stocks for fresh ideas beyond Royalty Pharma.

Yet with the stock already up sharply this year and trading below, but not far from, analyst targets, investors now face a tougher question: Is Royalty Pharma still a mispriced compounder, or is the market already discounting future growth?

Most Popular Narrative Narrative: 16% Undervalued

With the narrative fair value sitting above Royalty Pharma’s last close of $38.86, the story leans toward upside potential grounded in long duration cash flows.

Strategic reinvestment of large, stable cash flows into new and increasingly innovative royalty acquisitions, enhanced by improved data-driven diligence and risk management, allows Royalty Pharma to continually expand its portfolio with attractive economics, increasing operating leverage and net margins over time.

Curious how steady royalty receipts, shifting profit margins and a richer future earnings multiple can still point to upside? The full narrative unpacks the math behind that tension without holding back on detail.

Result: Fair Value of $45.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on navigating the Alyftrek royalty dispute and intensifying competition for new deals, both of which could pressure margins and growth.

Find out about the key risks to this Royalty Pharma narrative.

Another Lens on Valuation

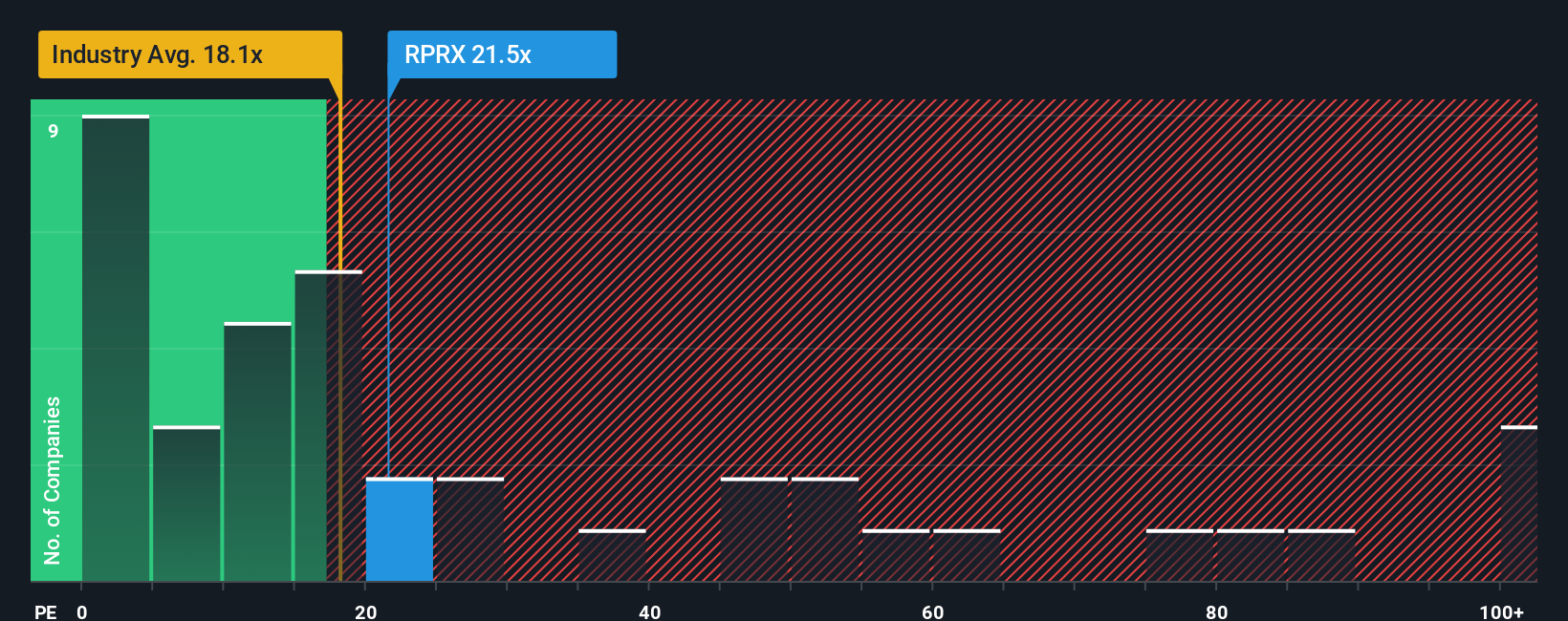

On a simple earnings yardstick, Royalty Pharma trades at 21.7 times earnings, slightly richer than the US pharma average of 19.8 times, but well below peers at 43.7 times and close to its 22.9 times fair ratio. Is that a modest premium or a margin of safety?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royalty Pharma Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your Royalty Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before the market’s next leg higher leaves you watching from the sidelines, put Simply Wall Street’s powerful screeners to work and line up tomorrow’s potential winners today.

- Secure more resilient income streams by targeting these 10 dividend stocks with yields > 3% that can steadily support your portfolio through changing markets.

- Capitalize on structural growth by focusing on these 24 AI penny stocks positioned to benefit as artificial intelligence reshapes entire industries.

- Turn market mispricing into opportunity by zeroing in on these 902 undervalued stocks based on cash flows that may offer more upside than the broader index.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報