Mobileye (MBLY): Assessing Valuation After New Oslo Autonomous Shuttle Partnership with MOIA, Ruter and Holo

Mobileye Global (MBLY) is back on traders radar after Ruter and Holo said they will team up with Volkswagens MOIA to deploy ID. Buzz AD shuttles using Mobileye Drive in Oslo from 2026.

See our latest analysis for Mobileye Global.

Despite this high profile Oslo deployment adding to wins with MOIA, Uber and German transit operators, Mobileye Global's share price return has been weak this year, signalling that investors are still cautious even as long term autonomous driving potential builds.

If this kind of autonomous mobility story interests you, it could be worth scanning other auto focused plays via our screen of auto manufacturers to see what else the market might be overlooking.

Yet with the stock still down sharply this year despite double digit revenue growth and a sizable discount to analyst targets, is Mobileye a misunderstood autonomous leader trading below its potential, or is the market already pricing in tomorrow's growth?

Most Popular Narrative Narrative: 46% Undervalued

With Mobileye Global closing at $10.23 against a narrative fair value near $18.94, the prevailing view leans toward meaningful upside if long term assumptions land.

The partnership with leading platforms like Uber and Lyft for the integration of Mobileye Drive is positioned to significantly enhance Mobileye’s revenue streams through upfront sales and recurring license fees tied to utilization rates.

Curious how a loss making auto tech name earns such a rich future profit multiple and still screens as undervalued? The narrative leans heavily on accelerating revenue, margin expansion and a sharp earnings inflection built into detailed long range forecasts. Want to see exactly which growth levers justify that valuation leap?

Result: Fair Value of $18.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on smooth execution, as tariff driven volume hits and slower OEM adoption of SuperVision or Chauffeur could quickly puncture growth assumptions.

Find out about the key risks to this Mobileye Global narrative.

Another View: Rich Sales Multiple Mutes the Bargain Story

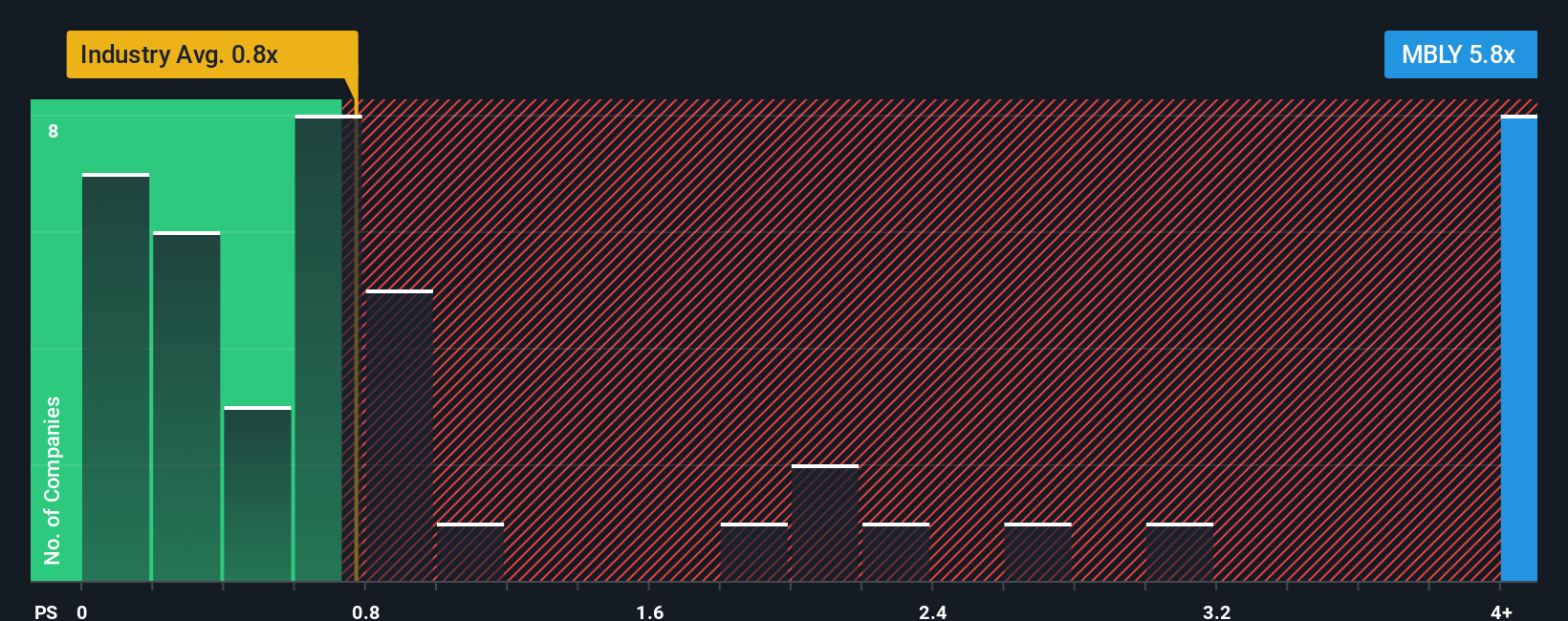

While the narrative fair value points to upside, the market is already paying 4.3 times sales for Mobileye compared to about 0.8 times for the US Auto Components industry and 1 time for peers, and above a fair ratio of 3.4 times. This raises the risk that expectations outrun execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized take in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Ready for more investing angles?

Do not stop at a single autonomous driving story. Use the Simply Wall St screener to uncover fresh stock ideas before the crowd catches on.

- Target income potential by scanning these 10 dividend stocks with yields > 3% that aim to balance yield with sustainable payout ratios and resilient cash flows.

- Capitalize on innovation trends through these 24 AI penny stocks positioned at the intersection of software, data, and real world problem solving.

- Position yourself ahead of a rerating by tracking these 902 undervalued stocks based on cash flows where current prices may still lag long term cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報