Cardinal Health (CAH): Evaluating Valuation After Revenue Beat and Growing Optimism in Healthcare Services

Cardinal Health (CAH) just delivered a quarter that topped revenue expectations and showed solid operational momentum, and the stock’s recent strength suggests investors are leaning into that story ahead of the next earnings update.

See our latest analysis for Cardinal Health.

That upbeat earnings print fits into a powerful run, with the share price at $205.2 after a strong 90 day share price return of 32.71% and a five year total shareholder return of 334.33%, signaling momentum that investors clearly trust.

If Cardinal Health’s rally has you rethinking your healthcare exposure, this could be a good moment to scan other opportunities across healthcare stocks.

With shares now near record highs and only a modest gap to Wall Street’s price target, the key question is whether Cardinal Health is still undervalued on its improving fundamentals or if the market is already pricing in years of future growth.

Most Popular Narrative Narrative: 5.3% Undervalued

With Cardinal Health closing at $205.20 against a narrative fair value near $216.60, the prevailing view still sees modest upside from here.

The strong performance and continued investment in Other growth businesses such as at Home Solutions, Nuclear and Precision Health, and OptiFreight Logistics aligns with the growing trend of outpatient and home healthcare underpinnng diversified revenue growth and supporting margin expansion.

Curious how steady revenue gains, slight margin expansion, and a richer future earnings multiple combine to justify that higher value? The full narrative unpacks the math behind this conviction.

Result: Fair Value of $216.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter drug pricing regulation, as well as any slowdown in pharma volume growth, could quickly pressure margins and challenge the current upside narrative.

Find out about the key risks to this Cardinal Health narrative.

Another Lens on Valuation

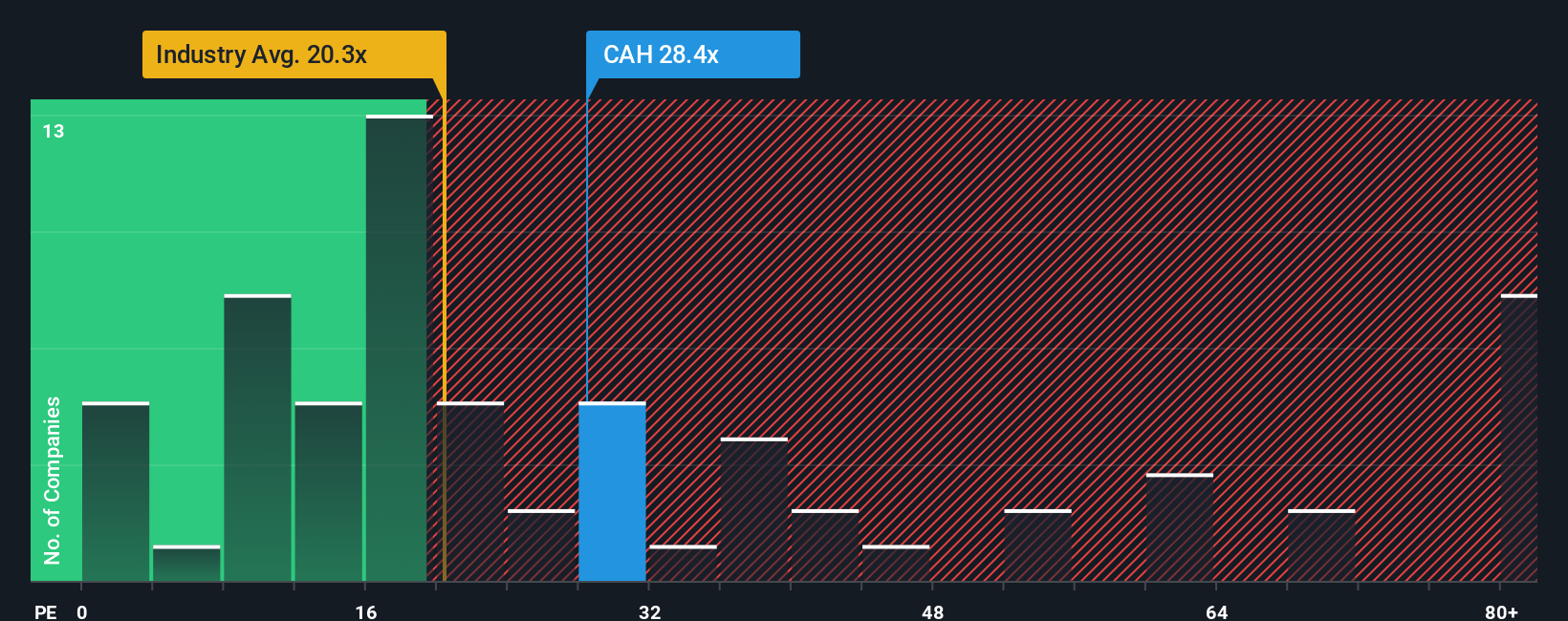

While the narrative fair value suggests Cardinal Health is modestly undervalued, the earnings multiple paints a tighter picture. Shares trade at about 30.6 times earnings versus a fair ratio near 29.2 times and an industry average of 23.7 times. This implies limited room for error if growth cools.

That premium may be justified by strong execution and high quality earnings, but it also raises the bar for future results, especially if sector sentiment turns. Is the extra multiple investors are paying today truly compensating them for the additional risk they are taking on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cardinal Health Narrative

If you would rather challenge these assumptions or dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart move?

Cardinal Health may look compelling, but you will miss fresh opportunities if you ignore other ideas our powerful screener surfaces across sectors and strategies.

- Capture potential growth early by reviewing these 3631 penny stocks with strong financials that already show strong financial foundations and room to scale.

- Position your portfolio for tomorrow’s technology shifts by evaluating these 24 AI penny stocks shaping breakthroughs in intelligent software and automation.

- Lock in steadier income streams by assessing these 10 dividend stocks with yields > 3% that combine strong cash generation with attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報