Undervalued Small Caps With Insider Buying To Consider In December 2025

As the U.S. stock market continues its upward momentum, with major indexes like the S&P 500 and Dow Jones Industrial Average nearing record highs, investors are keenly observing small-cap stocks for potential opportunities. In this environment of rising tech shares and record-breaking precious metal prices, identifying undervalued small-cap companies with insider buying can be a strategic move to capitalize on market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First United | 10.4x | 3.1x | 42.74% | ★★★★★☆ |

| Merchants Bancorp | 8.0x | 2.7x | 47.94% | ★★★★★☆ |

| Shore Bancshares | 10.7x | 2.9x | 39.41% | ★★★★☆☆ |

| Union Bankshares | 9.6x | 2.1x | 21.82% | ★★★★☆☆ |

| S&T Bancorp | 11.8x | 4.0x | 35.24% | ★★★★☆☆ |

| Angel Oak Mortgage REIT | 12.5x | 6.3x | 43.29% | ★★★★☆☆ |

| Farmland Partners | 6.5x | 8.0x | -91.86% | ★★★★☆☆ |

| Stock Yards Bancorp | 14.7x | 5.3x | 34.54% | ★★★☆☆☆ |

| Metropolitan Bank Holding | 12.9x | 3.1x | 28.83% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -15.43% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

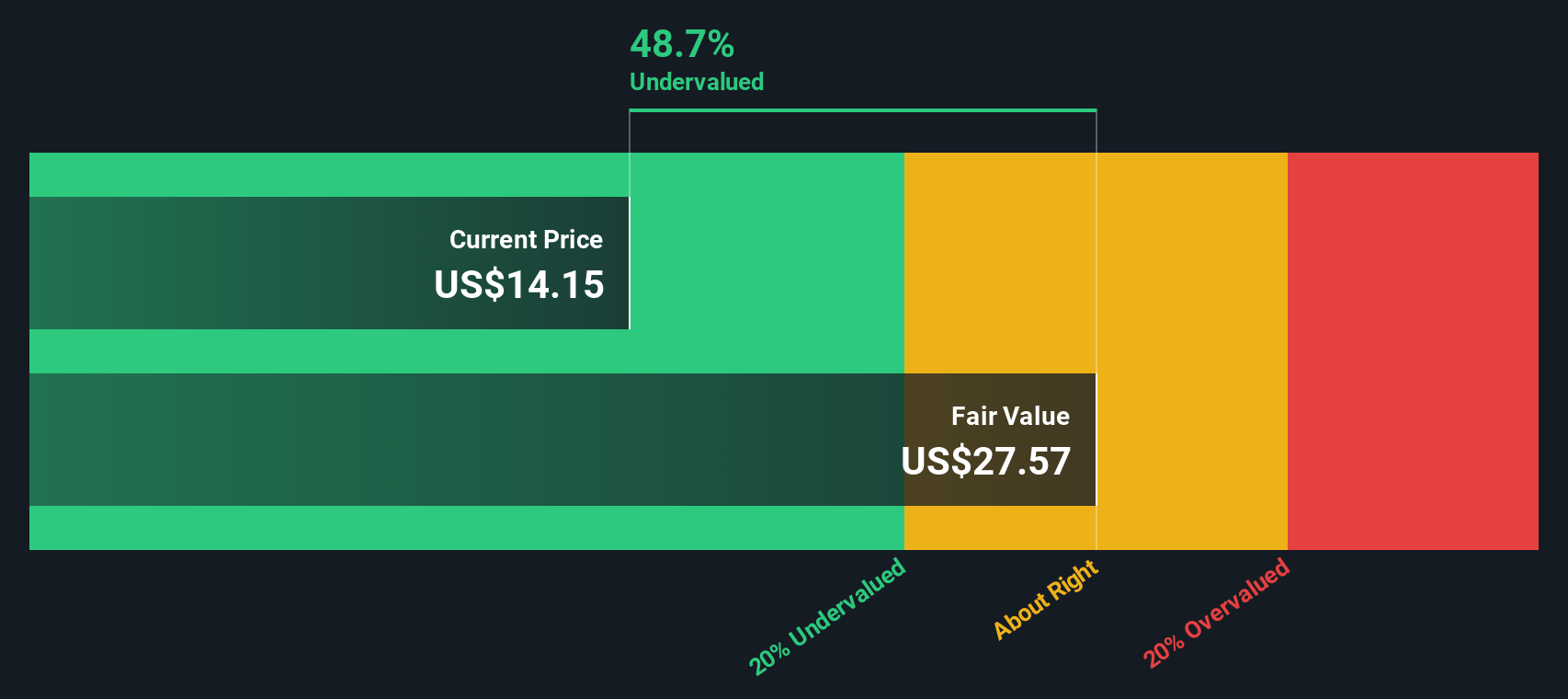

Eagle Bancorp (EGBN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagle Bancorp operates as a bank holding company providing commercial banking services, with a market capitalization of approximately $0.82 billion.

Operations: The company generates its revenue primarily from banking services, with recent figures showing a significant decline to $3.97 million. Operating expenses have consistently exceeded revenue in the latest periods, contributing to negative net income margins, such as -30.28% in the most recent quarter.

PE: -5.4x

Eagle Bancorp, a small U.S. company, has faced challenges with a net loss of US$67.51 million in Q3 2025, compared to a profit last year. Despite this, insider confidence is evident as executives purchased shares between October and December 2025. The company expects net interest income growth in 2026 due to improved mix and lower costs, despite a smaller balance sheet. Recent executive changes may drive strategic shifts for future growth potential.

- Navigate through the intricacies of Eagle Bancorp with our comprehensive valuation report here.

Assess Eagle Bancorp's past performance with our detailed historical performance reports.

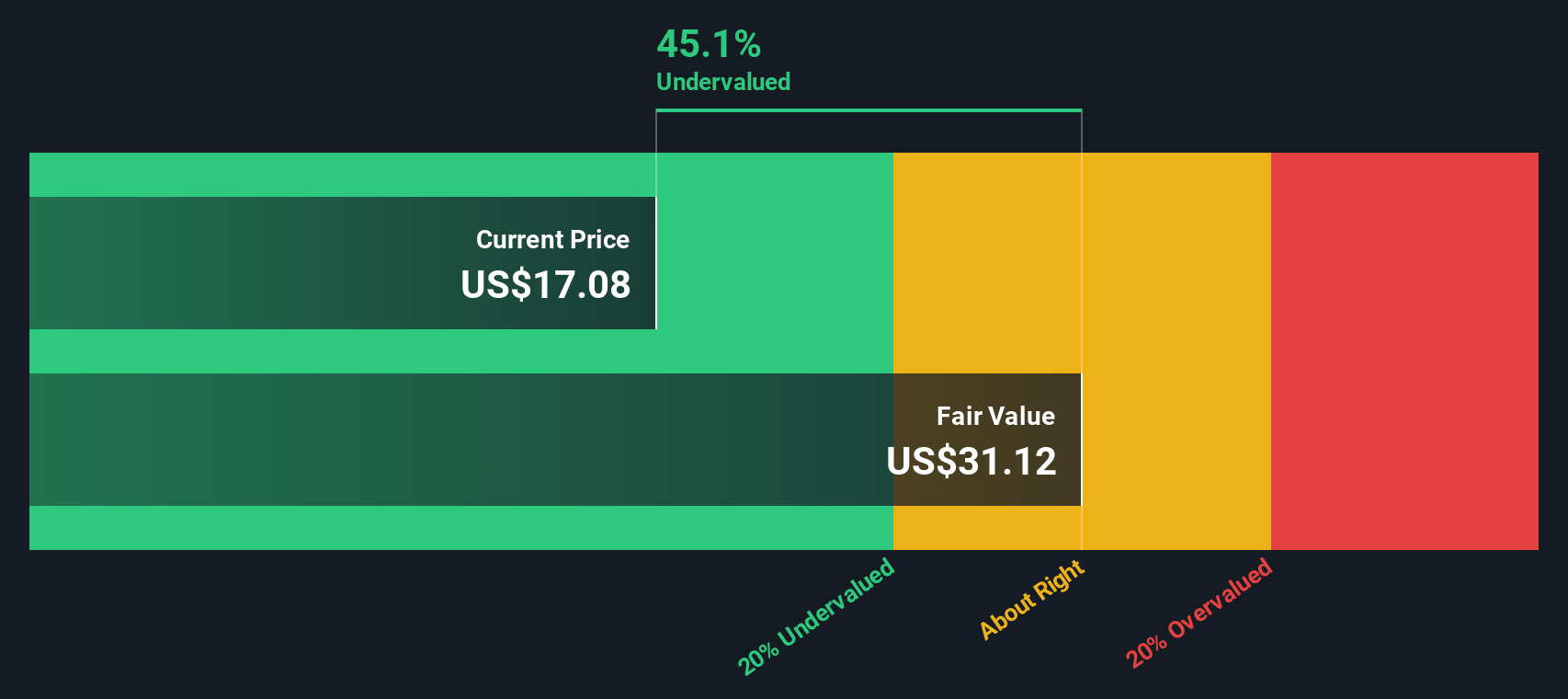

Trinity Capital (TRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Trinity Capital is a business development company specializing in providing debt and equity capital to growth-stage companies, with a market capitalization of approximately $0.69 billion.

Operations: Trinity Capital's revenue is derived from its venture capital segment, reaching $268.27 million by the end of 2025. The company consistently reports a gross profit margin of 100%, indicating that it incurs no cost of goods sold relative to its revenue. Operating expenses have shown an upward trend, with general and administrative expenses reaching $66.34 million in the latest period.

PE: 8.1x

Trinity Capital's recent shift to monthly dividends from January 2026, with consistent payouts totaling US$0.51 per quarter, highlights its commitment to shareholder returns. Despite earnings growth of 11.43% annually, the company faces challenges with high-risk funding due to reliance on external borrowing. The secured US$200 million credit facility from KeyBank bolsters liquidity but adds interest obligations not fully covered by earnings. Insider confidence is evident through share purchases in the past year, signaling potential value recognition within this small-cap stock's strategic positioning in life sciences and equipment financing sectors.

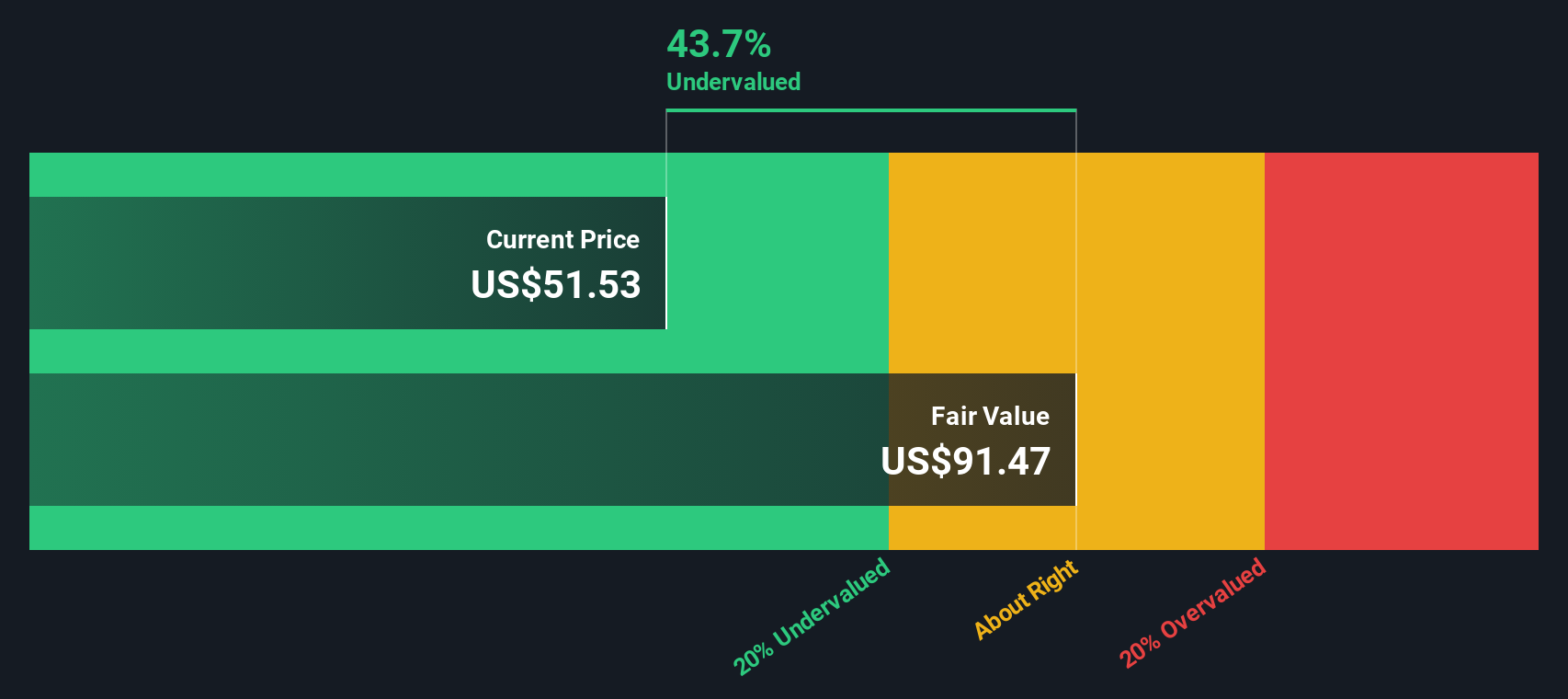

Central Securities (CET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Central Securities is a financial services company specializing in closed-end funds with operations contributing to its market capitalization of approximately $1.01 billion.

Operations: The company generates revenue primarily from financial services, specifically through closed-end funds, with recent figures showing $27.06 million in this segment. Operating expenses are consistently significant, with the latest data indicating $8.11 million, impacting net income outcomes. The gross profit margin has been consistently at 100%, reflecting that all revenue translates directly into gross profit due to the absence of reported COGS data. Net income margins have shown variability over time, recently recorded at 7.91%.

PE: 6.9x

Central Securities, a smaller player in its sector, shows potential despite some challenges. The company declared a $2.45 per share dividend payable in December 2025, with an option for shareholders to receive stock instead of cash. This move reflects financial strength and could appeal to long-term investors. However, reliance on external borrowing for funding introduces higher risk compared to customer deposits. Insider confidence is evident from recent share purchases, indicating belief in future prospects despite current margin pressures.

- Delve into the full analysis valuation report here for a deeper understanding of Central Securities.

Understand Central Securities' track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 76 Undervalued US Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報