Does Halozyme Still Offer Value After a 44.5% Surge and Strong DCF Upside?

- If you are wondering whether Halozyme Therapeutics at around $68 is still a smart buy, or if most of the upside is already priced in, you are not alone. This article is going to tackle that value question head on.

- The stock is up 7.4% over the last week and 42.0% year to date, even after a slightly softer 30 day patch with a 3.1% pullback, adding up to a 44.5% gain over the past year.

- Recent gains have largely been driven by growing investor confidence in Halozyme Therapeutics drug delivery platform and its expanding roster of partner deals, which strengthen its long term royalty and milestone streams. In addition, the market has been rewarding profitable, asset light biotech models, putting a spotlight on companies like Halozyme Therapeutics that can scale revenue without matching increases in cost.

- Based on our checks, Halozyme Therapeutics scores a 5/6 valuation score, meaning it looks undervalued on five of six metrics we track. Next we will unpack what that actually means across different valuation methods, before finishing with a more narrative driven way to judge whether the stock is truly good value.

Approach 1: Halozyme Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting all the cash it is expected to generate in the future and then discounting those cash flows back to today, using a required rate of return. For Halozyme Therapeutics, the model starts with last twelve month Free Cash Flow of about $596.8 million and uses analyst estimates for the next few years, then extrapolates further out.

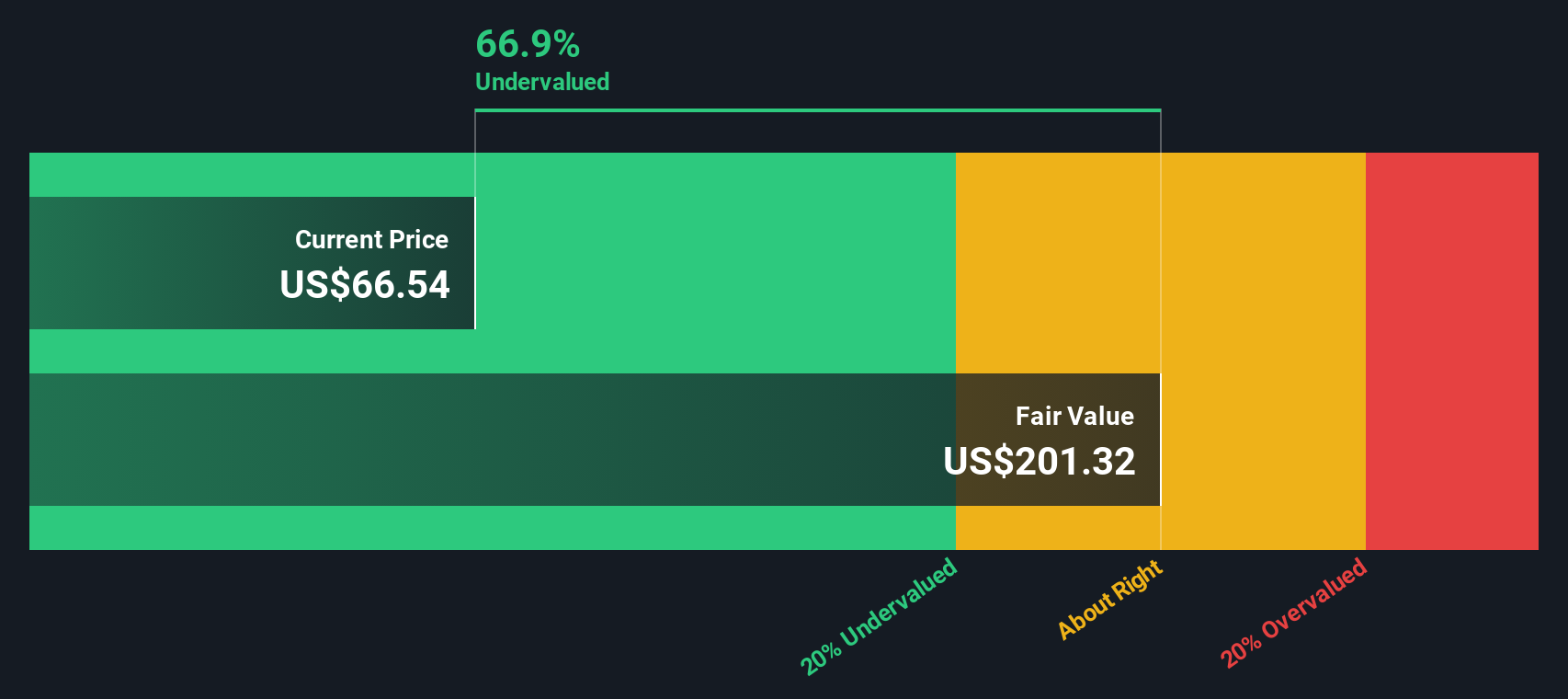

Under this 2 Stage Free Cash Flow to Equity model, Halozyme Therapeutics cash flows are projected to continue growing, with forecast Free Cash Flow in 2035 rising to roughly $1.34 billion. Simply Wall St converts these projected cash flows into today value, which yields an estimated intrinsic value of around $201.30 per share. Compared with the current share price near $68, this DCF suggests the stock is trading at a 66.1% discount to its calculated fair value. This indicates potential upside if the projections prove broadly accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Halozyme Therapeutics is undervalued by 66.1%. Track this in your watchlist or portfolio, or discover 900 more undervalued stocks based on cash flows.

Approach 2: Halozyme Therapeutics Price vs Earnings

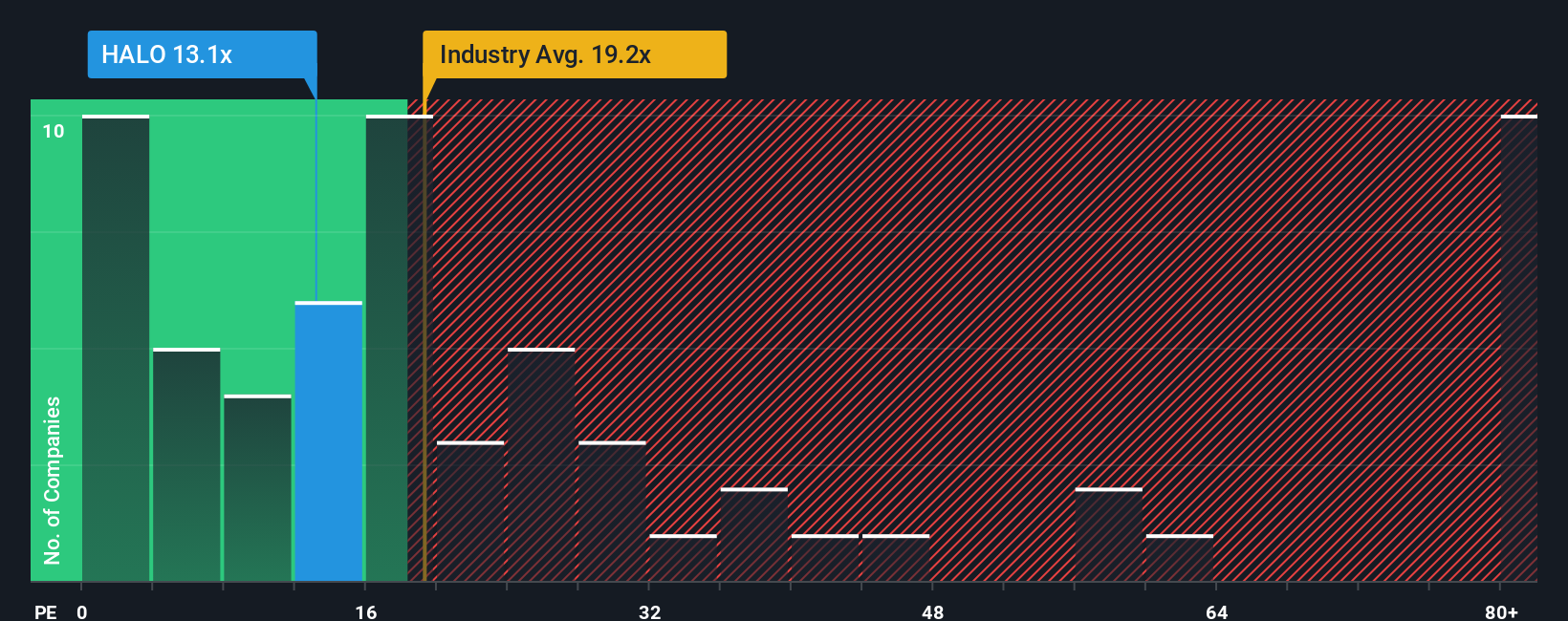

For profitable companies like Halozyme Therapeutics, the price to earnings (PE) ratio is a useful shorthand for how much investors are willing to pay today for each dollar of current earnings. A higher PE can be justified when a business has strong, durable growth prospects and relatively low risk. Slower growing or more volatile companies typically deserve a lower, more conservative multiple.

Halozyme Therapeutics currently trades on a PE of about 13.5x, which is below both the broader Biotechs industry average of around 20.4x and the peer group average of roughly 16.7x. On those simple comparisons alone, the stock looks inexpensive relative to many listed biotech names.

Simply Wall St also calculates a Fair Ratio of 21.7x, a proprietary estimate of what Halozyme Therapeutics PE should be given its earnings growth outlook, profitability, size, industry and specific risk profile. This is more informative than a straight peer or sector comparison because it adjusts for company specific strengths and weaknesses rather than assuming all biotechs deserve the same multiple. With the current PE sitting well below the 21.7x Fair Ratio, the shares appear undervalued on this earnings based lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Halozyme Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about Halozyme Therapeutics future to the numbers. You can link what you believe about its ENHANZE adoption, revenue growth, margins and risks to a financial forecast, then to a Fair Value you can easily compare with today price, all within the Narratives tool on Simply Wall St Community pages that millions of investors use. Each Narrative automatically updates as new earnings or news arrive so you can quickly see whether the latest information still supports buying, holding or selling. For example, a bullish Halozyme investor might build a Narrative that assumes continued high teens revenue growth, stable 50 plus percent margins and a Fair Value closer to the high end of analyst targets near $91. A more cautious investor might focus on patent and reimbursement risks, assume slower growth, a lower future PE and a Fair Value closer to $51, with both perspectives visible side by side so you can decide which story you find more convincing.

Do you think there's more to the story for Halozyme Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報