Vicor Corporation's (NASDAQ:VICR) 32% Share Price Surge Not Quite Adding Up

Despite an already strong run, Vicor Corporation (NASDAQ:VICR) shares have been powering on, with a gain of 32% in the last thirty days. The annual gain comes to 125% following the latest surge, making investors sit up and take notice.

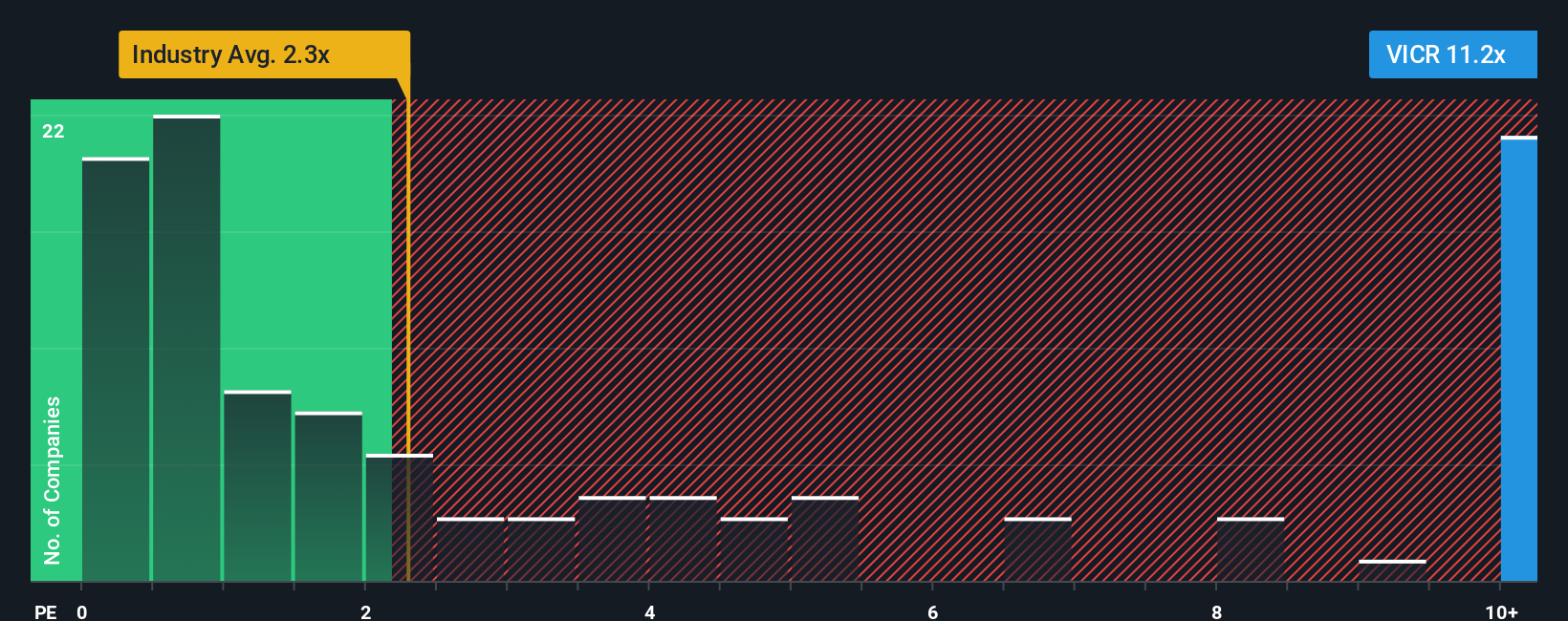

Since its price has surged higher, given around half the companies in the United States' Electrical industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Vicor as a stock to avoid entirely with its 11.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Vicor

How Has Vicor Performed Recently?

Recent times have been advantageous for Vicor as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Vicor's future stacks up against the industry? In that case, our free report is a great place to start.How Is Vicor's Revenue Growth Trending?

In order to justify its P/S ratio, Vicor would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen a 15% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 5.3% during the coming year according to the four analysts following the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Vicor is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Vicor's P/S Mean For Investors?

The strong share price surge has lead to Vicor's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Vicor currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Vicor that we have uncovered.

If these risks are making you reconsider your opinion on Vicor, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報