Top Global Dividend Stocks For December 2025

As we approach the end of 2025, global markets are navigating a complex landscape marked by mixed economic signals and shifting monetary policies. While U.S. stock indexes show varied performance, with tech stocks facing valuation concerns, European markets benefit from steady growth and looser monetary policy, illustrating a diverse set of opportunities for investors worldwide. In such an environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance risk with reliable returns amidst economic fluctuations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.88% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.58% | ★★★★★★ |

| NCD (TSE:4783) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.14% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.30% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our Top Global Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

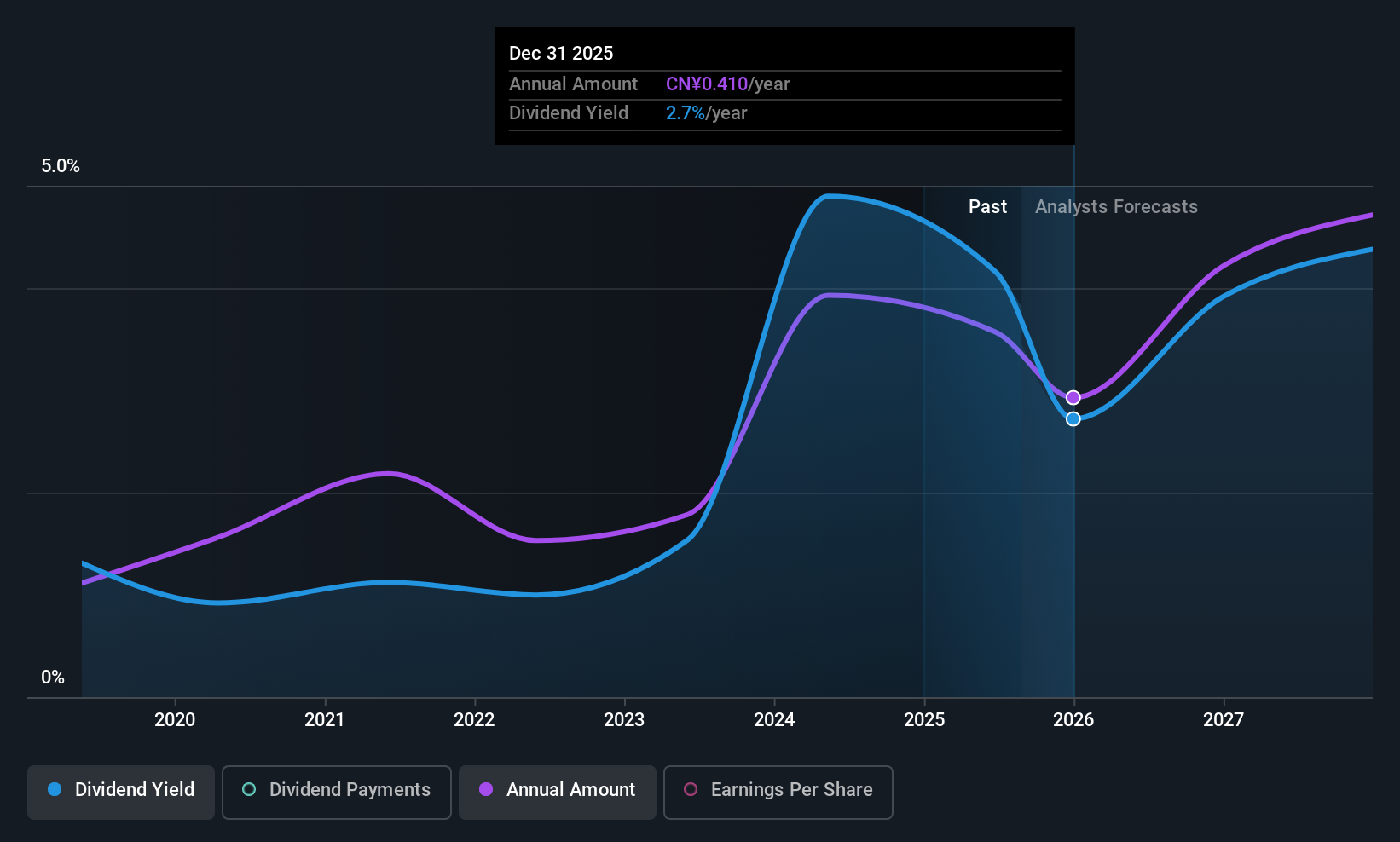

Qingdao Hiron Commercial Cold Chain (SHSE:603187)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Hiron Commercial Cold Chain Co., Ltd. operates in the commercial refrigeration industry, focusing on the production and sale of cold chain equipment, with a market cap of CN¥5.94 billion.

Operations: Qingdao Hiron Commercial Cold Chain Co., Ltd. generates its revenue primarily from the Food Service Equipment segment, which accounts for CN¥3.15 billion.

Dividend Yield: 3.1%

Qingdao Hiron Commercial Cold Chain has demonstrated growth in earnings, reporting a net income of CNY 300.56 million for the first nine months of 2025, up from CNY 271.94 million the previous year. Its dividend yield is attractive at 3.14%, placing it in the top quartile of CN market payers, though its seven-year dividend history has been marked by volatility and instability. The payout ratio is reasonable at 50%, but cash flow coverage remains high at 81.9%.

- Click to explore a detailed breakdown of our findings in Qingdao Hiron Commercial Cold Chain's dividend report.

- The analysis detailed in our Qingdao Hiron Commercial Cold Chain valuation report hints at an deflated share price compared to its estimated value.

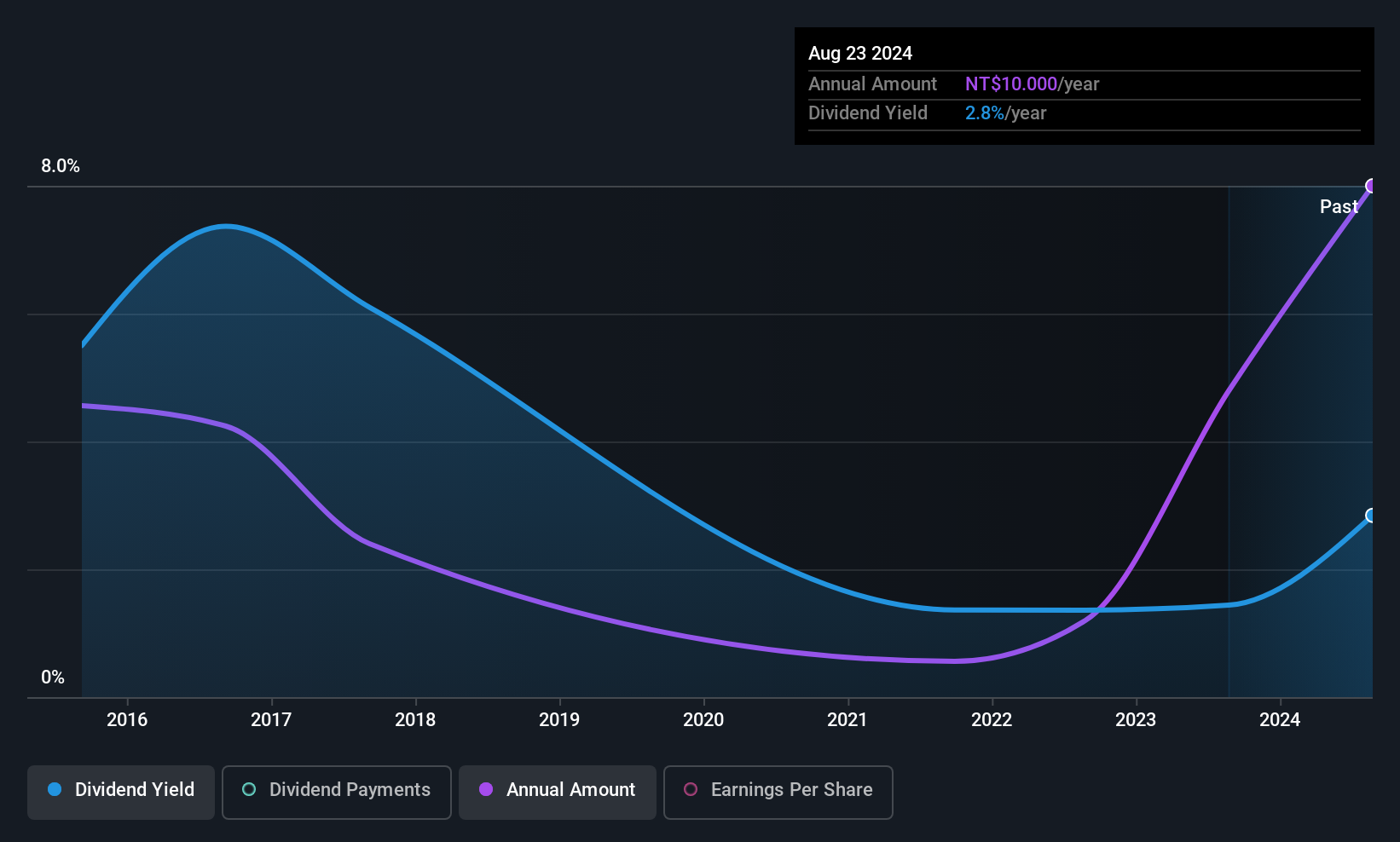

AIC (TPEX:3693)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AIC Inc. offers OEM/ODM, commercial off-the-shelf, and server and storage solutions both in Taiwan and internationally, with a market cap of NT$11.82 billion.

Operations: AIC Inc. generates revenue from its Computers and Related Spare Parts Department, amounting to NT$8.16 billion.

Dividend Yield: 3.8%

AIC's dividend payments are covered by earnings with a payout ratio of 61.9% and cash flows at 80.6%, but its dividend yield of 3.83% is below the top tier in Taiwan's market. Despite recent earnings declines, AIC showcases innovative AI and HPC solutions, potentially supporting future growth. However, investors should note the volatile and unreliable dividend history over the past decade, alongside a highly volatile share price recently.

- Dive into the specifics of AIC here with our thorough dividend report.

- The analysis detailed in our AIC valuation report hints at an inflated share price compared to its estimated value.

Marubun (TSE:7537)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marubun Corporation is engaged in the distribution of electronics products both in Japan and internationally, with a market cap of ¥32.55 billion.

Operations: Marubun Corporation's revenue segments include the Electronic Device Business at ¥154.03 billion, the Electronic System Business at ¥59.69 billion, and the Entrepreneur Business at ¥2.20 billion.

Dividend Yield: 3.9%

Marubun's dividend is well-covered by earnings and cash flows, with a payout ratio of 55.5% and a low cash payout ratio of 6.8%. The recent affirmation of a JPY 25.00 per share dividend aligns with its top-tier yield in the JP market. Despite this, Marubun's dividends have been volatile over the past decade, and it carries significant debt levels. Recent upward revisions in earnings guidance suggest potential future stability but warrant cautious optimism for dividend investors.

- Get an in-depth perspective on Marubun's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Marubun is trading behind its estimated value.

Taking Advantage

- Click this link to deep-dive into the 1292 companies within our Top Global Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報