Zhongsheng Group Holdings (SEHK:881): Assessing Valuation After Audit Committee Leadership Transition

Zhongsheng Group Holdings (SEHK:881) just overhauled a key part of its governance, with long serving audit committee chair Ying Wei stepping down and tax specialist Bai Fengjiu taking over leadership of audit oversight.

See our latest analysis for Zhongsheng Group Holdings.

The governance refresh comes after a tough stretch, with a 90 day share price return of negative 19.33 percent and a three year total shareholder return of negative 67.17 percent. Investors will be watching to see if confidence and momentum can rebuild from here.

If this boardroom shift has you reassessing your portfolio, it could be a good moment to look beyond autos and explore fast growing stocks with high insider ownership.

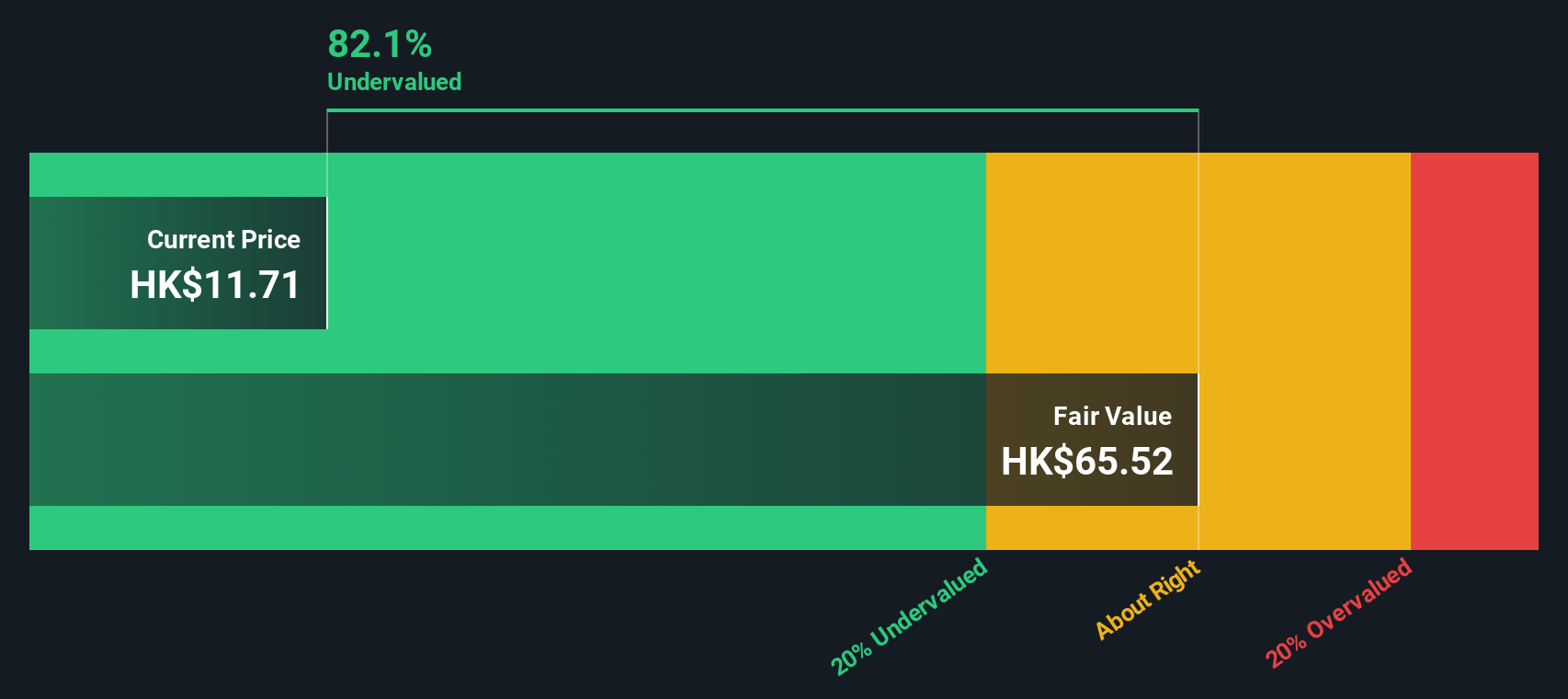

With the shares trading well below analyst targets and our fair value estimate, and profitability showing signs of recovery despite softer revenues, is Zhongsheng quietly undervalued or is the market already pricing in any future growth?

Price-to-Earnings of 9.4x: Is it justified?

Zhongsheng Group Holdings last closed at HK$11.64, and on a price-to-earnings ratio of 9.4x it screens as undervalued versus peers, despite recent share price weakness.

The price-to-earnings, or P E, ratio compares the company’s current share price to its earnings per share. It is a straightforward gauge of how much investors are willing to pay for each dollar of profit. For an established auto retailer with high quality earnings and forecast profit growth, this lens is particularly relevant because profits, rather than rapid revenue expansion, are expected to drive returns.

In Zhongsheng’s case, the current 9.4x P E sits well below both the peer average of 13.5x and the Hong Kong Specialty Retail industry average of 11.7x. This suggests the market is pricing its earnings at a discount. Our work also indicates that, based on the company’s fundamentals, a fair P E multiple could instead be closer to 17.8x. The market could move toward this level if confidence in the earnings outlook improves.

Explore the SWS fair ratio for Zhongsheng Group Holdings

Result: Price-to-Earnings of 9.4x (UNDERVALUED)

However, ongoing revenue stagnation and weak long term share returns suggest sentiment could stay fragile if earnings momentum stalls or industry volumes soften further.

Find out about the key risks to this Zhongsheng Group Holdings narrative.

Another View, What Does Our DCF Say?

On our DCF model, Zhongsheng looks far cheaper than even its low P E implies, with the shares trading about 82 percent below an estimated fair value of roughly HK$64.82. That is a big gap, but is it a once in a cycle opportunity or a value trap in disguise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zhongsheng Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zhongsheng Group Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Zhongsheng Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by scanning fresh ideas from high quality screeners that can uncover opportunities your usual watchlist may be missing.

- Capture early stage growth potential with these 3629 penny stocks with strong financials that already show stronger fundamentals than most micro caps.

- Position yourself for structural tailwinds by targeting innovators in automation and data with these 24 AI penny stocks.

- Identify value driven opportunities by filtering companies that appear mispriced on cash flow metrics using these 898 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報