Asian Growth Stocks With 20% Earnings Growth And High Insider Ownership

As the Bank of Japan raises interest rates to levels not seen in three decades, and China's economic indicators reveal mixed signals, Asia's markets are navigating a complex landscape. In this environment, growth companies with strong insider ownership can be particularly appealing as they often signal confidence from those closest to the business and may offer resilience amid broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.8% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

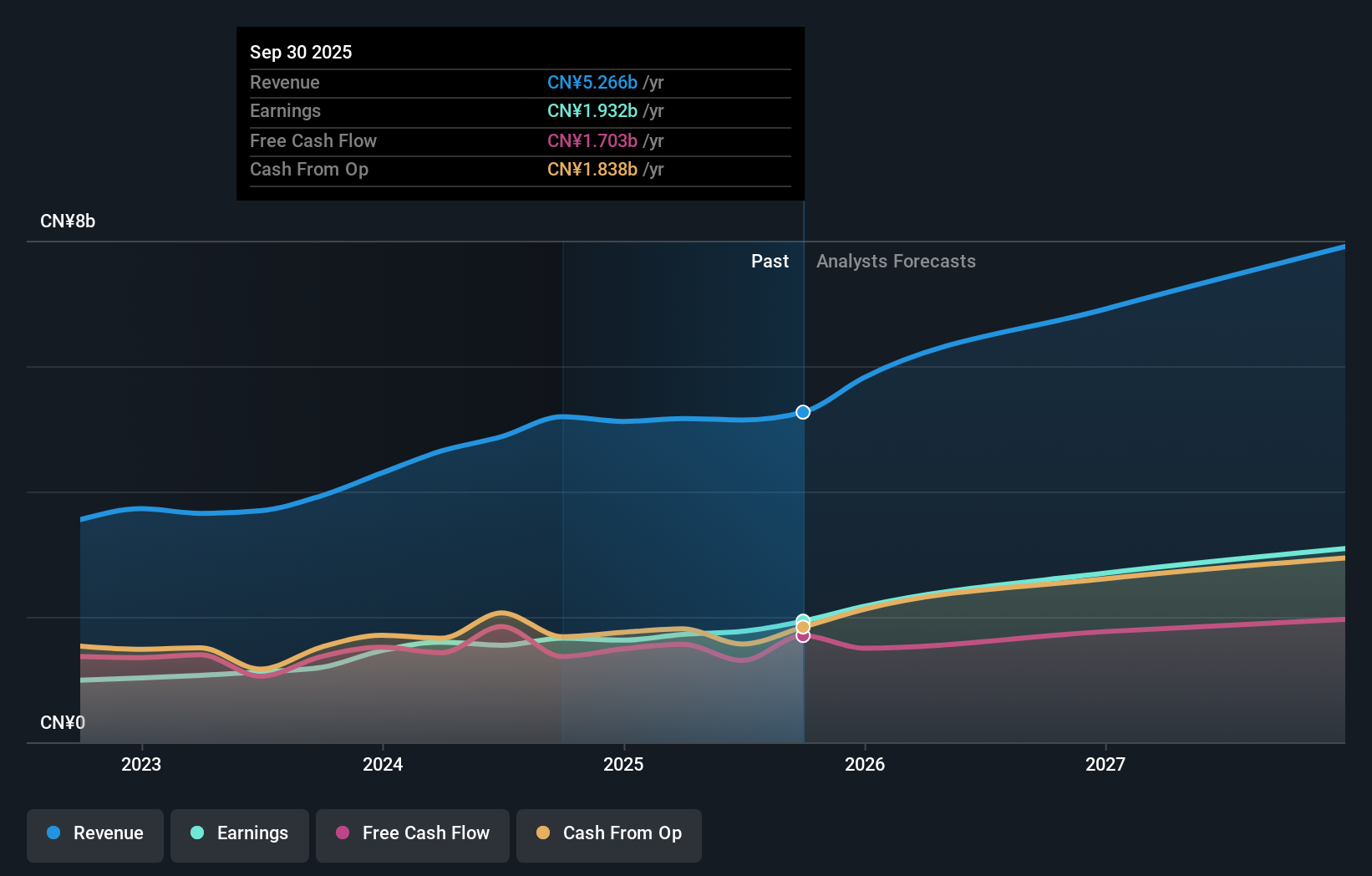

Kingnet Network (SZSE:002517)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingnet Network Co., Ltd. is involved in the development, operation, and distribution of mobile games, with a market cap of CN¥47.71 billion.

Operations: The company generates revenue from its Internet Software and Services segment, amounting to CN¥5.27 billion.

Insider Ownership: 15.4%

Earnings Growth Forecast: 20.5% p.a.

Kingnet Network has demonstrated strong financial performance with earnings growing at 40.4% annually over the past five years. The stock trades below analyst price targets, suggesting potential upside, and its Price-To-Earnings ratio of 24.7x is favorable compared to the CN market average of 43.5x. Despite an unstable dividend track record, insider ownership aligns management interests with shareholders. Recent earnings showed revenue growth to CNY 4 billion and net income improvement to CNY 1.58 billion for the first nine months of 2025.

- Navigate through the intricacies of Kingnet Network with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Kingnet Network implies its share price may be lower than expected.

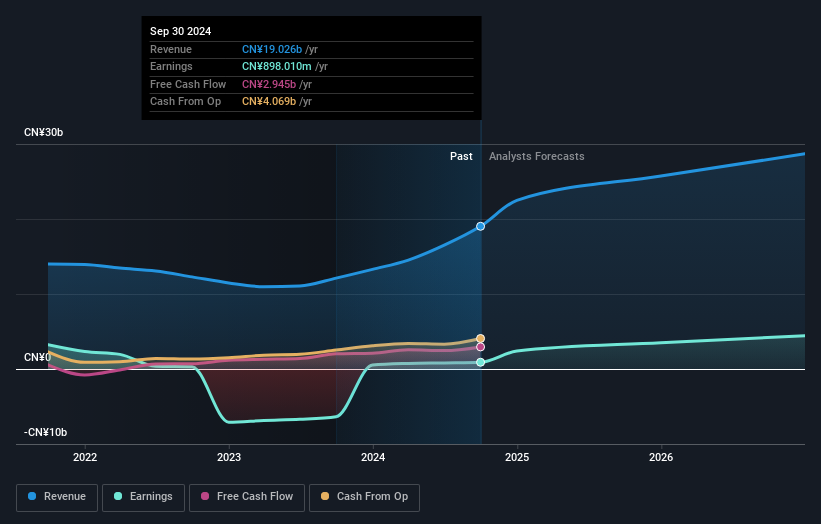

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and artificial intelligence cloud data sectors both in China and globally, with a market cap of CN¥127.96 billion.

Operations: The company's revenue is derived from its operations in the auto parts, Internet games, and artificial intelligence cloud data sectors.

Insider Ownership: 10.4%

Earnings Growth Forecast: 36.4% p.a.

Zhejiang Century Huatong Group has shown impressive financial growth, with earnings up significantly over the past year and forecasted to grow at 36.4% annually, outpacing the CN market. Despite high share price volatility, it trades below estimated fair value. Recent earnings report highlights revenue of CNY 27.22 billion and net income of CNY 4.36 billion for the first nine months of 2025. The company has initiated a substantial share buyback program worth up to CNY 1 billion, aiming to reduce registered capital through cancellation of shares pending shareholder approval.

- Click here to discover the nuances of Zhejiang Century Huatong GroupLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Zhejiang Century Huatong GroupLtd's current price could be quite moderate.

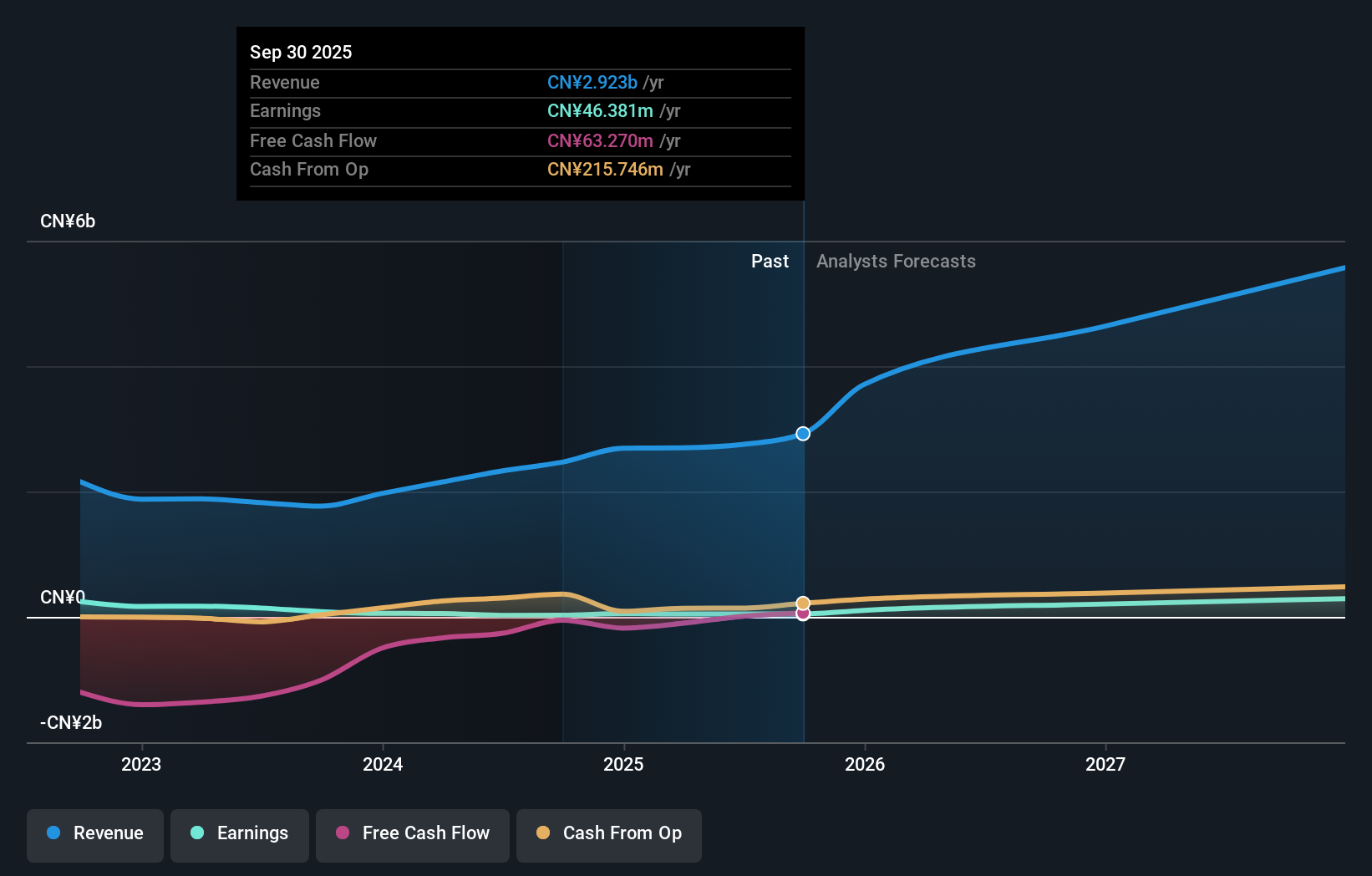

Jiangsu Sidike New Materials Science & Technology (SZSE:300806)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Sidike New Materials Science & Technology Co., Ltd. (SZSE:300806) specializes in the production and sale of advanced polymer materials, with a market cap of CN¥13.33 billion.

Operations: Jiangsu Sidike New Materials Science & Technology Co., Ltd. (SZSE:300806) focuses on the production and sale of advanced polymer materials, with a market cap of CN¥13.33 billion.

Insider Ownership: 38.5%

Earnings Growth Forecast: 69.4% p.a.

Jiangsu Sidike New Materials Science & Technology is poised for significant growth, with earnings expected to rise 69.4% annually over the next three years, surpassing the CN market's growth rate. Despite recent financials showing a decline in net income to CNY 45.27 million for the first nine months of 2025, revenue increased to CNY 2.24 billion from CNY 2 billion year-on-year. The company faces challenges with interest payments not well covered by earnings and a volatile share price recently.

- Take a closer look at Jiangsu Sidike New Materials Science & Technology's potential here in our earnings growth report.

- The analysis detailed in our Jiangsu Sidike New Materials Science & Technology valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 634 companies by clicking here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報