Undiscovered Gems In Middle East Stocks For December 2025

As the Gulf markets continue to rise, buoyed by increasing oil prices and optimism around potential U.S. Federal Reserve rate cuts, investors are keeping a keen eye on the opportunities within this dynamic region. In such an environment, identifying stocks with solid fundamentals and growth potential can be key to navigating the evolving economic landscape, making it essential for investors to stay informed about emerging prospects in Middle Eastern markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Almawarid Manpower (SASE:1833)

Simply Wall St Value Rating: ★★★★★★

Overview: Almawarid Manpower Company offers recruitment and temporary employment services for domestic workers and expatriate labor in Saudi Arabia, with a market cap of SAR1.98 billion.

Operations: The company's revenue is primarily driven by the Corporate Segment, which accounts for SAR1.98 billion, followed by the Individual Segment at SAR291.13 million and the Hourly Segment at SAR179.66 million.

Almawarid Manpower seems to be an intriguing player in the Middle East market, with its recent earnings report showing a significant rise in net income to SAR 36.98 million for Q3 2025 from SAR 17.1 million the previous year, alongside sales climbing to SAR 678.78 million from SAR 548.2 million. The company's debt-free status over the past five years adds a layer of financial stability, while earnings growth of 45.5% outpaces the industry average of 13.6%. Trading at approximately 34% below estimated fair value suggests potential for appreciation as it continues expanding its business activities and board leadership evolves.

- Click to explore a detailed breakdown of our findings in Almawarid Manpower's health report.

Assess Almawarid Manpower's past performance with our detailed historical performance reports.

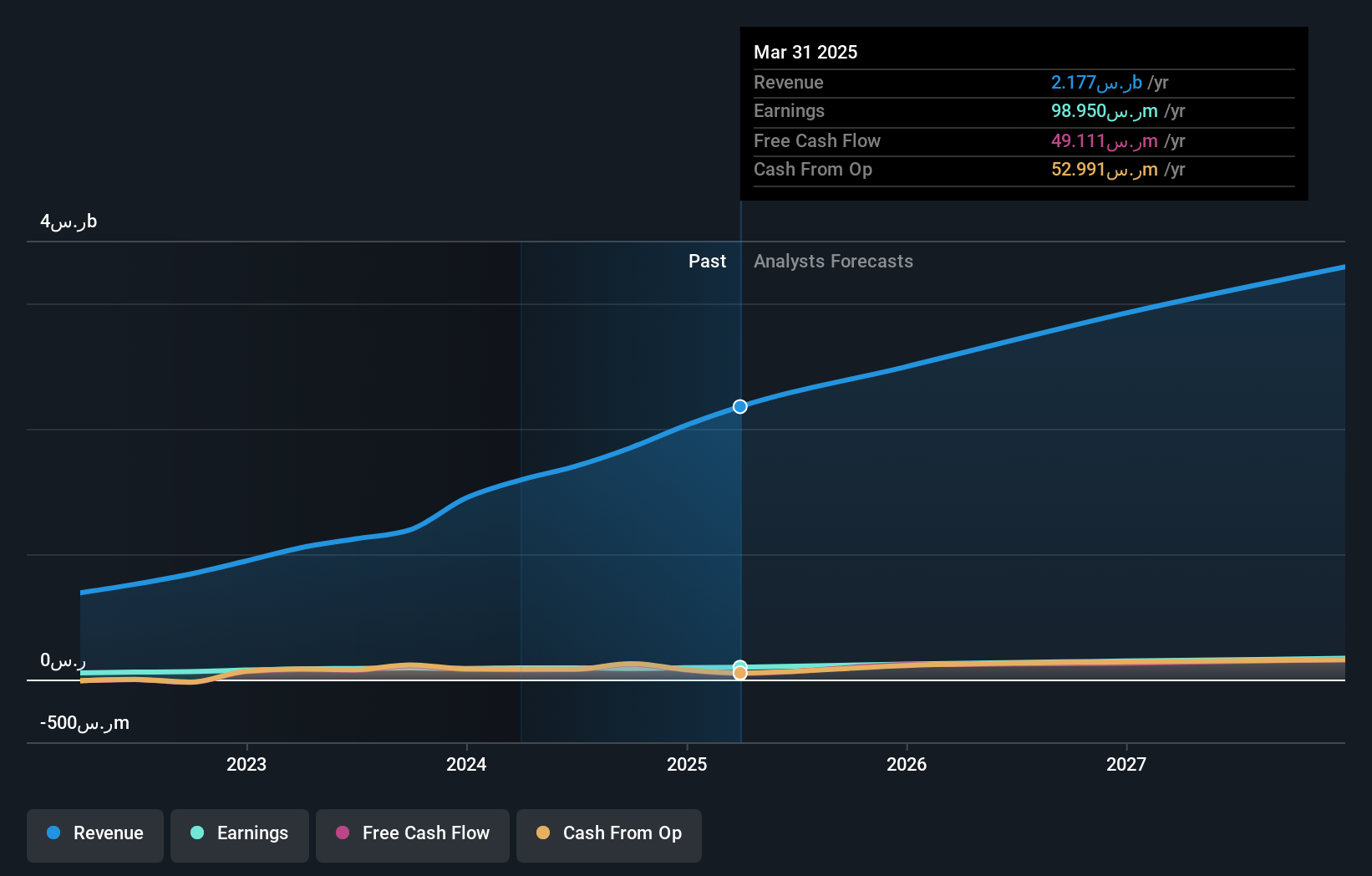

Alamar Foods (SASE:6014)

Simply Wall St Value Rating: ★★★★★☆

Overview: Alamar Foods Company, with a market cap of SAR1.05 billion, operates and manages quick service restaurants across the Middle East, North Africa, and Pakistan through its subsidiaries.

Operations: The company's primary revenue streams are from its operations in the Kingdom of Saudi Arabia, generating SAR608.96 million, and Other GCC and Levant regions, contributing SAR226.19 million. North Africa adds SAR101.22 million to the revenue while internal revenue adjustments account for a deduction of SAR22.62 million.

Alamar Foods, a relatively small player in the Middle East's food industry, reported third-quarter sales of SAR 236.67 million, up from SAR 229.02 million the previous year. However, net income dropped to SAR 15.66 million from SAR 20.28 million during the same period last year, reflecting challenges despite revenue growth. Over nine months, sales reached SAR 684.51 million compared to last year's SAR 662.32 million with net income rising significantly to SAR 30.08 million from SAR 16.75 million previously noted for its high-quality earnings and robust EBIT coverage of interest payments at a ratio of 14:7x times indicating financial stability amidst executive changes and dividend increases further solidifying investor confidence in its long-term prospects.

- Click here to discover the nuances of Alamar Foods with our detailed analytical health report.

Understand Alamar Foods' track record by examining our Past report.

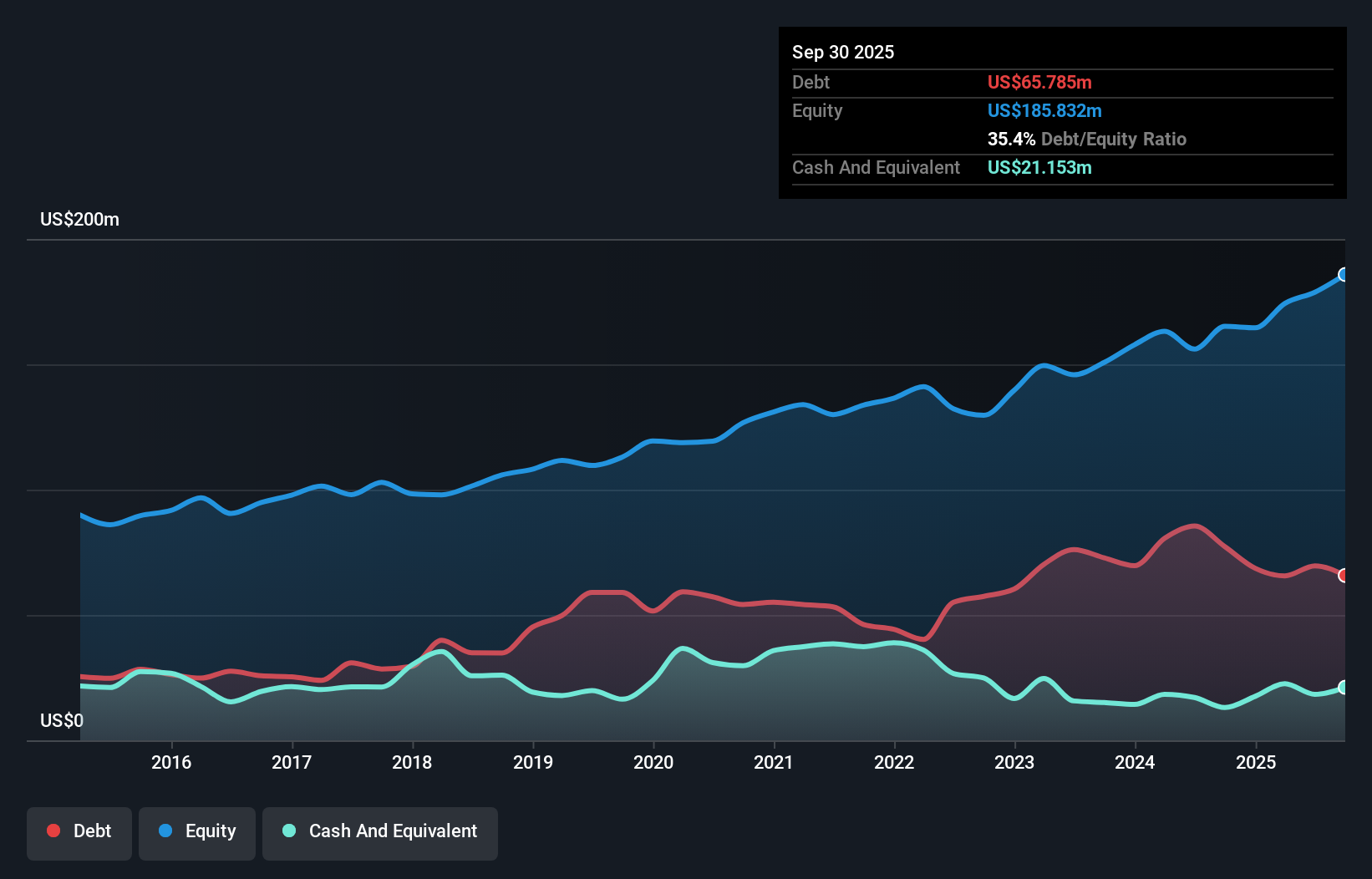

Arad (TASE:ARD)

Simply Wall St Value Rating: ★★★★★★

Overview: Arad Ltd. designs, produces, and markets water measurement and management products globally with a market cap of ₪1.26 billion.

Operations: Arad Ltd. generates revenue primarily from its Electronic Test & Measurement Instruments segment, which reported $418.48 million in sales.

Arad, a smaller player in the electronics industry, showcases promising financial health with its interest payments well covered by EBIT at 15.6 times and a satisfactory net debt to equity ratio of 24%. Over the past year, earnings growth of 23.2% outpaced the industry average of 15.2%, highlighting its competitive edge. Recent results further bolster confidence; third-quarter sales rose to US$104 million from US$98 million last year, while net income increased to US$7 million from US$6 million. Trading significantly below fair value estimates suggests potential upside for this high-quality earner with positive free cash flow.

- Click here and access our complete health analysis report to understand the dynamics of Arad.

Explore historical data to track Arad's performance over time in our Past section.

Next Steps

- Access the full spectrum of 183 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報