Grindr (GRND): Taking Stock of Valuation After Recent Share Price Pullback

Grindr (GRND) has quietly drifted this month, but its longer track record, including a strong 3 year return, makes the current pullback worth a closer look for patient, risk tolerant investors.

See our latest analysis for Grindr.

The stock has bounced 6.2 percent on a 7 day share price return, but that sits against a weaker year to date share price trend and a still impressive 3 year total shareholder return. This suggests momentum has cooled while the longer term growth story remains intact.

If Grindr’s mix of growth and volatility has your attention, it could be a good moment to look for similar upside potential by exploring fast growing stocks with high insider ownership.

With the share price lagging this year despite robust multi year returns and analyst targets far above today’s level, is Grindr quietly trading at a discount, or is the market already factoring in all of its future growth?

Most Popular Narrative Narrative: 36.1% Undervalued

With Grindr last closing at $13.89 against a most popular narrative fair value of $21.75, the story assumes meaningful upside from here.

Ongoing shift toward value added premium tiers, coupled with planned pricing experiments and the introduction of more differentiated features (for example, mapping, intentions based products, A List), positions Grindr to lift ARPU and improve net margins over time. Investments in proprietary AI infrastructure (gAI) and enhanced in app experiences (such as mapping and local discovery) provide durable differentiation and are likely to increase user engagement and retention, thereby supporting stable, recurring revenues and long term earnings growth.

Want to see the math behind that upside, from surging top line forecasts to a future profit engine that looks very different from today? Read on.

Result: Fair Value of $21.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating operating expenses and brand safety concerns could limit Grindr’s ability to fully monetize growth initiatives and pressure the long term margin story.

Find out about the key risks to this Grindr narrative.

Another View: Rich Multiples, Different Story

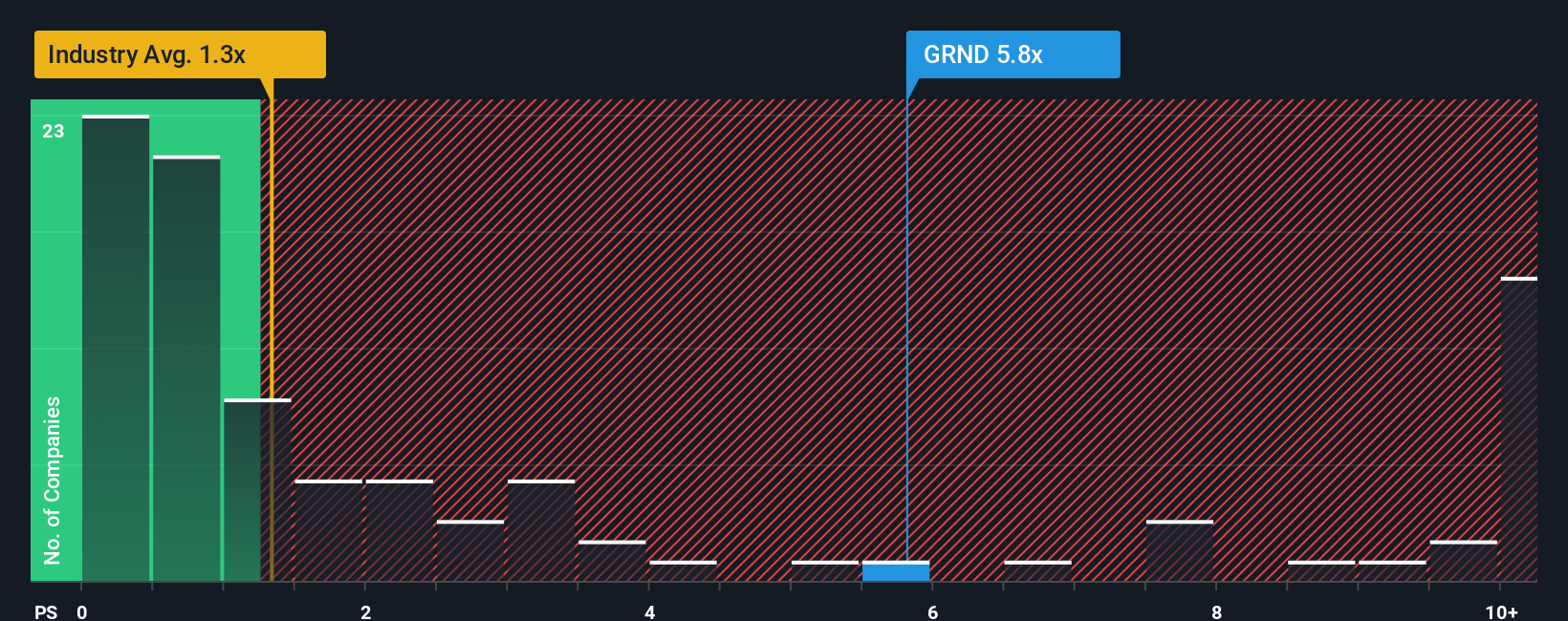

Our fair value work suggests Grindr is undervalued, but the price to sales ratio tells a tougher story. At 6.2 times sales versus a 2.8 times fair ratio and 1 times for the wider industry, the stock appears expensive and raises meaningful valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grindr Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh narrative in just minutes using Do it your way.

A great starting point for your Grindr research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused stock ideas you might otherwise overlook.

- Target reliable income streams by scanning these 10 dividend stocks with yields > 3% and spot companies paying yields that can strengthen your portfolio’s cash flow.

- Capture explosive innovation potential with these 24 AI penny stocks, where emerging artificial intelligence leaders could reshape entire industries.

- Position yourself ahead of the crowd by reviewing these 899 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報