Knowledge Marine & Engineering Works Limited's (NSE:KMEW) 30% Jump Shows Its Popularity With Investors

Knowledge Marine & Engineering Works Limited (NSE:KMEW) shares have continued their recent momentum with a 30% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 65% in the last year.

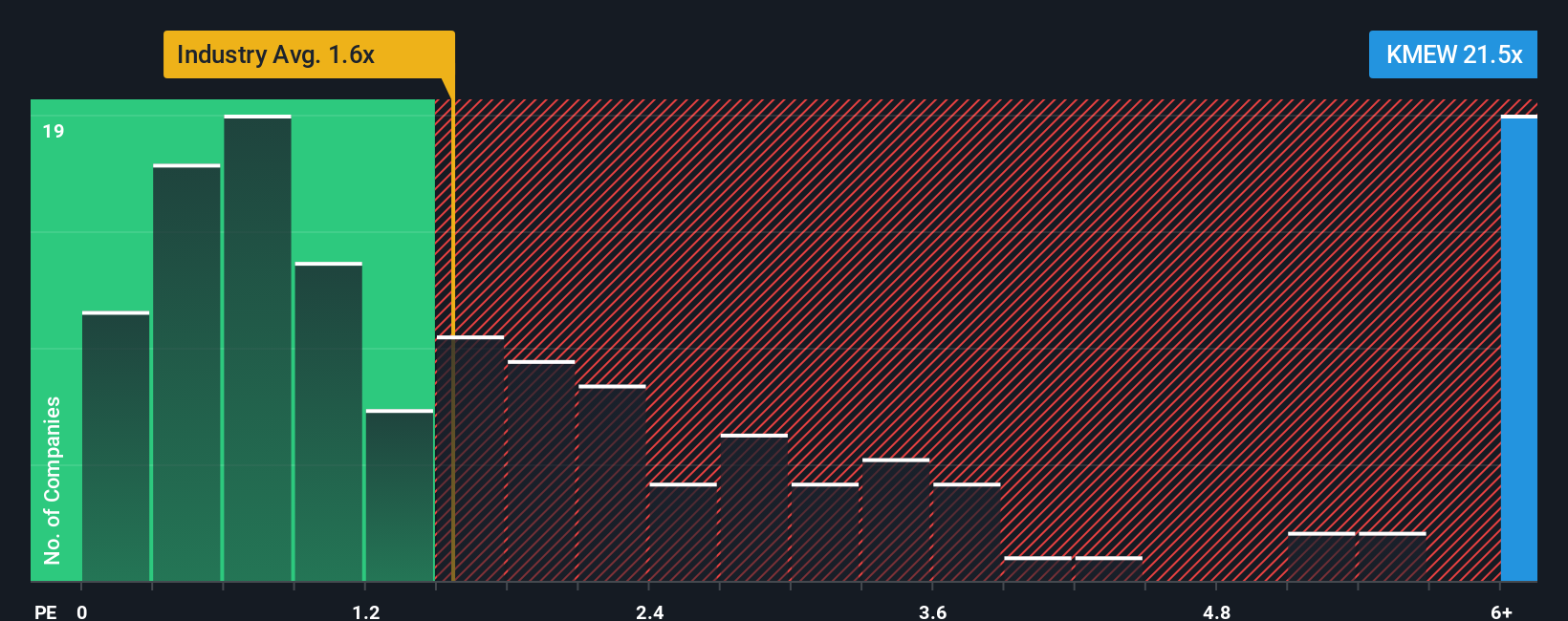

Following the firm bounce in price, given around half the companies in India's Shipping industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider Knowledge Marine & Engineering Works as a stock to avoid entirely with its 21.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Knowledge Marine & Engineering Works

How Has Knowledge Marine & Engineering Works Performed Recently?

With revenue growth that's exceedingly strong of late, Knowledge Marine & Engineering Works has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Knowledge Marine & Engineering Works will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Knowledge Marine & Engineering Works' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 34% last year. As a result, it also grew revenue by 24% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 3.6% shows it's a great look while it lasts.

With this in mind, it's clear to us why Knowledge Marine & Engineering Works' P/S exceeds that of its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What Does Knowledge Marine & Engineering Works' P/S Mean For Investors?

Knowledge Marine & Engineering Works' P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We see that Knowledge Marine & Engineering Works justifiably maintains its high P/S on the merits of its recentthree-year revenue growth beating forecasts amidst struggling industry. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Knowledge Marine & Engineering Works that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報