Valvoline (VVV): Assessing Valuation After Analyst Optimism and the Breeze Autocare Acquisition

Valvoline (VVV) has landed back on investors' radar after upbeat analyst coverage following its fourth quarter results and the acquisition of 162 Breeze Autocare locations, highlighting a disciplined, acquisition-led growth strategy.

See our latest analysis for Valvoline.

Despite the upbeat narrative around tuck in acquisitions and growth, Valvoline's recent momentum has been soft, with a 90 day share price return of minus 20.3 percent and a 1 year total shareholder return of minus 18.5 percent. However, the 5 year total shareholder return of about 30.8 percent shows the longer term story is still intact.

If this kind of acquisition driven growth story interests you, it is worth exploring auto manufacturers to see which other names the market currently favors in the broader vehicle related space.

With shares down double digits over the past year but trading at about a 31 percent discount to analyst targets, is Valvoline quietly undervalued today, or are investors already factoring in its next leg of acquisition fueled growth?

Most Popular Narrative: 23.1% Undervalued

With Valvoline’s fair value in the high 30s versus a sub 30 dollar share price, the prevailing narrative sees meaningful upside from here.

Continued execution on operational efficiencies, including labor management improvements and digitalization of scheduling, demand planning, and customer engagement, is expected to drive EBITDA margin expansion and lower costs over time, supporting improved net margins and profitability.

Want to see how steady double digit growth, fatter margins, and a richer future earnings multiple all fit together? The narrative’s math might surprise you.

Result: Fair Value of $38.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster electric vehicle adoption and rising labor costs could squeeze demand for traditional oil changes and pressure the margin recovery that this narrative leans on.

Find out about the key risks to this Valvoline narrative.

Another Angle on Value

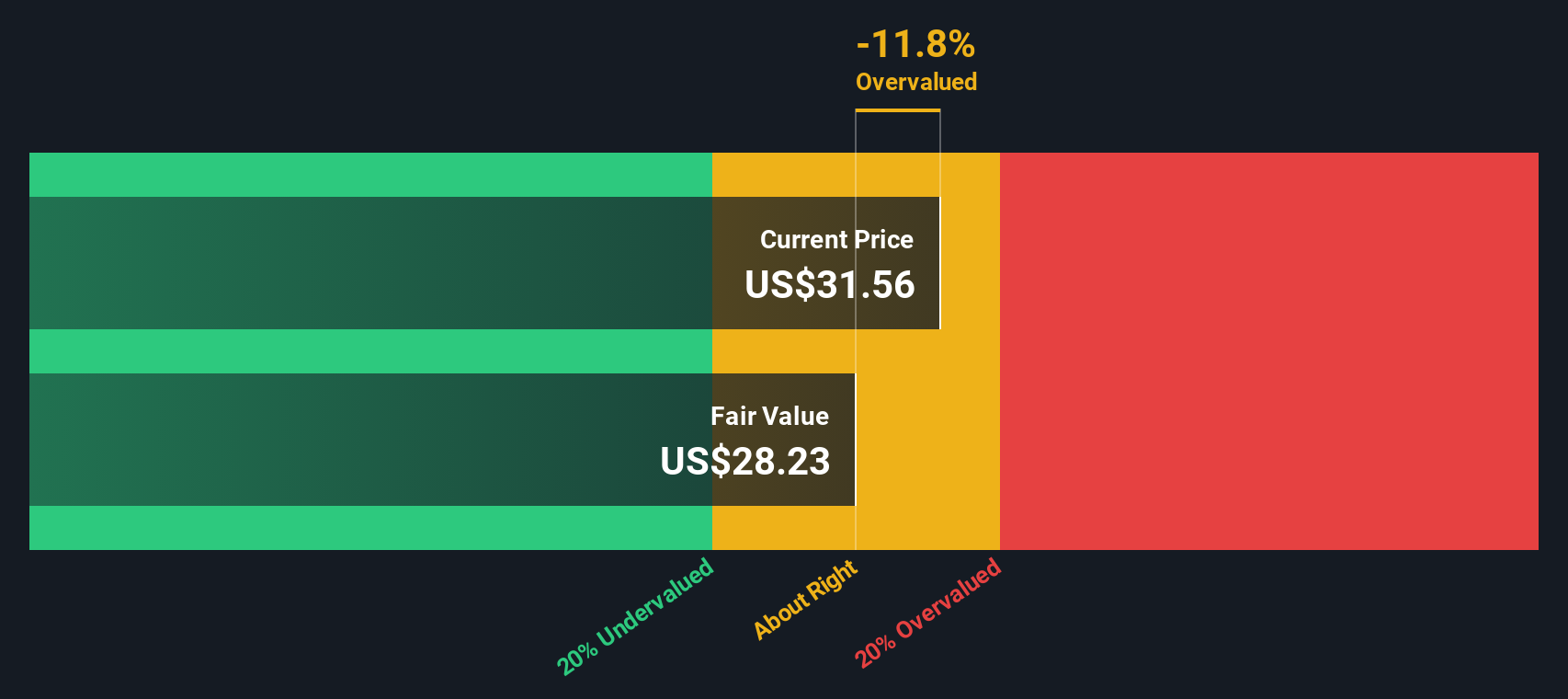

Our DCF model sketches a cooler picture than the upbeat narrative, suggesting Valvoline is trading above an estimated fair value of 26.88 dollars. Cash flows, debt load, and integration risk pull the valuation back and raise the question: is the market already paying up for execution perfection?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Valvoline for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Valvoline Narrative

If you are skeptical of these views or simply prefer to dig into the numbers yourself, you can craft a custom story in just minutes, Do it your way.

A great starting point for your Valvoline research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart move by using the Simply Wall Street Screener to uncover opportunities most investors are still overlooking.

- Capture mispriced potential by targeting companies trading below intrinsic value with these 898 undervalued stocks based on cash flows, turning market pessimism into your edge.

- Ride the next wave of innovation by zeroing in on breakthrough automation, data, and productivity trends through these 24 AI penny stocks before they become mainstream.

- Strengthen your portfolio’s income engine by identifying reliable yield opportunities using these 11 dividend stocks with yields > 3% while others focus only on headline growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報