Air Products and Chemicals (APD): Assessing Valuation After Recent Share Price Weakness

Air Products and Chemicals (APD) has been grinding through a weaker stretch, with the stock down about 5% over the past month and roughly 11% in the past 3 months.

See our latest analysis for Air Products and Chemicals.

That recent slide comes on top of a weak year to date, with the share price down sharply in 2024 and longer term total shareholder returns barely positive over five years. This suggests momentum has clearly faded as investors reassess growth versus risk.

If APD’s pullback has you rethinking where to put fresh capital, it could be a good moment to scout fast growing stocks with high insider ownership that might offer stronger momentum and conviction.

With APD trading below analyst targets yet still facing profit pressure, the key question now is whether the recent weakness has created a mispriced value opportunity or if the market is already discounting all of its future growth.

Most Popular Narrative: 16.4% Undervalued

With Air Products and Chemicals last closing at $244.78 against a narrative fair value near $293, the valuation case hinges on large energy transition projects finally delivering.

Heavy investments in large-scale hydrogen, blue/green ammonia, and carbon capture projects, supported by multi-decade power and supply agreements in growth regions (e.g., Middle East, Asia, U.S. Gulf Coast), are set to come online over the next several years, providing robust and stable earnings and supporting a trajectory of consistently higher operating margins.

Want to see what powers that premium? The narrative leans on accelerating revenue, sharply higher margins, and a future earnings multiple more typical of market leaders. Curious how those moving pieces add up to that fair value call?

Result: Fair Value of $292.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on megaprojects and heavier than expected capital needs could strain cash flows, delay earnings inflection and erode confidence in that upside narrative.

Find out about the key risks to this Air Products and Chemicals narrative.

Another Lens on Valuation

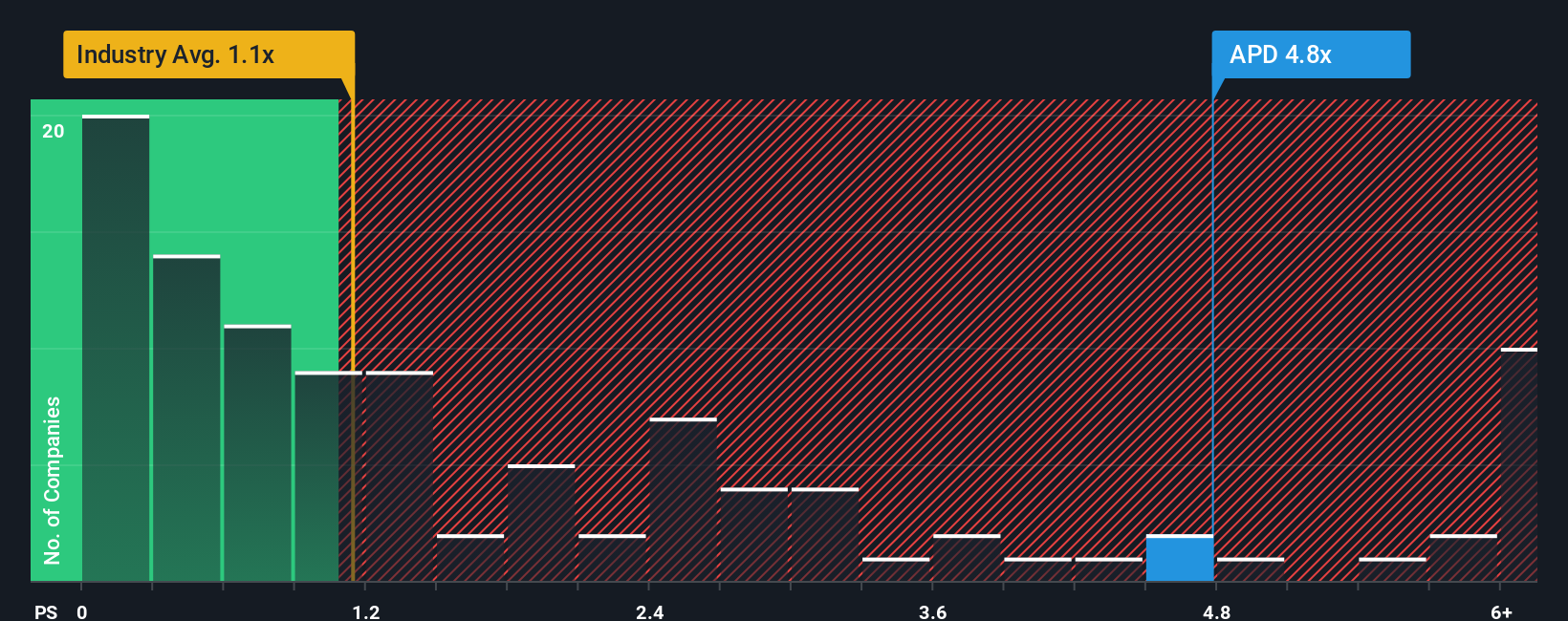

On price to sales, APD looks much richer than its backdrop, trading at 4.5 times versus a 4.2 times peer average and just 1.1 times for the wider US Chemicals group, while our fair ratio suggests closer to 2.4 times. Is the market overpaying for the hydrogen story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Air Products and Chemicals Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If APD is only one piece of your strategy, do not stop here. Use our powerful screeners to uncover fresh, data-backed opportunities before others act.

- Capture potential multi-baggers early by scanning these 3631 penny stocks with strong financials with solid fundamentals rather than pure speculation.

- Position yourself at the forefront of innovation by targeting these 24 AI penny stocks that could benefit most as AI adoption accelerates.

- Lock in value-focused opportunities by filtering for these 898 undervalued stocks based on cash flows where strong cash flows are not yet fully priced in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報