The9 (NasdaqCM:NCTY) Earnings Reversal: Deepening Losses Reinforce Bearish Profitability Narrative

The9 (NCTY) has turned in a starkly weaker set of H1 2025 numbers, with revenue falling to about CNY 19.6 million and basic EPS sliding to around CNY minus 14.4, alongside a net loss excluding extra items of roughly CNY 73.7 million. The company has seen revenue drop from about CNY 82.0 million in H2 2023 to roughly CNY 19.6 million in H2 2024, while EPS has swung from approximately CNY 34.6 to CNY minus 14.4 over the same stretch. This underscores how quickly margins have compressed as the business moved from profitable to meaningfully loss making.

See our full analysis for The9.With the headline numbers on the table, the next step is to see how this sharp earnings reversal lines up with the most widely held narratives about The9 and where those stories might need updating.

Curious how numbers become stories that shape markets? Explore Community Narratives

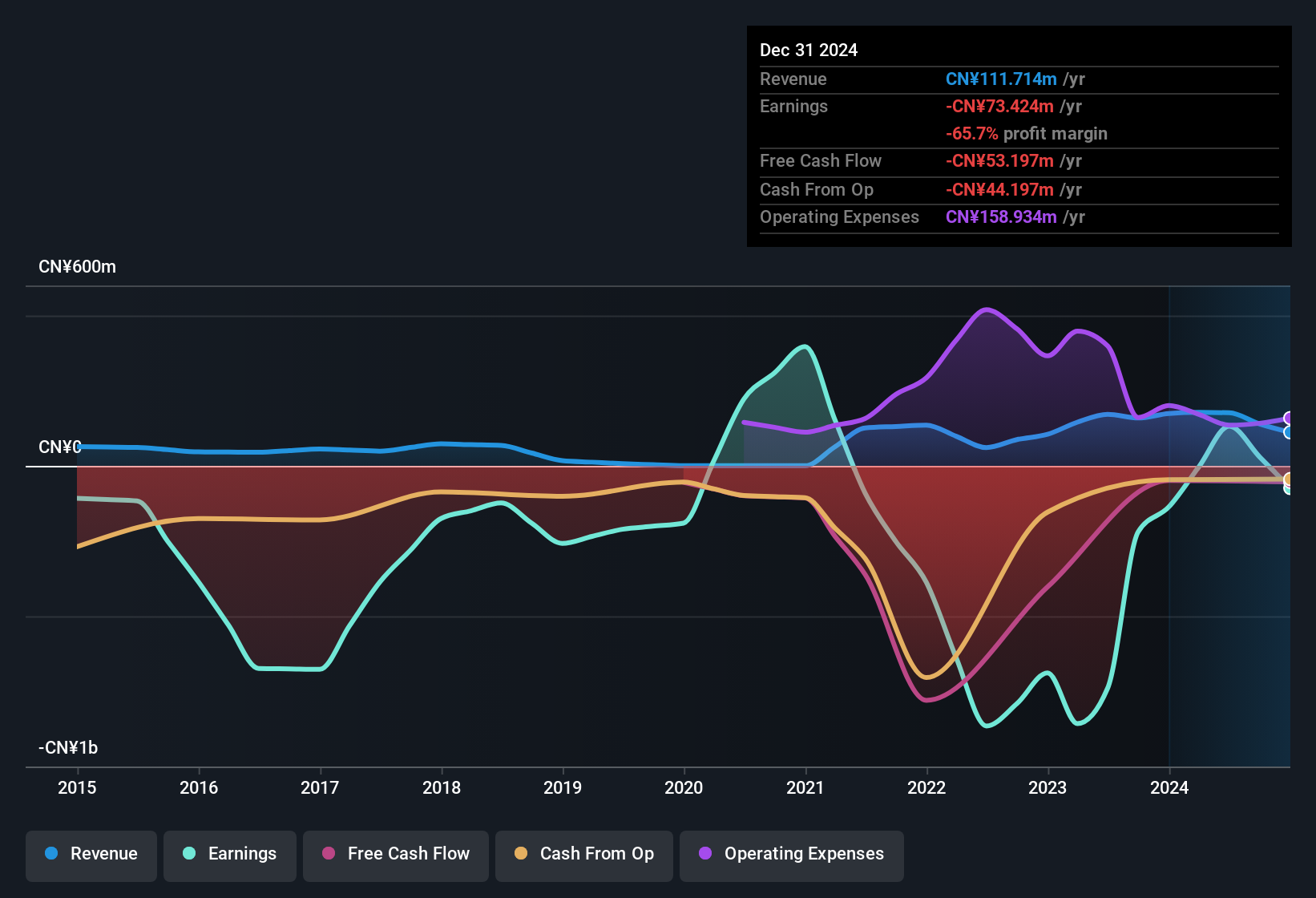

LTM losses deepen versus five year trend

- Over the trailing 12 months, The9 is loss making and this lines up with a five year pattern where losses have worsened at about 17.4 percent per year.

- Bears argue that a company with losses compounding at roughly 17.4 percent annually faces a tough path back to profit, and the latest H2 2024 net loss excluding extra items of about CNY 73.7 million backs up that concern.

- The move from a positive net income excluding extra items of roughly CNY 131.5 million in H2 2023 to that CNY 73.7 million loss highlights how sharply the earnings profile has reversed.

- The trailing 12 month data still flags The9 as unprofitable, which supports the bearish view that the business has not yet stabilized after that swing.

In a market where some software names are rebuilding profitability, seeing multi year losses accelerate at The9 makes skeptics question how long the turnaround could take and what dilution or restructuring might sit ahead.

📊 Read the full The9 Consensus Narrative.Valuation sits between industry and peers

- The9 trades on a price to sales ratio of about 6 times, higher than the broader US Software industry at 4.9 times but lower than its peer group average of 12.3 times.

- What stands out for the cautiously optimistic camp is that despite trailing losses, a 6 times price to sales multiple is below the 12.3 times peer average, though the premium to the wider industry keeps the bearish argument about downside risk alive.

- Compared with the broader industry at 4.9 times, bears can point to The9 as more expensive than many software names that are already profitable.

- Relative to closer peers on 12.3 times, investors looking for speculative upside might see room for re rating if revenues recover toward the higher CNY 176.5 million trailing levels seen in H1 2024.

Shareholder dilution compounds profit pressure

- Alongside the earnings slide, shareholders have faced substantial dilution over the past year, meaning ownership has been spread across a larger share base while the company remained loss making.

- Critics highlight that dilution on top of a net income excluding extra items swing from about CNY 131.5 million in H2 2023 to a loss of roughly CNY 73.7 million in H2 2024 makes each share claim a smaller slice of a weaker business.

- The deterioration from positive basic EPS of around CNY 34.6 in H2 2023 to negative basic EPS of about CNY 14.4 in H2 2024 shows that the per share picture has moved sharply against existing holders.

- Because the trailing 12 month window still shows The9 as unprofitable, the bearish narrative that fresh capital raises may be needed again finds support in the numbers already on display.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on The9's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

The9’s deepening losses, shareholder dilution, and valuation premium to many profitable software names suggest a fragile setup that may struggle to regain durable profitability.

If you would rather focus on businesses with more predictable performance and fewer nasty surprises, use our stable growth stocks screener (2119 results) to quickly shift your attention toward companies showing steadier revenue and earnings momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報