Shochiku (TSE:9601 investor five-year losses grow to 19% as the stock sheds JP¥13b this past week

Ideally, your overall portfolio should beat the market average. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Shochiku Co., Ltd. (TSE:9601) shareholders for doubting their decision to hold, with the stock down 19% over a half decade. More recently, the share price has dropped a further 11% in a month.

With the stock having lost 7.6% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Shochiku became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

The modest 0.3% dividend yield is unlikely to be guiding the market view of the stock. In contrast to the share price, revenue has actually increased by 8.1% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

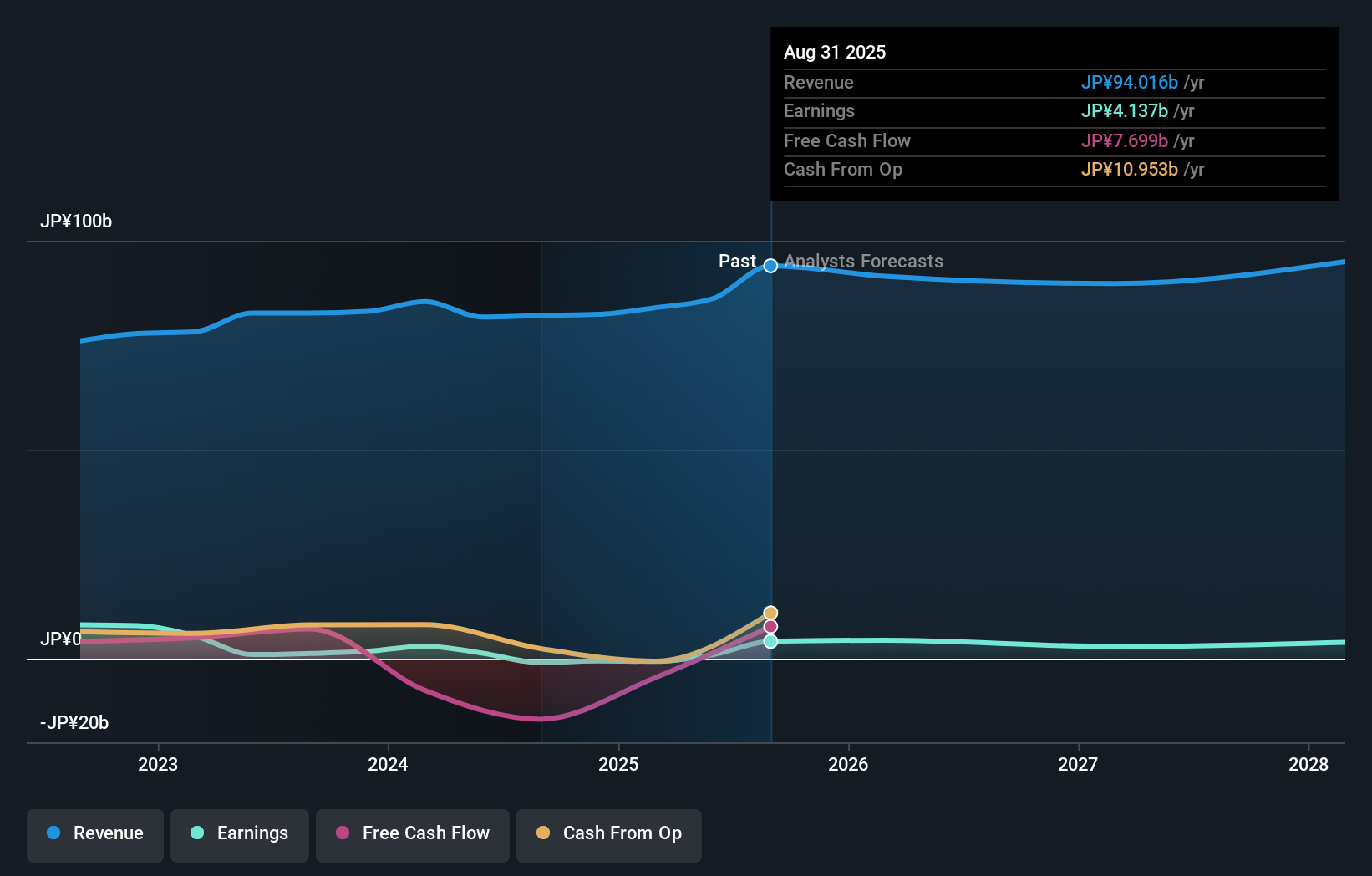

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Shochiku has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Shochiku

A Different Perspective

Shochiku provided a TSR of 1.8% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 3% per year, over five years. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Shochiku has 2 warning signs we think you should be aware of.

Of course Shochiku may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報