Chefs' Warehouse (CHEF): Assessing Valuation After Strong Multi‑Year Share Price Gains

Chefs' Warehouse (CHEF) has quietly rewarded patient investors, with the stock up about 34% over the past year and nearly 88% in the past 3 years, outpacing many consumer names.

See our latest analysis for Chefs' Warehouse.

With the share price now around $64 and a strong year to date share price return, recent gains suggest momentum is still building. This is supported by steady revenue and earnings growth as investors increasingly price in its niche, premium positioning.

If Chefs' Warehouse has you thinking about what else could quietly outperform, this is a good moment to explore fast growing stocks with high insider ownership.

Yet with shares trading near record highs and analysts still seeing upside, the key question now is whether Chefs' Warehouse remains undervalued relative to its growth trajectory or if the market has already priced in the next leg of expansion.

Most Popular Narrative: 15.3% Undervalued

With Chefs' Warehouse last closing at $64.46 against a narrative fair value of $76.13, the story leans toward upside built on premium growth.

Operational improvements, such as investments in procurement, digital ordering (now ~60% of specialty sales), predictive demand forecasting, and inventory optimization technology, are already contributing to margin efficiency and scalability, laying the groundwork for further net margin and earnings expansion as these initiatives mature.

Want to know how modest revenue growth, rising margins, and a punchy future earnings multiple can still justify upside from here? The full narrative unpacks the precise growth runway, profitability path, and valuation math behind that target, step by step, in a way the current share price does not fully reveal.

Result: Fair Value of $76.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation and challenges integrating acquisitions like Hardie's could squeeze margins and undermine the premium growth story investors are betting on.

Find out about the key risks to this Chefs' Warehouse narrative.

Another View on Valuation

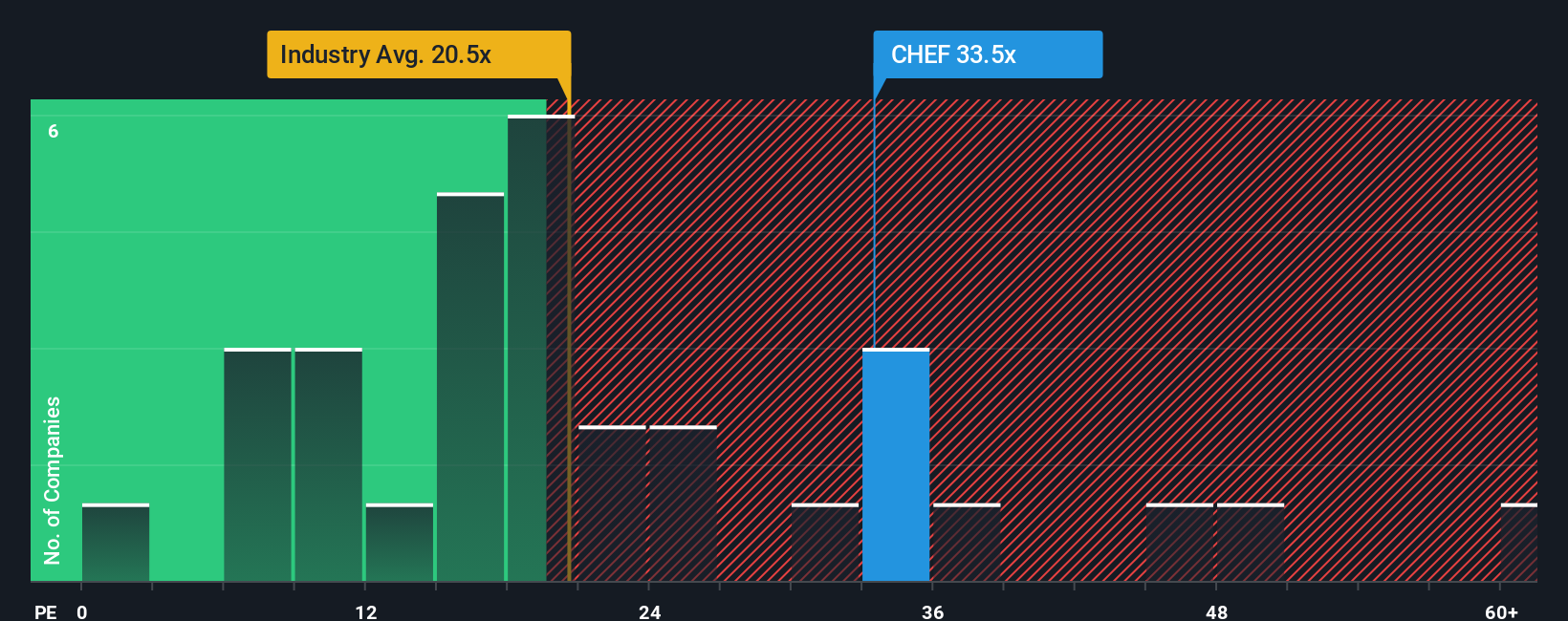

On earnings, Chefs' Warehouse looks much richer than the story suggests. The stock trades on 35.2 times earnings, versus 28.2 times for peers and 21.5 times for the broader Consumer Retailing group. Our fair ratio is 16.6 times, which raises the risk of a sharp derating if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chefs' Warehouse Narrative

If you see the numbers differently or want to test your own assumptions, you can build a complete narrative yourself in just a few minutes, starting with Do it your way.

A great starting point for your Chefs' Warehouse research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one strong story. Use the Simply Wall Street Screener today to tap into more targeted opportunities before other investors catch on.

- Capitalize on potential multi-baggers early by reviewing these 3629 penny stocks with strong financials built around solid business fundamentals instead of hype.

- Position yourself at the forefront of intelligent automation by targeting these 29 healthcare AI stocks shaping the future of diagnostics, treatment, and hospital efficiency.

- Strengthen your income strategy with these 12 dividend stocks with yields > 3% that combine attractive yields with resilient balance sheets and reliable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報